Options

Share

Options are versatile derivative instruments that give traders the right, but not the obligation, to buy (Call) or sell (Put) a digital asset at a specific strike price.Unlike futures, options offer a flexible way to hedge against "black swan" events or speculate on implied volatility. The 2026 landscape features a surge in on-chain options vaults (DOVs) and structured products that simplify complex "Greeks" for retail users. Explore this tag for insights into premium pricing, expiration cycles, and advanced strategic hedging in the decentralized derivatives market.

20487 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

U.S. Treasury Rules Out BTC Buys as GOP Senators Push For Use Of Gold Reserves

2026/02/05 04:35

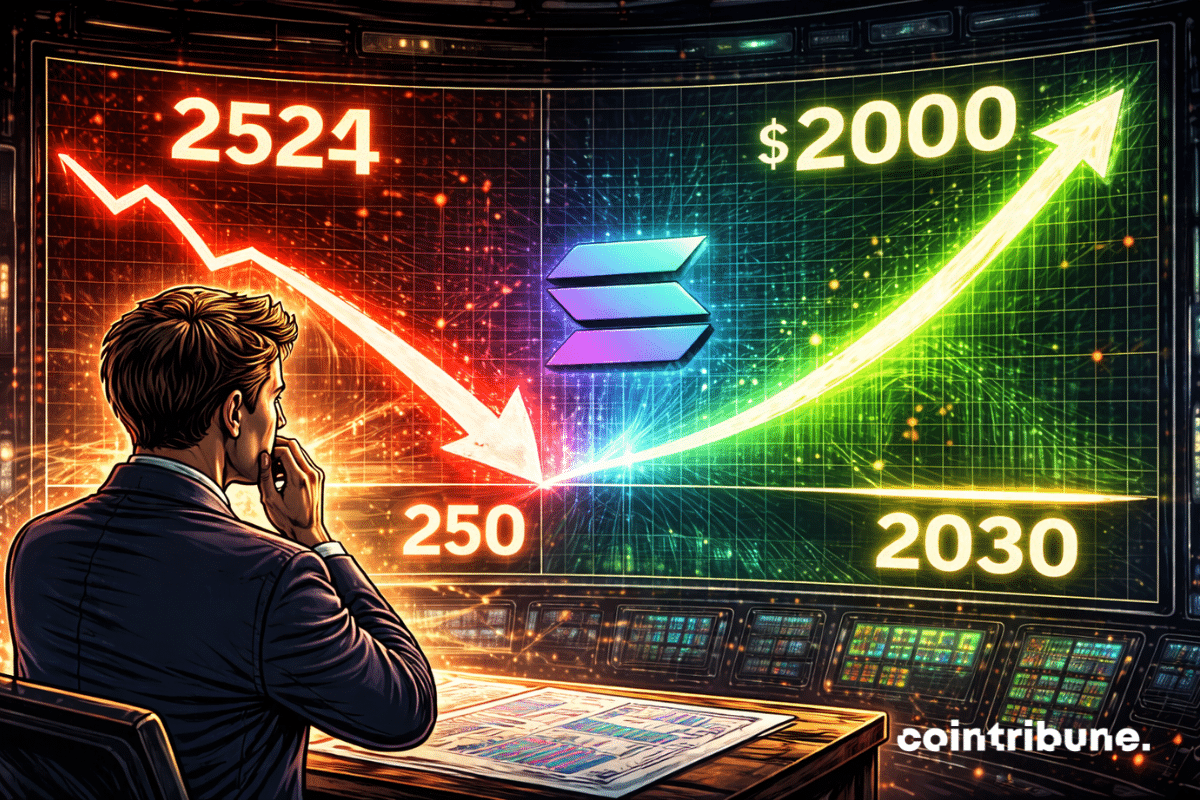

Solana To Hit $250 In 2026 ? Bank Explains Why

2026/02/05 04:05

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

2026/02/05 04:00

This is Trump's plot to rig the midterms — we must unite to beat it

2026/02/05 03:57

Over 80% of 135 Ethereum L2s record below 1 user operation per second

2026/02/05 03:52