CEX

Share

CEXs are platforms managed by centralized organizations that facilitate the trading of cryptocurrencies, offering high liquidity and user-friendly fiat on-ramps. Leaders like Binance, OKX, and Coinbase serve as the primary gateways for institutional and retail entry. In 2026, the industry focus is on Proof of Reserves (PoR), enhanced regulatory compliance, and hybrid models that offer self-custody options. This tag provides updates on exchange security, listings, and global market trends.

4227 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Presale Almost at $4M Burns Red

Author: BitcoinEthereumNews

2025/11/05

Share

Recommended by active authors

Latest Articles

Robinhood (HOOD) Stock Jumps 14% on Market Rally and Analyst Upgrades

2026/02/07 20:44

Pi Network Targets Open Mainnet 2026, Millions Prepare as Utility and Migration Accelerate

2026/02/07 20:41

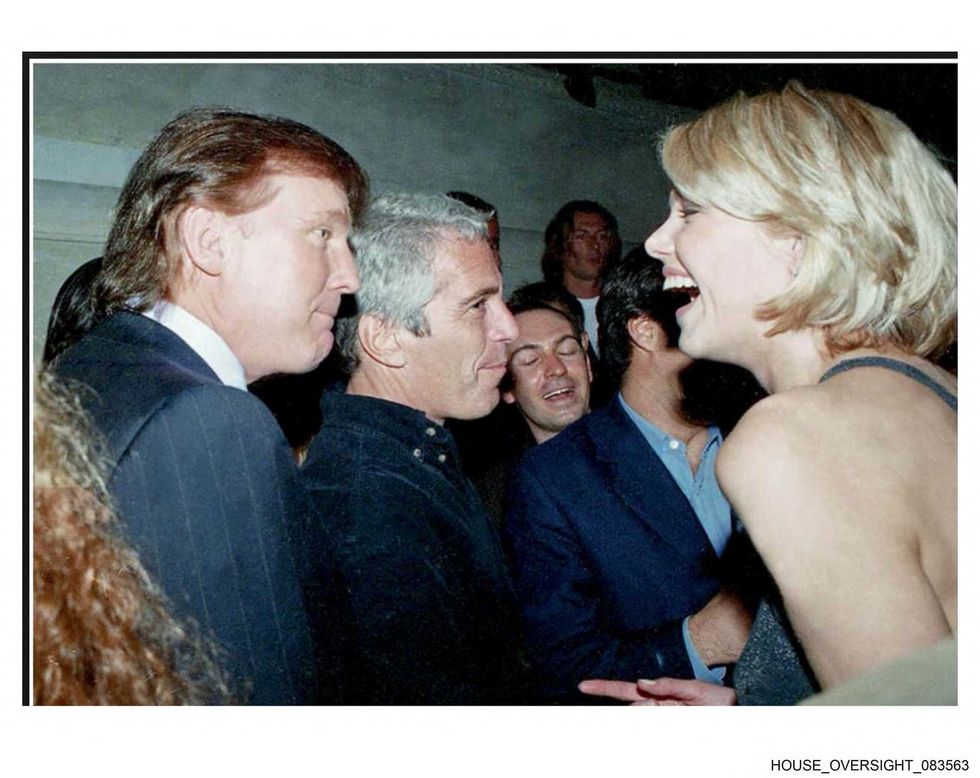

Trump named in explosive tip regarding Epstein’s death: ‘Authorized murder’

2026/02/07 20:37

Trump Administration Approves New Crypto-Friendly Bank

2026/02/07 20:37

XRP eyes $3 amid whale buying – Reversal or relief rally?

2026/02/07 20:19