CEX

Share

CEXs are platforms managed by centralized organizations that facilitate the trading of cryptocurrencies, offering high liquidity and user-friendly fiat on-ramps. Leaders like Binance, OKX, and Coinbase serve as the primary gateways for institutional and retail entry. In 2026, the industry focus is on Proof of Reserves (PoR), enhanced regulatory compliance, and hybrid models that offer self-custody options. This tag provides updates on exchange security, listings, and global market trends.

4257 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

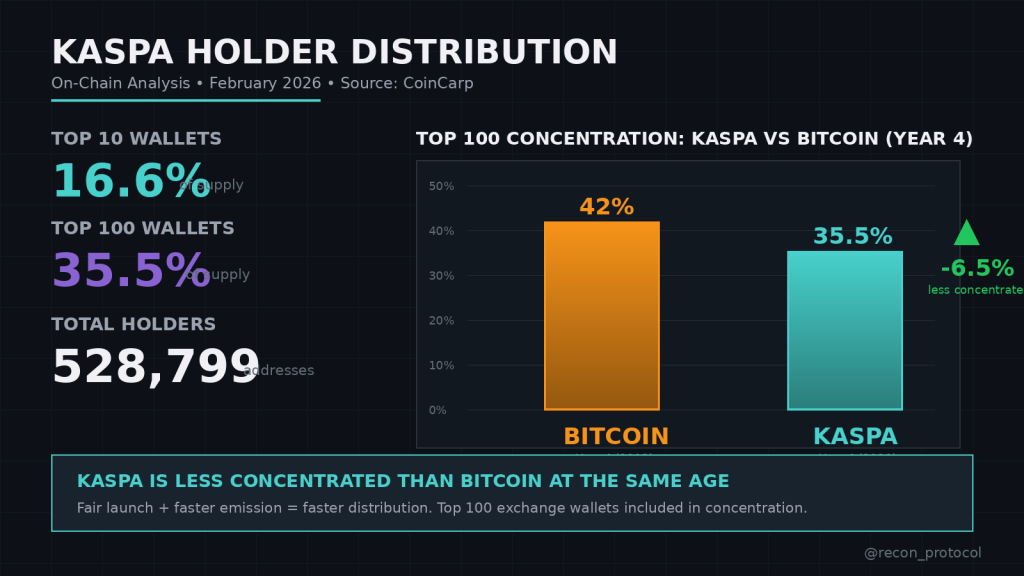

Who Really Owns Kaspa? On-Chain Data Reveals the Truth About Wallet Concentration

2026/02/09 17:45

XRP Price at $10 Dreams or $0.70 Reality? This Chart Maps the Next Move

2026/02/09 17:00

Solana Champion Kyle Samani Takes Aim at Hyperliquid After Departure

2026/02/09 16:59

Motivational Speaker Rocky Romanella Launches Intentional Listening Workshop to Transform Business Communication

2026/02/09 16:00

Ohio Implements Stricter Distracted Driving Laws with Increased Penalties

2026/02/09 16:00