Solana (SOL) Price: Can the Token Recover After Dropping Below $90?

TLDR

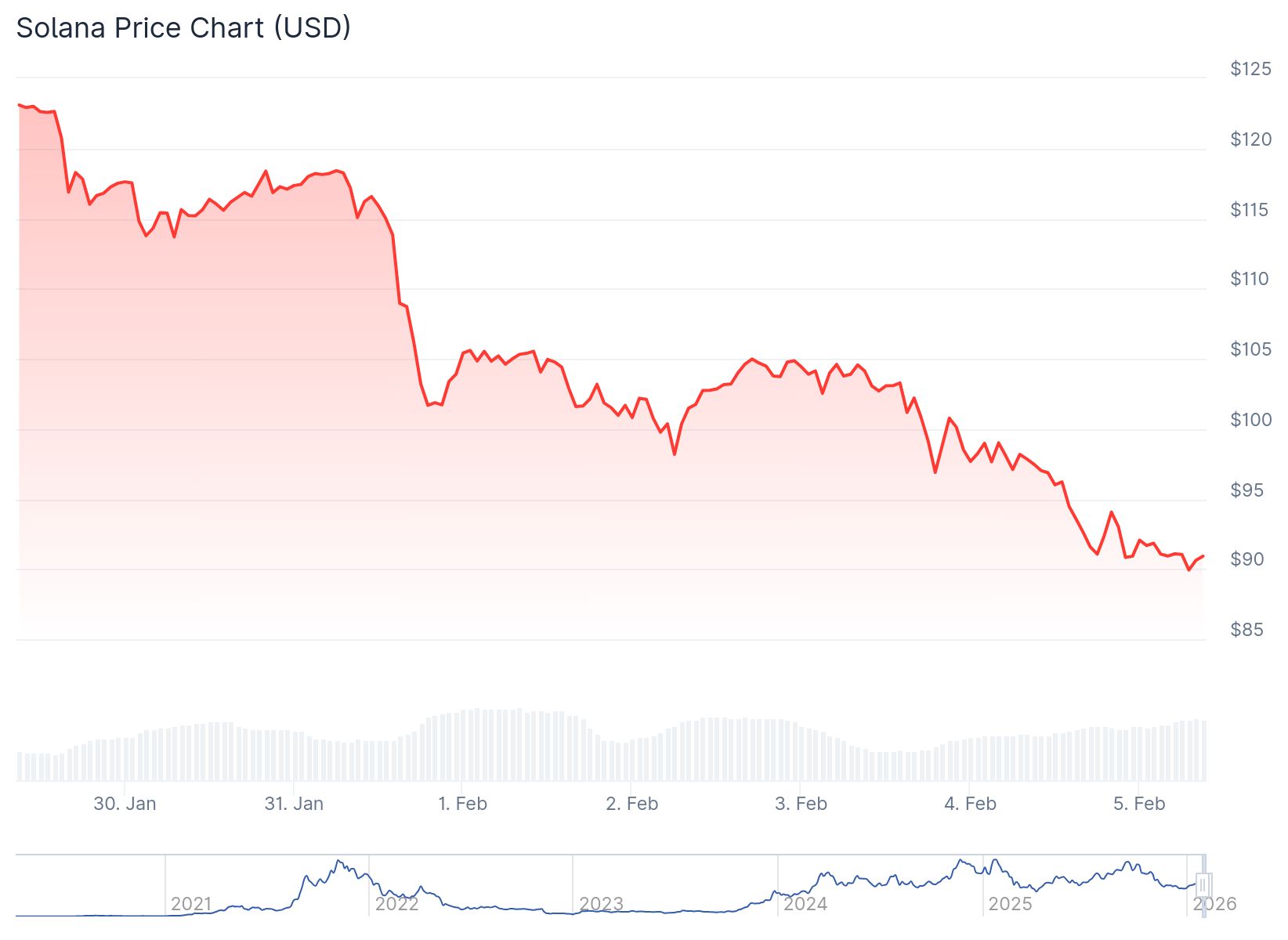

- Solana (SOL) dropped below $97, hitting its lowest price since 2024 with a 16% decline over one week

- The network processed a record 148 million transactions in a single day on January 30, showing strong on-chain activity

- Tokenized stocks on Solana reached a $230 million market cap, indicating continued institutional interest despite price struggles

- US Solana ETF inflows remain weak at under $9 million daily, with the derivatives market showing bearish sentiment

- Technical indicators point to potential further decline to $85, though long-term forecasts predict SOL could reach $2,000 by 2030

Solana (SOL) is currently trading around $91 after dropping to $89, marking its lowest price point since 2024. The cryptocurrency has fallen over 16% in the past week as part of a broader market downturn.

Solana (SOL) Price

Solana (SOL) Price

The price decline comes as Bitcoin dropped below $73,000 and Ethereum fell under $2,100. SOL has struggled to maintain support above the $100 level, breaking through multiple support zones in recent days.

Despite the price pressure, Solana’s network activity tells a different story. The blockchain processed nearly 148 million transactions on January 30, excluding governance votes. This represents one of the highest daily transaction counts in the network’s history.

The disconnect between price performance and network usage highlights the current market dynamics. Users continue to interact with the Solana blockchain even as traders sell off their holdings.

Institutional interest in Solana remains present through tokenized products. The market cap of tokenized stocks on the Solana blockchain reached $230 million. WisdomTree recently expanded its tokenized investment offerings to the Solana network.

GustoHQ, a payroll platform, now uses USDC on Solana for real-time settlement of foreign fund transfers. These developments show continued business adoption of the network.

ETF Flows Show Weak Demand

US Solana ETF inflows have remained under $9 million daily over the past three weeks. On February 2, the ETF recorded an inflow of $1.24 million, down from $5.58 million the previous day. Some days have seen outflows instead of inflows.

The derivatives market reflects the current bearish sentiment. Solana’s Open Interest dropped 1.24% in 24 hours to $6.37 billion. Long liquidations outpaced short liquidations by more than five times.

The OI-weighted funding rate for Solana sits at negative 0.0238. This indicates traders expect further price declines. Total market liquidations reached $735 million, with long positions accounting for $529 million.

Technical Analysis Points to Further Downside

SOL currently trades below its 50-day, 100-day, and 200-day exponential moving averages. The Relative Strength Index sits at 28, placing it in oversold territory. This suggests additional selling pressure may continue.

The Moving Average Convergence Divergence indicator shows negative momentum. If SOL breaks below $95, analysts see $85 as the next support level. A breakdown below $85 could push the price toward $82.

Immediate resistance sits at $93, with the next level at $97. A bearish trend line on the hourly chart shows resistance at $98. For bulls to regain control, SOL would need to reclaim $100 and break above $102.

A successful move above $119 could open the door to $150 in the medium term. However, the current technical setup favors continued downside risk in the short term.

Standard Chartered maintains a long-term forecast of $2,000 for Solana by 2030. The bank views Solana as evolving from a speculative asset into a platform for microtransactions and AI applications.

The post Solana (SOL) Price: Can the Token Recover After Dropping Below $90? appeared first on CoinCentral.

Ayrıca Şunları da Beğenebilirsiniz

‘Slam dunk’ case? The brutal killing of a female cop and her son

Adoption Leads Traders to Snorter Token