Bitcoin Fuels Bear Market Fears as $49K Target Looms

Bitcoin is trading sub-$50,000 ahead of Sunday’s weekly close, underscoring how bulls have struggled to reverse a slide that has kept the asset near ten-month lows. After a day in which BTC/USD declined more than 6% and failed to reclaim key levels, market participants remain cautious about the near-term trajectory. Traders are weighing whether a renewed downside pressure will give way to a relief rally, or if the current setup signals a deeper pullback as on-chain signals tilt toward risk-off postures and macro sentiment remains constrained.

Key takeaways

- Price action points to sustained bearish pressure with the market testing support levels that have historically capped rallies.

- Nearby CME futures gaps could act as short-term magnets, with the nearest notable gap near $84,000 potentially drawing bids back into the coming weeks.

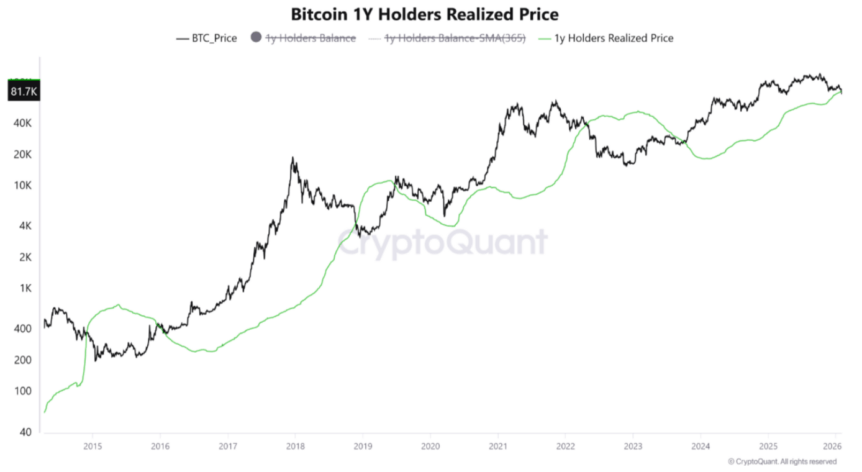

- On-chain indicators suggest a bearish regime, as price remains below the realized price for holders with 12–18 months of activity.

- The market is watching a confluence of moving-average signals — notably the 21-week EMA crossing and its historical association with past bear markets — as a potential guide for the next leg.

- Two measured downside liquidity targets cited by market observers sit at roughly $74,400 and $49,180, underscoring how fragility in the current phase could amplify if liquidity dries up.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. BTC moved lower and failed to reclaim early-session gains, reinforcing downside pressure into the weekly close.

Trading idea (Not Financial Advice): Hold. With persistent bear factors and unfilled CME gaps, a cautious stance is warranted until a clear reclaim of key levels materializes.

Market context: The move sits within a broader risk-off environment where liquidity remains constrained and traders are watching for catalysts that could shift sentiment, including macro developments and potential ETF-related flows.

Why it matters

From a longer-horizon view, the latest action reinforces a pattern that traders have observed in prior bear cycles. After a period of relative resilience, Bitcoin appears to be testing the strength of its support structure, with on-chain metrics highlighting the importance of realized price as a ceiling for rallies. In practice, realized price represents the aggregate cost basis for coins that last moved on-chain, and when price trades consistently below this line — particularly for addresses with 12 to 18 months of history — the market has historically faced more pronounced downside dynamics. The current configuration, with price below those thresholds and negative unrealized profitability, aligns with episodes that preceded extended declines rather than swift recoveries.

Market participants have also focused on the technical picture surrounding moving averages. The recent crossing of longer-term indicators — the 21-week and 50-week exponential moving averages — has, in past instances, preceded further downside. Traders like Rekt Capital have echoed the sentiment that a bearish continuation may unfold in the wake of such a cross, noting that momentum often lags price action before turning decisively. The discussion around these EMAs is not merely academic; it helps frame expectations for price behavior in the weeks ahead, especially if there is no sustained reclamation of the range lows that previously offered reprieve.

BTC/USDT perpetual contract one-month chart. Source: Cmt_trader/XIn the near term, the market is paying attention to structural gaps in CME’s Bitcoin futures market. The gaps, often described as price magnets on lower timeframes, have attracted speculation that price could be drawn toward the next target in the vicinity of $84,000 if buyers step in to fill the space. Market participants like Killa have highlighted the potential for BTC to gravitate toward that level in the coming weeks, especially if the market fails to reclaim the range lows that previously served as a baseline for bulls. The dynamic around CME gaps underscores how exchange-derived signals can influence price discovery, even if they do not guarantee a reversal.

BTC/USDT one-week chart with 21-week, 50-week EMA. Source: Rekt Capital/X

BTC/USDT one-week chart with 21-week, 50-week EMA. Source: Rekt Capital/X

Beyond the price action, the on-chain narrative remains largely risk-off. CryptoQuant’s Quicktake highlights that when spot price trades below the realized cost basis for the cohort of holders in the 12–18‑month bracket, the market tends to enter phased bear markets rather than brief pullbacks. Realized price itself appears to be stabilizing but remains above the current price in some cases, implying the overhead resistance could persist while sellers remain active. In this context, those watching for a deeper rebound may need to see a material shift in the balance of supply between newer buyers and longer-term holders who have yet to realize profits or cut losses.

Traders and analysts have pointed to a cluster of signals that could inform the next few weeks. A renewed push above the $80,000–$80,700 zone would be a notable development, as that level previously acted as a rough yardstick for the market’s health during the latest cycle. A sustained move back above this threshold would require not only robust buying interest but a re-emergence of liquidity that has been in shorter supply in recent sessions. Until such a move materializes, the balance of probabilities favors continuation of the current bearish texture, with occasional rallies failing to sustain momentum beyond a handful of sessions.

Bitcoin risks new “extended bearish phase”

Zooming out, on-chain research continues to frame the situation as a risk-off regime over longer horizons. The data points to a confluence of factors that have historically marked extended declines rather than fleeting pullbacks. The key observation is that price has drifted below the realized price for holders who entered the market in the mid-term window, a condition that CryptoQuant contributors describe as a potential indicator of structural bearishness. The underlying logic is that when price remains under a flat or rising realized cost, rallies tend to stall as market participants exit at breakeven levels or through concentrated selling pressure.

BTC/USD chart with one-year hodler realized price (screenshot). Source: CryptoQuant

BTC/USD chart with one-year hodler realized price (screenshot). Source: CryptoQuant

In a broader sense, the combination of price under realized cost, negative unrealized profitability, and slowing balance growth has historically aligned with extended bearish phases. The narrative isn’t about a single catalyst but rather a suite of indicators that corroborate a cautionary stance for the immediate future. While some traders point to a potential near-term bounce anchored by the demand from CME-driven gaps, others warn that the structural headwinds — on-chain resistance, macro risk-off sentiment, and the absence of a decisive bullish trigger — could prolong weakness into the next quarter. The interplay between technicals and on-chain signals remains central to how the market calibrates risk once the weekend milestone passes.

//platform.twitter.com/widgets.js

This article was originally published as Bitcoin Fuels Bear Market Fears as $49K Target Looms on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Ayrıca Şunları da Beğenebilirsiniz

SAND Bearish Analysis Feb 2

CME Group to launch options on XRP and SOL futures