Donald Trump Officially Picks Kevin Warsh as New Fed Chair

Donald Trump has finalized his choice for the next Chair of the Federal Reserve, with an official announcement naming Kevin Warsh expected imminently on Friday, January 30, 2026.

The decision follows a final White House meeting late Thursday and ends weeks of speculation around the future leadership of the U.S. central bank.

According to multiple reports, including Axios and The New York Times, Warsh emerged as the clear favorite after last-minute deliberations.

Trump reinforced the signal publicly by recalling that Warsh “could have been there a few years ago,” referencing his near-appointment in 2017 before Jerome Powell was ultimately selected. The move marks a return to a long-standing Trump preference and suggests a deliberate reset at the top of the Federal Reserve.

Source: https://truthsocial.com/@realDonaldTrump/posts/115983891481988557

Source: https://truthsocial.com/@realDonaldTrump/posts/115983891481988557

A Familiar Name With a Complex Policy Reputation

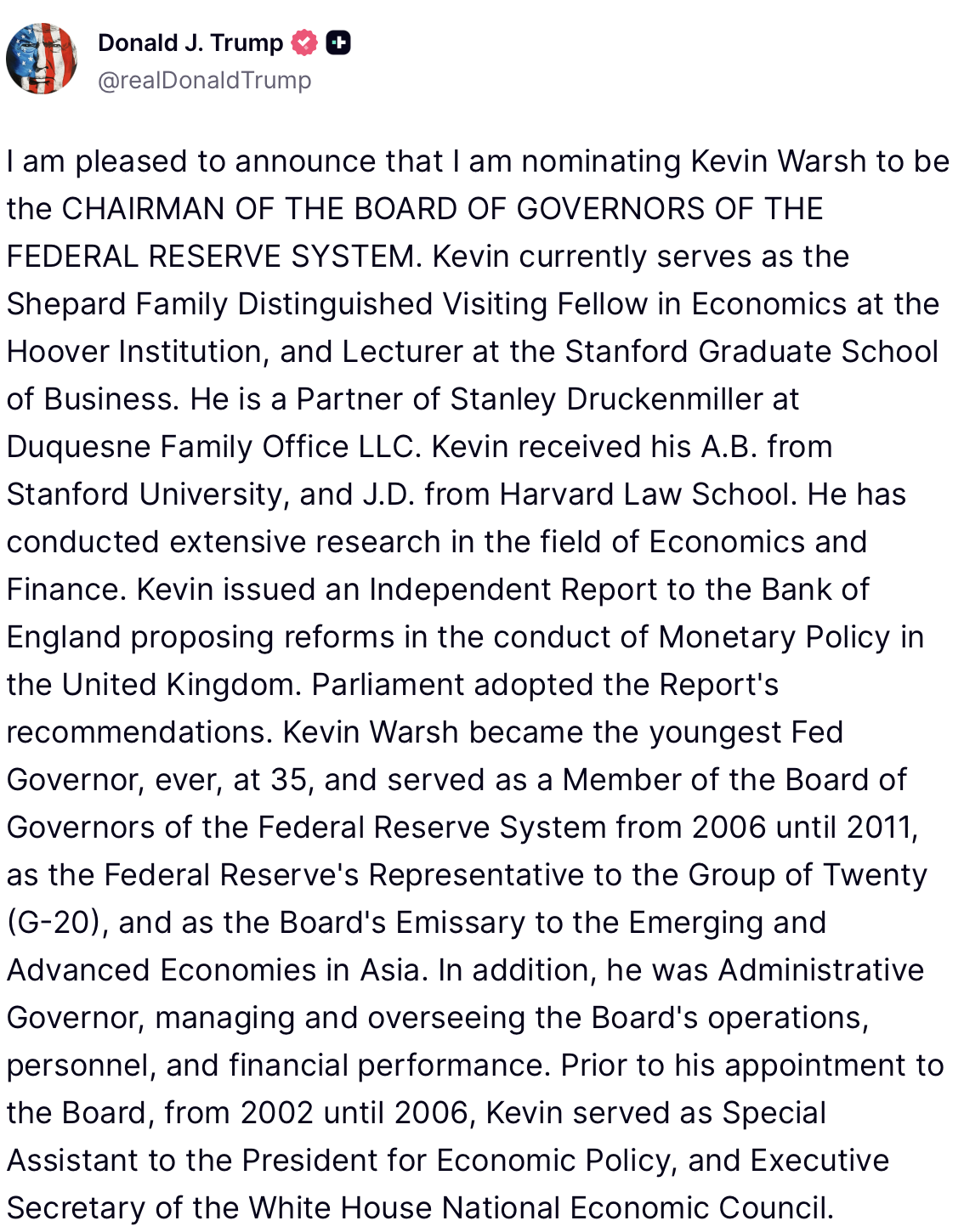

Warsh is no stranger to the Federal Reserve. He previously served as a member of the Board of Governors from 2006 to 2011, becoming the youngest Fed governor in history at age 35. During that period, he also acted as the Federal Reserve’s representative to the G-20 and as the Board’s emissary to emerging and advanced economies in Asia.

Earlier in his career, Warsh served as Special Assistant to the President for Economic Policy and Executive Secretary of the White House National Economic Council. He later worked at Morgan Stanley in its Mergers & Acquisitions division and has since held academic and research roles, including at the Hoover Institution and Stanford Graduate School of Business.

While once known as an “inflation hawk,” analysts now note that Warsh has appeared to align more closely with Trump’s push for lower rates. This evolution has fueled debate over whether he can maintain the Federal Reserve’s credibility while accommodating the administration’s growth-focused agenda.

Senate Hurdles and a Delicate Confirmation Path

Despite the momentum behind the nomination, confirmation is not guaranteed. Reports within the past hour indicate that Republican Senator Thom Tillis has threatened to block Federal Reserve nominees until an unrelated Department of Justice investigation is resolved. This stance could complicate the timing and inject additional uncertainty into the process.

For now, the nomination represents a significant strategic shift. Warsh is widely viewed as a market-literate and institutionally experienced candidate, potentially capable of navigating political pressure without overtly undermining the Fed’s independence. Whether that balance convinces lawmakers, and calms markets, will become clear as the confirmation process begins.

The post Donald Trump Officially Picks Kevin Warsh as New Fed Chair appeared first on ETHNews.

Ayrıca Şunları da Beğenebilirsiniz

The Channel Factories We’ve Been Waiting For

Shanghai residents flock to sell gold as its price hit record highs