What the Fed Meeting Could Mean for Bitcoin and Crypto This Week

The post What the Fed Meeting Could Mean for Bitcoin and Crypto This Week appeared first on Coinpedia Fintech News

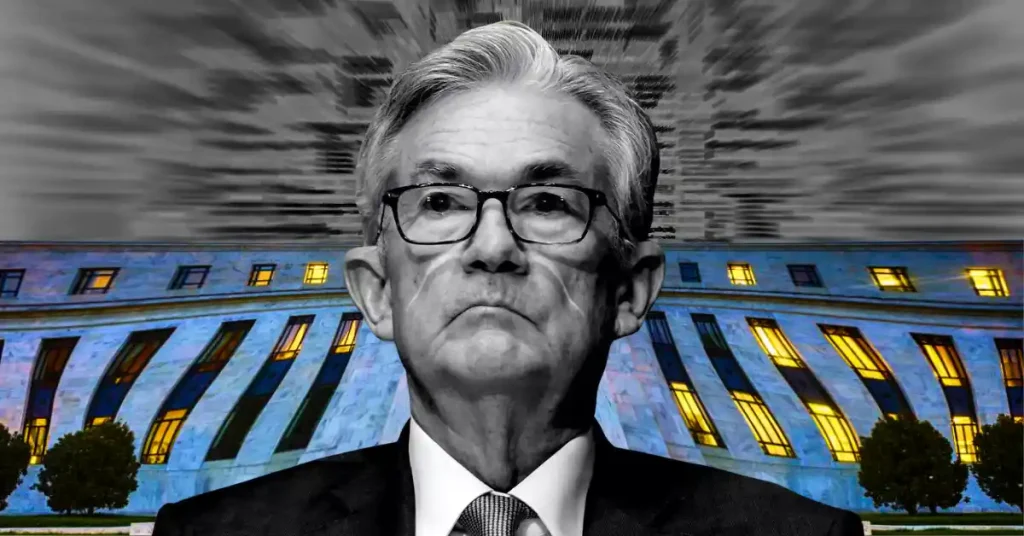

With the Federal Reserve set to announce its latest policy decision, markets are calm but not relaxed. Interest rates are widely expected to stay where they are, yet Bitcoin traders are paying close attention to what comes next.

Veteran financial trader Matthew Dixon said interest rates are likely to remain unchanged at the upcoming FOMC meeting, adding that markets are more likely to react to the Fed’s economic guidance than the rate decision itself.

Why the Fed Is Expected to Hold

Markets are almost fully aligned on the outcome. CME FedWatch data shows a 97.2% chance the Fed keeps rates unchanged in the 3.5%-3.75% range. That view matches comments made by Fed Chair Jerome Powell late last year and recent remarks from Minneapolis Fed President Neel Kashkari, who said it is “way too soon” to cut rates again.

After three straight rate cuts toward the end of 2025, policymakers are expected to wait for more clarity as inflation remains above target while job growth cools but stays positive.

Also Read: No Fed Cuts in 2026? JPMorgan’s New Forecast Puts Bitcoin Back Under Pressure

One Trader Bets Big on Extreme Outcomes

While most traders expect a quiet decision, on-chain data tells a different story for at least one wallet. Blockchain analytics firm Lookonchain reported that a newly created Polymarket account placed $23,000 in bets across three extreme outcomes for the January 28 Fed meeting.

Still, the wallet bet on a 25+ basis point rate hike, a 25 bps cut, and a 50+ bps cut – outcomes that cannot all occur.

If any one scenario hits, the wallet could earn between $1.27 million and $5.64 million, despite currently showing an all-time loss of about $3,000.

Why Crypto Traders Are Paying Attention

For Bitcoin, the rate decision itself may not move prices. The bigger factor is tone. A hawkish pause could pressure risk assets, while dovish language, especially hints that future cuts remain possible, could support a breakout.

As the Fed prepares to speak, Bitcoin is holding its ground, and traders are listening closely.

Ayrıca Şunları da Beğenebilirsiniz

tonies Unveils Lightning Yellow Toniebox 2 Special Edition in Partnership with Pokémon

UAE’s Stargate data centre to cost $30bn, says AI minister