Tom Lee Warns Crypto Markets Could Face Painful Correction in 2026

- Fundstrat Global Advisors’ Tom Lee said the crypto market may experience a drastic correction in 2026.

- Bitcoin dropped below $90,000 as the overall market came under pressure due to macro issues like tariffs.

The cryptocurrency market’s strength has been weakened by the drop in the price of Bitcoin, which fell below the $90,000 level. This is a continuation of losses experienced since the last market peak due to macroeconomic pressures and the effect of the deleveraging experienced in the market previously.

Fundstrat Global Advisors’ research head, Tom Lee, warned of the potential for the weakness to persist well into 2026, terming the period as potentially ‘painful’ for crypto as well as other risk assets before the eventual bounce. He attributed the ills affecting the sentiment to the continued uncertainty in policies as well as risks associated with the global economy.

Such is the comment made by Lee during a recorded video interview he conducted on an economic market podcast, where he talked about market conditions in the world of cryptocurrencies, the aftereffects of the October 2025 crash, and why the restrained balance sheets among market makers might mean that any possible market recovery could be delayed until 2026.

Macro Risks And Price Dynamics

Several macro influences that could negatively impact markets in early 2026 have been stressed by Lee, such as geopolitical conflicts, tariff wars, and political fragmentation that could slow down market rallies, whether in the crypto market or the stock market. His estimates indicated that overall markets will likely experience a 15% to 20% correction during 2026 before improving market conditions. Such supportive changes will potentially come from changes like the dovish Fed and the end of quantitative tightening.

Despite the outlook over the short period, Lee stated that the long-term structural supports, including the advancements in the areas of blockchain technology and artificial intelligence, would remain supportive of the growth prospects when the market headwinds dissipate. He also stated that the new Bitcoin record high would indicate that the market has fully absorbed the effects of the October Deleveraging Event in the latter part of 2026.

However, other analysts have noted that crypto markets have been diverging from other assets, such as gold, which performed better than crypto markets in 2025. Lee has argued that energy or basic materials could lead markets in 2026, but opinions vary about what will happen to other asset markets.

The current situation in the crypto market, with Bitcoin’s fall below key psychological levels, has attracted somewhat tentative forecasts even among leading analysts. The “painful downturn” forecast for most of 2026 by Tom Lee reflects ongoing challenges, which include overall macroeconomic conditions as well as lingering effects of the deleveraging witnessed toward the end of 2025. However, possible end-of-year rallies and underlying positive fundamentals may provide a recovery story for investors willing to wait and see what happens and develop accordingly.

Highlighted Crypto News:

Grayscale Files S-1 With SEC to Convert Near Trust Into Spot NEAR ETF

Ayrıca Şunları da Beğenebilirsiniz

Sygnum’s new bitcoin fund pulls in $65 million from investors looking for steady yield

Copy linkX (Twitter)LinkedInFacebookEmail

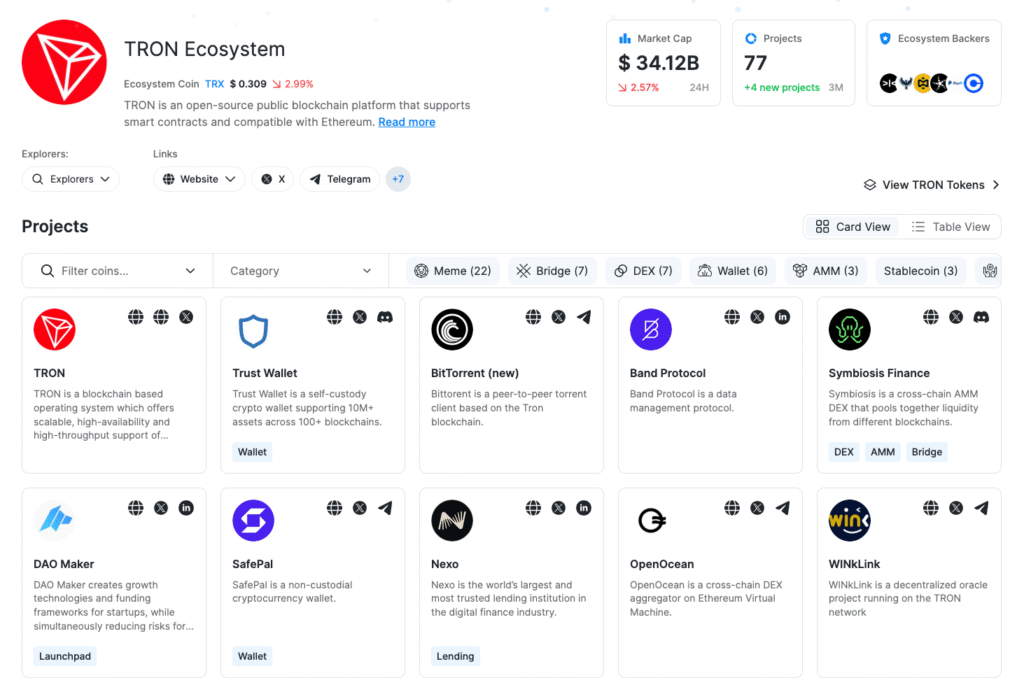

The State of TRON H2 2025: Stablecoin Settlement at Scale Amid Rising Competition