Solana DEXs Overtake Top Exchanges With $1.6 Trillion Volume Despite SOL Price Stagnation

Solana has attempted a modest recovery after extended weakness, supported by rising on-chain activity. Increased network usage has translated into stronger performance metrics, helping stabilize price action.

While SOL remains under pressure, expanding transaction volume could position the altcoin for a short-term rally if demand sustains.

Solana Is Shaming CEXes

Solana’s 2025 performance has outpaced several centralized exchanges by trading volume. According to Artemis researcher ZJ, decentralized exchange activity on Solana reached $1.6 trillion this year. That figure ranks Solana second overall, behind only Binance, which posted $7.2 trillion in volume.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana vs Cex. Source: ZJ

Solana vs Cex. Source: ZJ

The data highlights rapid growth in on-chain trading. Solana surpassed Bybit, Coinbase Global, and Bitget in total volume. ZJ noted on X that Solana ranked fifth among major trading venues just one year ago.

Solana Investors Are Grounding The Token

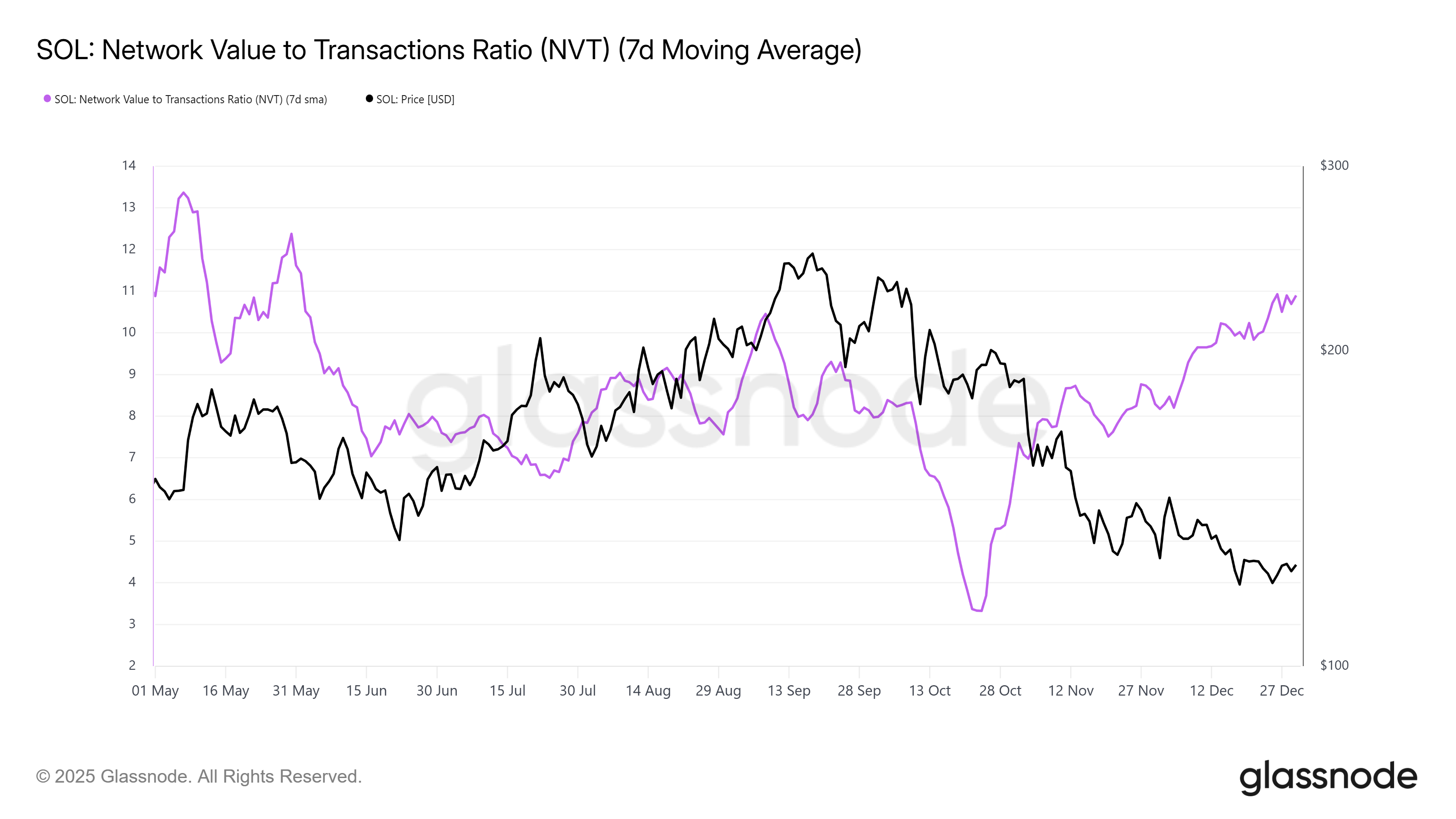

Despite strong volume metrics, valuation indicators raise caution. Solana’s Network Value to Transactions ratio has climbed steadily and now sits at a seven-month high. Historically, rising NVT readings signal bearish risk, as market value grows faster than actual transaction demand.

This divergence suggests hype may be outpacing real economic activity. When network valuation expands without matching usage growth, prices often face correction. Elevated NVT levels tend to precede bearish breaks, placing near-term pressure on SOL’s recovery attempts.

Solana NVT Ratio. Source: Glassnode

Solana NVT Ratio. Source: Glassnode

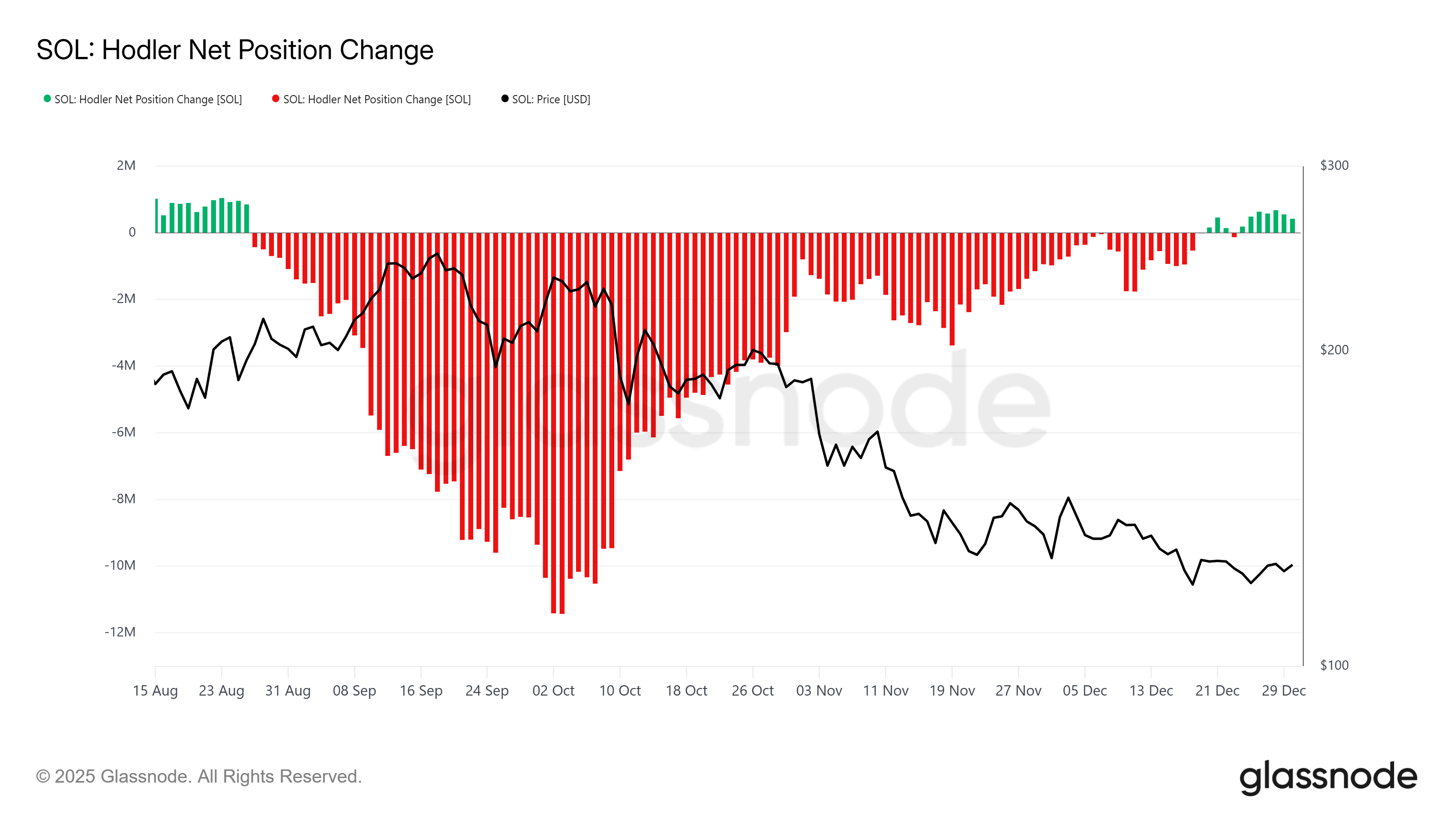

Long-term holder behavior offers a counterbalance to bearish signals. The HODLer net position change shows a notable shift over the past week. After nearly four months of distribution, long-term holders have returned to accumulation.

This transition is significant because long-term holders often stabilize the price during volatile periods. Their renewed accumulation suggests confidence in Solana’s longer-term prospects. This support could help absorb selling pressure and limit downside risk despite mixed short-term indicators.

Solana HODLer Position Change. Source: Glassnode

Solana HODLer Position Change. Source: Glassnode

SOL Price May Find A Breach

Solana price is trading near $126 at the time of writing, meeting resistance at this level. Even with recent stabilization, SOL is on track to close 2025 down roughly 33%. This context frames the current recovery as corrective rather than trend-defining.

In the short term, Solana could test resistance near $130 if long-term holder support persists. Without stronger inflows from broader investors, upside may remain capped. Consolidation below $126 appears likely if momentum weakens.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingView

Downside risk remains present. A failure to maintain support at $123 could expose SOL to a decline toward $118. Such a move would invalidate the bullish thesis and reinforce the broader bearish structure until stronger demand returns.

Ayrıca Şunları da Beğenebilirsiniz

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

The Manchester City Donnarumma Doubters Have Missed Something Huge