Aave V4 Launches Hub-and-Spoke Liquidity Model to Boost DeFi Growth, Founder Shares Impact

- Aave founder says the new V4 Hub-and-Spoke liquidity model can improve capital efficiency.

- Aave Labs is ready for the V4 mainnet upgrade to bring better value to users.

Stani Kulechov, the founder of Aave just showed the community the benefits of the protocol’s new V4 model. This Hub-and-Spoke model manages liquidity on Aave to promote its decentralized finance (DeFi) features.

Founder Stani Highlights Key Aave V4 Features

In an X post, Stani explained that Aave V4 is important in liquidity management. For emphasis, the V4 liquidation engine replaces the fixed mechanism of V3, as previously mentioned in our report.

The new system introduces dynamic liquidation thresholds and an automated auction mechanism. The goal is to reduce manual intervention and improve liquidation speed and capital efficiency.

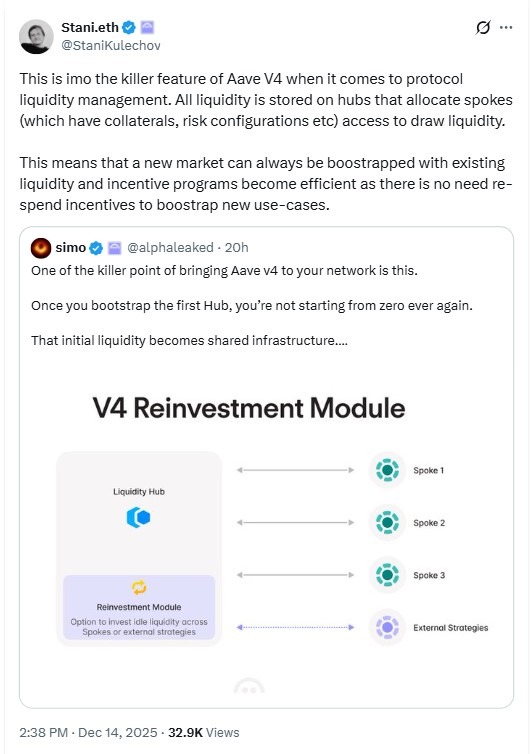

In his post, the Aave founder noted that all liquidity is stored on hubs that allocate spokes access to draw liquidity. Each Spoke defines its own accepted collaterals, risk parameters, borrowing rules, and potentially specialized features.

However, Hubs are the primary venue where all supplied capital is stored and distributed based on chains connected to Aave. While suppliers deposit assets through Spokes, the assets then flow into the Hub for management. This model helps with overall efficiency.

According to Stani, the new Hub-and-Spoke Aave V4 model will ensure instant bootstrapping for emerging markets. This makes launching new features, asset support, or specialized modes much faster and more viable in a new market.

The Aave V4 New Liquidity Model Spotlight | Source: Stani Kulechov on X

The Aave V4 New Liquidity Model Spotlight | Source: Stani Kulechov on X

He added that incentives will become more targeted and effective because the shared Hub means liquidity is already available. In older versions, the protocol often had to spend AAVE tokens as incentives to grow a new market.

However, with the new version, there is no need to re-spend incentives to bootstrap new use-cases. Primarily, this kind of design scales liquidity without wasting incentives.

Aave Gears Up for V4 Mainnet Upgrade

Alongside the new model, Aave has launched the V4 public testnet, as we covered in our latest report. The testnet came with a fully open-source V4 codebase and a developer preview of the upgraded Aave Pro interface.

It launched in a Tenderly-based fork environment, with the codebase set to migrate soon to the Aave DAO organization. In the near future, the team will present licensing frameworks for the DAO to review, vote on, and ultimately determine the official licensing approach.

In a related development, Aave Labs submitted a new governance proposal to deploy Aave V3 on MegaETH on the mainnet debut day. The protocol seeks to capture early user activity, deepen liquidity, and meet strong borrowing demand.

Furthermore, Aave also plans to close low-revenue V3 markets and apply a $2 million threshold for new deployments. Previously, we explored that the plan responds to widening revenue gaps between top-performing networks.

]]>Ayrıca Şunları da Beğenebilirsiniz

BitMine Expands Treasury Holdings with $140 Million Ethereum Acquisition

Hyper Foundation Proposes Validator Vote to Burn Assistance Fund Tokens