British fraud office arrests two men accused of $28 million Basis Markets rug pull

Officers from the United Kingdom's Serious Fraud Office (SFO) carried out a series of raids, arresting two men in connection with the $28 million rug pull of Basis Markets, a project that sought to create a decentralized hedge fund before vanishing with investors' funds.

SFO officers carried out raids alongside police in Herne Hill, south London, and Bradford, West Yorkshire, arresting one man in his thirties and one man in his forties on suspicion of fraud and money laundering, the office said. The probe into Basis Markets was the office's first major cryptocurrency case.

"With our expanding cryptocurrency capability and growing expertise in this area, we are determined to pursue anyone who would seek to use cryptocurrency to defraud investors," SFO director Nick Ephgrave QPM said in a statement.

No one has yet been charged, and the SFO described the scheme as a “suspected” fraud; the investigation is ongoing.

Basis Markets raised red flags from the start

The launch of Basis Markets raised red flags immediately, according to an investigation by a group dubbed Crypto Sleuth Investigations. According to the investigation, the founders of Basis Markets advertised themselves as having more than 80 years of professional experience in traditional finance, software development, and crypto tooling.

The team said it intended to create a decentralized hedge fund as a way for everyday crypto investors to earn “delta-neutral” yields from arbitrage (“basis trades”) that were traditionally only accessible to institutions.

The project offered membership NFTs, telling holders they would be entitled to a portion of trading profits, and later launched the BASIS token, promising holders a portion of performance fees and governance in the Basis Markets decentralized pool.

The Basis Markets founders described themselves as "proffesionals" [sic], via Crypto Sleuth Investigations.

The team raised about $28 million across an NFT sale in November 2021 and their public token sale for the BASIS token the following month. The NFT sale raised a total of 32,000 SOL, about $7 million at the time, and was fully subscribed. The token sale also went well, raising about $20.7 million in USDC.

Yet instead of directing the funds towards a project treasury, the funds were distributed directly to the founders' personal wallets, the Crypto Sleuth Investigators found, despite a promise to lock the tokens for 12 months. The Block was unable to immediately reach the investigators for updated comment.

The project initially projected that it could attract a TVL of over $1 billion by December 2022, about a year after the NFT and token sales, and once said an individual NFT, which cost about $1,880 at time of sale, could earn as much as $18,000 a month in profit distributions by the end of year three, according to a slide in its prospectus, before later revising that figure to the still-high $30,000 cumulative.

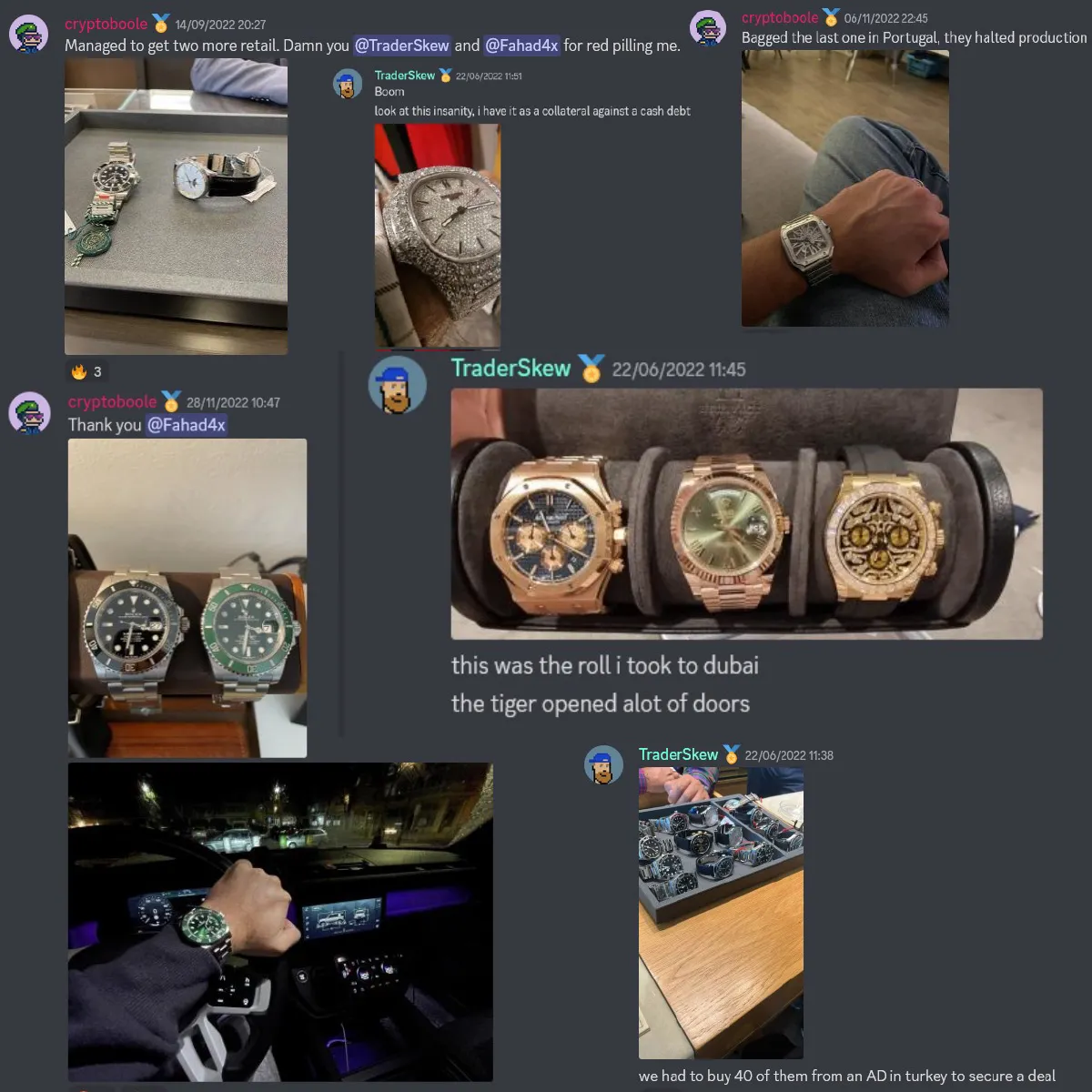

No product was delivered by that time, and in June 2022, the project suddenly announced it had halted operations and went dark shortly after, with no funds returned to investors, despite the project's founders showing off luxury watch purchases in the project's Discord over the prior months.

Luxury watches shown off by Basis Markets team members, via Crypto Sleuth Investigations.

"There was simply not enough left in the Basis Markets 'treasury' to give back to investors, nor even apparently to hire any extra programmers to help build out the remains of their threadbare 'roadmap'," the sleuths wrote.

One of the founders, known as "TraderSkew" but identified by the investigators as Adam Cobb-Webb, was also found by the CFTC of "engaging in multiple instances of spoofing in West Texas Intermediate (WTI) light sweet crude oil futures contracts traded on New York Mercantile Exchange, Inc. (NYMEX) from approximately December 16, 2021 through at least January 14, 2022," according to a CFTC press release.

The agency filed and settled charges against Cobb-Webb in Aug. 2023, ordering a $150,000 fine and banning Cobb-Webb from trading on CFTC-designated exchanges for one year.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ayrıca Şunları da Beğenebilirsiniz

Bitcoin (BTC) Rebounds Today: “This Level Must Be Broken for Major October Rally,” Says Analysis Firm

WIF Price Prediction: Targeting $0.48 Recovery Within 2 Weeks as MACD Shows Bullish Divergence