Bitcoin ETFs Revive with $241 Million Inflow, Ethereum ETFs Report Lowest Trading Value of the Week

The post Bitcoin ETFs Revive with $241 Million Inflow, Ethereum ETFs Report Lowest Trading Value of the Week appeared first on Coinpedia Fintech News

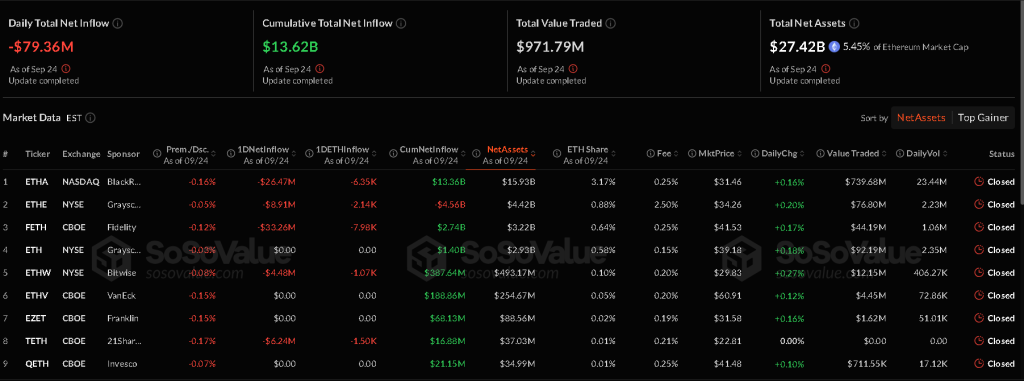

On September 24, the US spot Bitcoin ETF saw a combined inflow of $241.00 million, while Ethereum ETFs continued their day 3 streak of outflow. It recorded a total net outflow of $79.36 million, as per the SoSoValue report.

Bitcoin ETF Breakdown

After two consecutive days of experiencing huge sell-offs, Bitcoin ETFs finally managed to record an inflow of $241.00 million. BlackRock IBIT led with $128.90 million, and Ark and 21Shares ARKB followed with $37.72 million.

Additional gains were made by Fidelity FBTC, Bitwise BITB, and Grayscale BTC of $29.70 million, $24.69 million, and $13.56 million, respectively. VanEck HODL also made a smaller addition of $6.42 million in inflows.

Despite the inflows, the total trading value of the Bitcoin ETF dropped to $2.58 billion, with total net assets $149.74 billion. This marks 6.62% of Bitcoin market cap, slightly higher than the previous day.

Ethereum ETF Breakdown

Ethereum ETFs saw a total outflow of $79.36 million, with Fidelity’s FETH leading with $33.26 million. BlackRock ETHA also experienced heavy selling pressure of $26.47 million, followed by Grayscale’s ETHE $8.91 million. 21Shares TETH and Bitwise ETHW also posted smaller withdrawals of $6.24 million and $4.48 million, respectively.

The total trading value of Ethereum ETFs dropped below a billion, reaching $971.79 million. Net assets came in at $27.42 billion, representing 5.45% of the Ethereum market cap.

Ethereum ETF

Ethereum ETF

Market Context

Bitcoin is trading at $111,766, signalling a 4.6% drop compared to a week ago. Its market cap has also dipped to $2.225 trillion. Its daily trading volume has reached $49.837 billion, showing mild progress there.

Ethereum is priced at $4,011.92, with a market cap of $483.822 billion, showing a sharp decline. Its trading volume has also slipped to $37.680 billion, reflecting a slow market.

Due to heavy outflow this week, Bitcoin and Ethereum’s prices are experiencing price swings. Crypto analysts from Bloomberg warn the market to brace for further volatility.

Ayrıca Şunları da Beğenebilirsiniz

The Channel Factories We’ve Been Waiting For

PA Daily | Moonshot launches New XAI gork ($gork); analysis shows that Trump’s crypto assets account for about 40% of his total assets