Whales Load Up on ETH 19% Below ATH: Is a Big Ethereum Move Brewing?

Ethereum (ETH) is trading near $4,000 after bouncing from a low of $3,900 earlier this week. While the token is up about 4% over the past seven days, it has seen a decline of 3% in the last 24 hours. ETH remains about 19% below its all-time high of $4,950 (CoinGecko).

Data from Alphractal shows a sharp increase in the number of Ethereum addresses holding more than 1,000 ETH. This rise in large wallet balances has drawn attention in recent sessions.

ETH Leaves Exchanges as Supply Shrinks

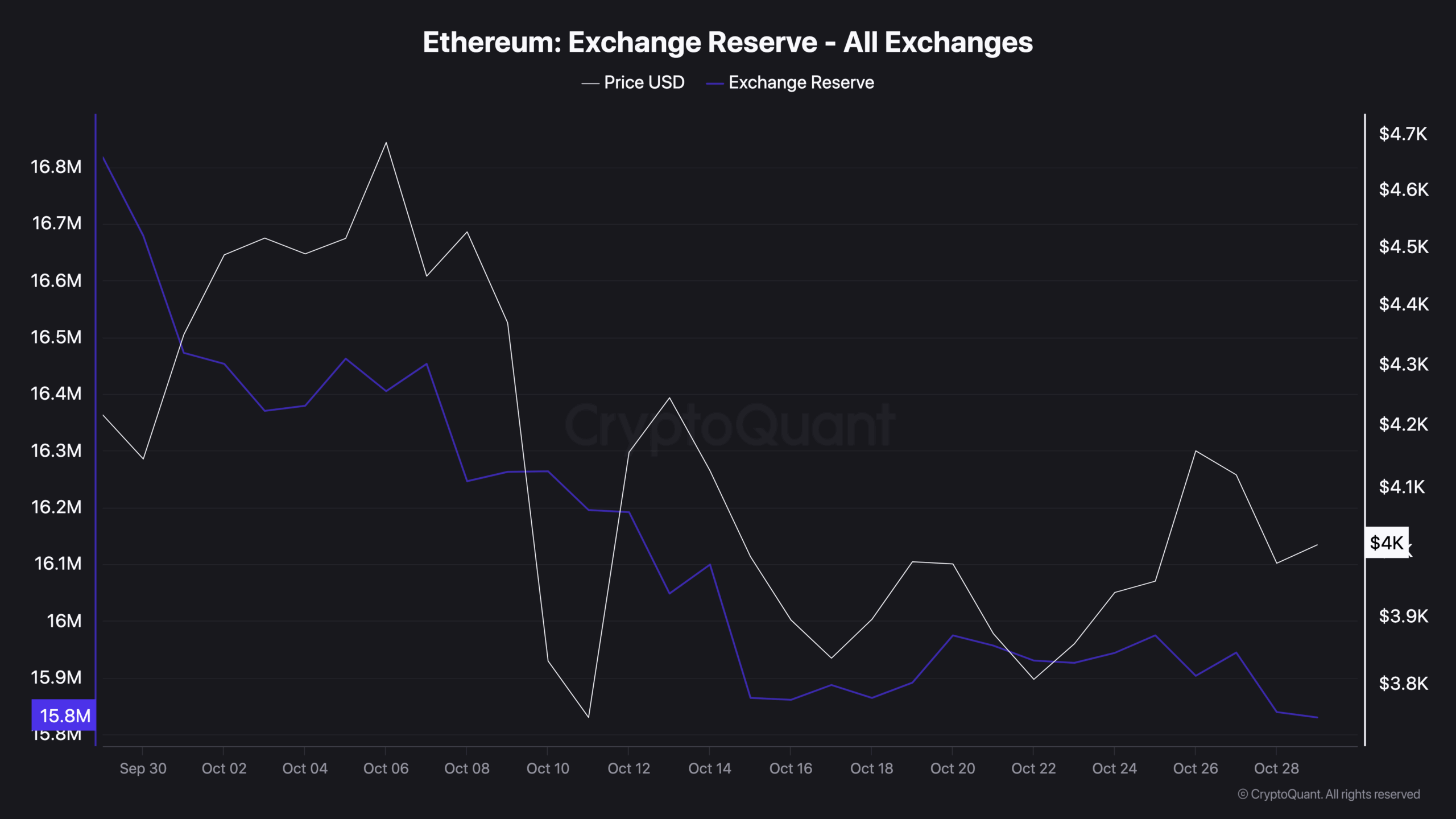

Supporting this, data from CryptoQuant shows ETH reserves across all exchanges have dropped by about 1 million coins since late September. The figure has fallen from 16.8 million to 15.8 million ETH, indicating a steady outflow over the past month.

Meanwhile, these withdrawals suggest ETH is moving into self-custody, a sign often seen as a longer-term holding. The price has held steady above $4,000 during this shift, suggesting reduced sell pressure in the short term.

Source: CryptoQuant

Source: CryptoQuant

Bigger Players Increase Exposure

Institutional interest in Ethereum has also risen. CryptoPotato reported that ETH held by institutions has grown nearly four times faster than Bitcoin over the last year. This shift may point to a growing role for Ethereum in large portfolios.

Bitmine, a firm backed by Tom Lee, recently bought 27,316 ETH worth over $113 million. The firm now holds 3.34 million ETH, valued at $13.3 billion. Lee has said ETH could reach $15,000 by December, though such targets remain speculative.

Key Levels Hold as Market Waits

Ethereum is trading in a tight range between $4,000 and $4,150. As we reported, a similar pattern was seen in mid-2025, when ETH moved sideways before jumping from $2,500 to $3,800. Some analysts view the current structure as a possible base.

BitBull noted that “as long as the $3.8K–$4K zone holds, there’s no reason to be bearish on Ethereum.”

Short-term price action remains sensitive. Another analyst pointed out ETH dropped to $3,900 before bouncing and added,

The post Whales Load Up on ETH 19% Below ATH: Is a Big Ethereum Move Brewing? appeared first on CryptoPotato.

You May Also Like

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam

Crypto News of the Week (Oct 23–30, 2025)