SWIFT partners with Linea to test blockchain messaging and interbank token

- SWIFT pilots blockchain messaging and interbank token settlement with Linea and top banks.

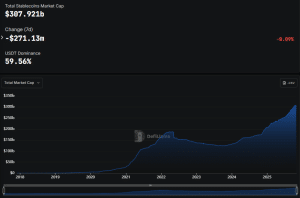

- Stablecoins surpass $270B market value as adoption rises across banks and institutions.

- Ripple faces tougher competition as SWIFT expands blockchain-based cross-border settlement.

SWIFT, the global financial messaging backbone, has launched a blockchain pilot with Linea, an Ethereum Layer-2 network by Consensys. The project will test on-chain messaging and a stablecoin-like settlement token with more than a dozen global banks. Participants include BNP Paribas and BNY Mellon, according to The Big Whale.

The trial seeks to cut costs and increase speed in cross-border settlements. Payment instructions and settlement will combine into a single on-chain transaction, allowing participants to track transactions in real time.

SWIFT currently connects more than 11,000 financial institutions worldwide but relies on correspondent banks and multiple intermediaries.

Linea Blockchain Technology for Secure Banking

The pilot expands SWIFT’s digital asset strategy. The organization has also tested tokenized fund settlement with UBS Asset Management and Chainlink and joined the Bank for International Settlements’ Project Agora.

Linea’s network is designed to be compatible with Ethereum which ensures privacy and provides advanced cryptographic security. Linea uses zk-rollup technology, which offers scalability and low-cost transactions while ensuring Ethereum-level security.

Its privacy features, based on zero-knowledge proofs, make it suitable for banks to balance innovation with regulatory compliance. Linea’s network also assists institutions in exploring tokenized payments in trusted frameworks.

The pilot also follows the growing use of stablecoins in global finance. The total market value of stablecoins has grown to over $270 billion, with Circle’s USDC and Tether (USDT) leading the sector.

Stablecoin Adoption and Expanding Infrastructure

In July, the US passed the first federal stablecoin law, which has prompted banks to explore their own tokens. Additionally, technology companies are showing interest, with Apple, Airbnb, Uber, and X reviewing stablecoin payment options. Furthermore, Google Cloud accepts PayPal’s PYUSD and supports stablecoin-based frameworks.

The institutional infrastructure is also expanding. For instance, Fireblocks, a crypto services firm valued at $8 billion, introduced a stablecoin payments network with more than 40 participants, including Circle and Stripe-owned Bridge. The system can facilitate enterprise cross-border transactions and is experimenting with pilots in Japan.

Also Read: Circle and Fireblocks Forge Powerful Alliance to Transform Cross-Border Payments

Cross-Border Payments Competition with Ripple Network

In addition, the pilot also signals increased competition in cross-border settlements, a space in which Ripple has positioned itself as a leader. Ripple’s use of a blockchain-based payment system has long been touted as a faster and cheaper alternative to SWIFT’s traditional system.

SWIFT’s pilot signals its intent to maintain leadership in global finance by offering its own settlement token. By offering its own settlement token, SWIFT aims to provide banks with trusted rails. Tom Zschach, SWIFT’s chief innovation officer, said that banks are likely to be interested in tokenized deposits or regulated stablecoins.

Following the announcement, Linea’s native cryptocurrency saw a more than 7% price increase. The rise indicated market interest in Linea’s potential for institutional adoption.

Also Read: Coinbase, Sony, and Samsung Power $14.6M Boost for Breakthrough Stablecoin Startup Bastion

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Taiko and Chainlink to Unleash Reliable Onchain Data for DeFi Ecosystem