A trader noted for earning over $12 million from meme coins has now bet on GhostwareOS (GHOST), a privacy-focused cryptocurrency.

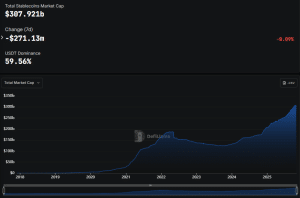

This investment comes amid a growing focus on privacy-first technologies in crypto. The privacy coin sector has seen notable growth recently, with the market cap now at $14.5 billion.

Sponsored

Sponsored

High-Profile Trader Backs New Privacy Coin

According to the latest data from Lookonchain, the trader, identified as “LeBron,” made millions from several coins earlier this year. In February, the blockchain analytics firm highlighted that the trader had gained over $12 million from PolitiFi meme coins.

This included $8.9 million from Melania Meme (MELANIA) and $3.2 million from Official Trump (TRUMP). Furthermore, he also made $4.56 million from LIBRA and $1 million from Harry Bōlz (HARRYBOLZ), which surged after Elon Musk’s user name change on X (formerly Twitter).

Now, the trader has invested 102 Solana (SOL) worth around $18,300 to obtain 2.9 million GHOST tokens.

Trader LeBron’s GHOST Purchase. Source: X/LookonchainGhostWare bills itself as a platform built for “total invisibility.” It is a decentralized framework that anonymizes user activity across communications, wallets, and identity layers through tools like GhostMask (alias management), GhostScrub (on-chain trace cleaning), and GhostRelay (encrypted communication relays).

Sponsored

Sponsored

Its native token, GHOST, is a new market entrant but has positioned itself as the top daily gainer among privacy coins on CoinGecko. The token has appreciated nearly 24% over the past day.

Furthermore, it peaked at an all-time high of $0.015 in early Asian trading hours today before stabilizing to a press time value of $0.013.

GhostwareOS (GHOST) Price Performance. Source: BeInCrypto MarketsGHOST’s arrival comes as the privacy narrative is gaining increased attention in the space. BeInCrypto reported that privacy tokens have outperformed every other sector this year, with coins like ZCash (ZEC) leading the rally with massive gains. This broader interest has also raised optimism for GHOST.

Another prominent cryptocurrency trader noted that privacy is the primary narrative where innovation remains underdeveloped. The trader expects renewed Solana ecosystem activity if market conditions strengthen later in the year, potentially benefiting GHOST.

For GHOST, strong price movement and community support suggest a solid early reception. However, lasting relevance depends on GhostWare’s ability to move from short-term hype to real user adoption in Solana’s competitive ecosystem.

Source: https://beincrypto.com/ghostware-trader-invests-solana-privacy/