Kalshi Partners with Pyth Network for Blockchain Integration as Prediction Markets Boom

TLDR

- Kalshi raised $300 million at a $5 billion valuation from investors including Sequoia Capital and Andreessen Horowitz, while competitor Polymarket raised $2 billion at a $9 billion valuation

- The two prediction platforms combined for $1.44 billion in trading volume during September, with Kalshi capturing 60% market share through its Robinhood partnership

- Kalshi partnered with Pyth Network to stream real-time event data across 100+ blockchains, marking the first large-scale integration of regulated prediction market data

- Donald Trump Jr. joined Kalshi as a strategic adviser earlier this year as the platform plans to expand to 140 countries

- Kalshi operates as a CFTC-regulated Designated Contract Market while Polymarket runs fully on-chain with all positions publicly viewable on the blockchain

Kalshi secured $300 million in new funding at a $5 billion valuation in a round led by Sequoia Capital and Andreessen Horowitz. The federally regulated prediction market exchange also announced a partnership with Pyth Network to bring real-time event data to over 100 blockchains.

The funding round included participation from Paradigm and Coinbase. This comes as prediction markets experienced record growth, with Kalshi and competitor Polymarket combining for $1.44 billion in trading volume during September.

Kalshi captured 60% market share against Polymarket in September. This marked a reversal from earlier in the year when Polymarket dominated trading activity. The shift coincided with Kalshi’s integration with Robinhood, allowing users to place bets directly through the Robinhood interface.

Polymarket raised $2 billion from Intercontinental Exchange (ICE) at a $9 billion valuation. Bloomberg reported that Polymarket founder Shayne Coplan became the youngest self-made billionaire following the raise.

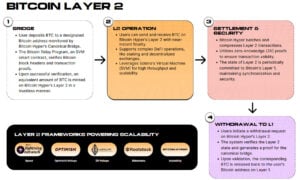

The partnership with Pyth Network allows blockchain developers to access live data from Kalshi markets. Events include the New York City Mayor Election, F1 Drivers Champion, MLB Champion, and Federal Reserve rate cut predictions. The integration turns market-priced probabilities into verifiable data for use in DeFi applications, risk modeling, gaming, and governance systems.

Regulated Market Infrastructure

Kalshi operates as a Designated Contract Market under the U.S. Commodity Futures Trading Commission (CFTC). The platform lets traders buy and sell outcomes tied to real-world events, from Federal Reserve decisions to presidential elections.

The company runs off-chain with market data accessible through traditional APIs. Polymarket operates fully on-chain with all markets and positions publicly viewable on the blockchain.

0xUltra, who handles crypto growth at Kalshi, said oracles represent the first step in taking Kalshi on-chain. The collaboration with Pyth Network creates what both companies describe as the first large-scale integration of regulated prediction data into blockchain ecosystems.

Expansion Plans

Kalshi plans to expand operations to 140 countries following the funding round. Donald Trump Jr. joined the platform as a strategic adviser earlier this year. The Robinhood partnership provides Kalshi with access to the trading platform’s retail user base.

Pyth Network already provides asset price feeds from over 100 publishers. The addition of event-based data extends the concept of market data from traditional financial assets to real-world events.

Polymarket received approval to operate in certain US markets. Political betting remains contentious in Washington, with regulators debating the boundaries of event-based markets. Kalshi and Polymarket’s expansion will be closely watched by policymakers and market observers.

The post Kalshi Partners with Pyth Network for Blockchain Integration as Prediction Markets Boom appeared first on CoinCentral.

You May Also Like

Mastercard Goes All Into Web3 Via Acquisition of Zerohash for Nearly $2B

Bitcoin Hyper Coin Review 2025 — Is it Safe to Invest in? Everything You Need to Know