Bitcoin Whales Drive Movement as Price Slips Below $111,000

- Bitcoin whales intensify accumulation as price drops below $111,000.

- Over 6,300 large transfers spark heightened market activity and volatility.

- Institutional confidence strengthens despite Bitcoin’s short-term correction phase.

Bitcoin’s market faced heightened volatility over the past 24 hours as large investors continued their aggressive accumulation. According to Ali Martinez, on-chain data from Santiment revealed a surge in whale transactions this week, with more than 6,311 transfers valued at over $1 million each. This marks the strongest wave of whale activity in nearly two months, showing that major holders remain undeterred by recent market corrections.

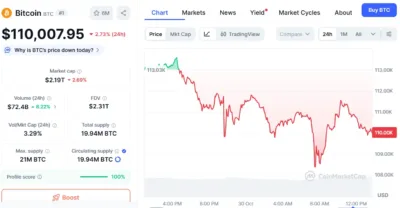

Even with institutional inflows from spot Bitcoin ETFs sustaining market optimism, Bitcoin’s value has fallen from recent highs. Data from CoinMarketCap shows the cryptocurrency declined by over 3%, currently trading near $110,007. Analysts suggest that this consistent whale activity signals ongoing accumulation as large holders position themselves for potential long-term gains.

Also Read: Trending: Solana Paid Western Union $50M for the Stablecoin Deal? XRP Army Reacts

Bitcoin Price Movement After Whale Surge

Following the surge in whale transactions, Bitcoin’s price chart displayed a sharp decline from $113,000 to around $110,000 within a single day. The chart from CoinMarketCap shows that the drop began shortly after increased whale movement was recorded, indicating intensified market selling and profit-taking pressure.

During the early hours, Bitcoin saw multiple recovery attempts but failed to maintain upward momentum. Each rebound was followed by renewed selling pressure, which drove the asset’s price briefly below $109,000 before stabilizing near the $110,000 mark. The red trend on the chart reflects heightened trading activity, with market participants reacting swiftly to whale transactions and overall market uncertainty.

Source: CoinMarketCap

Additionally, the trading volume spiked by over 8%, reaching $72.4 billion within 24 hours, highlighting the growing market engagement despite the decline. This movement suggests that while whales continue to accumulate, short-term traders remain cautious amid rapid intraday fluctuations.

Overall, the current Bitcoin movement reflects a tug-of-war between accumulating whales and hesitant retail traders. The consistent whale activity continues to reinforce institutional confidence, while short-term volatility underscores the ongoing uncertainty shaping the broader crypto landscape.

Also Read: Pundit: “Western Union is a Centralized Predator, XRP’s Role is Clear”

The post Bitcoin Whales Drive Movement as Price Slips Below $111,000 appeared first on 36Crypto.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Shiba Inu Price Prediction: PEPE Holders Looking For The Next 100x Crypto Set Their Sights On Layer Brett Presale