Top Cryptocurrencies to Invest in for 2025 Feature Rollblock Alongside BTC, ETH And ADA

In 2025 investors aren’t just chasing blue-chip stability; they’re looking for projects that combine proven adoption with explosive upside.

Bitcoin (BTC), Ethereum (ETH) and Cardano (ADA) continue to dominate headlines, but analysts are now adding a new contender to the conversation.

Rollblock, a viral presale that already boasts verifiable growth, is emerging as a GameFi token that could stand alongside the industry’s giants. The question is: can a low-cap newcomer really compete with legacy players?

Rollblock (RBLK) Stands Tall Among Blue-Chip Tokens in 2025

Rollblock has gone from an emerging presale in 2024 to a breakout contender in 2025, now being mentioned in the same breath as BTC, ETH and ADA.

The reason? Verifiable adoption in presale. The iGaming ecosystem is already live with over 12,000 AI-powered titles and an integrated sportsbook driving nonstop engagement from 50,000+ active players. Over $15 million in wagers have already been processed before Tier-1 listings, proving Rollblock’s utility before the token is launched.

At the core of its popularity lies RBLK, the utility token powering governance, staking and VIP access. Weekly RBLK buybacks permanently burn 60% of repurchased tokens while channeling 40% into staking pools offering up to 30% yield. This deflationary cycle ensures that every wager makes the token scarcer and more rewarding for holders.

For investors, Rollblock presents a dual advantage: exposure to the $80B iGaming industry and predictable value circulation back to token holders. At just $0.068 in presale, the entry point remains attractive given the mechanics already driving traction.

Key reasons why Rollblock is amongst the top cryptocurrencies to invest in include:

- $11.7M raised in presale with adoption proven pre-listing

- Weekly buyback-and-burn model tightening supply and rewarding holders

- Cross-border onboarding with fiat and crypto onramps

- iOS/Android apps under development, loyalty bonuses and multi-million-dollar prize pools

By blending entertainment and finance into one ERC-20 powered hub, Rollblock is creating the kind of sticky ecosystem that keeps traders, gamers and long-term investors aligned. With adoption already verified, analysts argue that RBLK is emerging as one of the rare low-cap gems capable of competing with legacy giants in 2025.

Bitcoin (BTC) Builds Momentum Toward $120K

The Bitcoin price reached $113,865 on September 10, marking a recovery from a multi-week downtrend. The catalyst was US macro tailwinds that pushed Bitcoin back above the critical $114,000 level, reigniting optimism among traders.

Analyst Rekt Capital highlighted that Bitcoin’s repeated tests of the $113,000 zone have shown progressively weaker rejections. Despite some speculation that Bitcoin could be nearing a cycle top, analysts remain confident that the rally can be extended.

Most liquidity lies just above spot prices, with a major liquidity cluster sitting around $112,631 which could raise the likelihood of a short squeeze. The 50-day SMA at $114,700 is the nearest resistance, with analysts calling for further Bitcoin upside toward $120,000 if that level is breached.

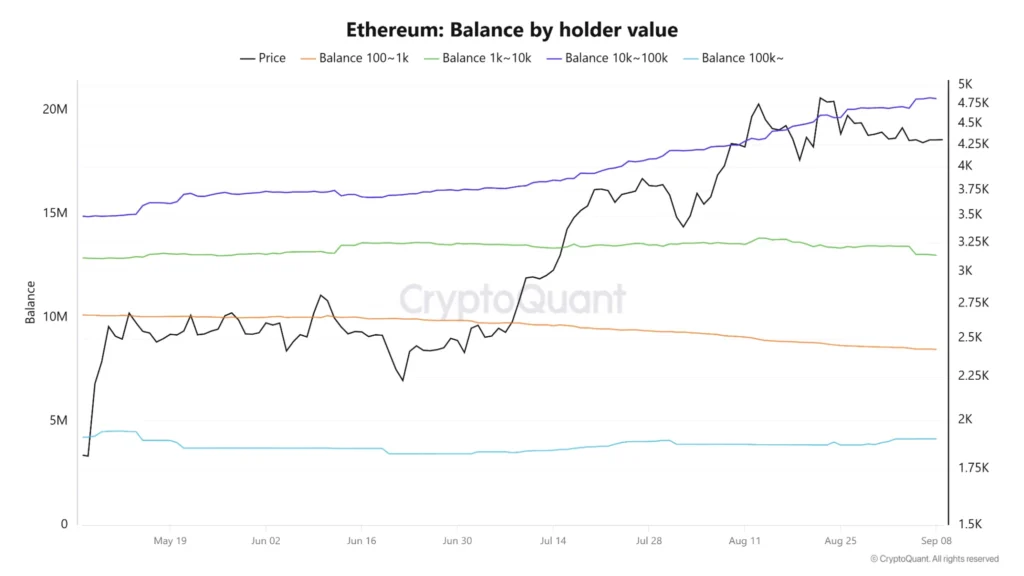

Ethereum (ETH) Whales Signal Long-Term Confidence

The Ethereum price stabilized around the $4,240 level before starting a fresh increase above $4,300. The ETH/USD pair broke above a key bearish trendline with resistance at $4,330, with the Ethereum price briefly climbing above $4,440 before there was a pullback.

Whales purchased over 450,000 ETH in the past week, continuing an accumulation trend that began in May 2025. Ethereum’s exchange reserves paint a similar picture by recording a 260,000 ETH decrease since the beginning of September. Investors are likely moving ETH to private wallets for long-term holding, boosting sentiment across the market.

Despite the uptrend, Ethereum saw $64 million in futures liquidations over the past 24 hours after modestly rejecting the $4,500 level. If Ethereum can hold above the upper boundary trendline of a descending triangle, it could retest the $4,500 level in coming weeks.

Cardano (ADA) Breaks Key Resistance with Whale Accumulation

The Cardano price has been building steam, and this week it finally broke through key levels that traders have been monitoring closely. In just two days, whales accumulated 200 million Cardano tokens worth $178 million, marking the largest buying spree since July 2025.

This whale accumulation coincided with Cardano’s breakout above $0.89, a level that had been acting as a stubborn resistance. If buying activity continues and Cardano stays above the critical $0.90 level, it could force short sellers to cover their positions and trigger a short squeeze toward $0.921 and beyond.

Why Rollblock Belongs in the 2025 Big League

As the markets gear up for another pivotal cycle, Bitcoin continues to push toward new highs, Ethereum’s whale accumulation signals faith in its long-term role in smart contract networks and Cardano finally shows signs of strength after months of muted action.

But Rollblock’s rapid ascent shows that the next generation of altcoins is ready to share the spotlight.

With $11.7M raised in presale and 50,000 players onboarded pre-listing, Rollblock has already delivered adoption that most presale tokens can only promise. Its iGaming hub, revenue-sharing model and deflationary tokenomics have created a foundation where utility and investor value intersect.

That’s why analysts are putting RBLK alongside BTC, ETH and Cardano in 2025. Not because it replaces them, but because it represents something new: a scalable ERC-20 ecosystem with 20x–40x upside and proven use cases that traders can measure in real time.

Rollblock has already earned its place in the conversation about top cryptocurrencies to invest in – and for early backers at just $0.068 in presale, the upside could be among the most compelling of the cycle.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse