A look inside Trump's World Liberty crypto power play

Author: TM

Compiled by: TechFlow

Good news: Another wave of enthusiasm on the Solana chain is coming!

We are finally getting the massive liquidity we’ve been dreaming of, and this time it’s the bankers injecting funds into our meme.

If you need a quick summary: @worldlibertyfi is providing TWAP (Time Weighted Average Price) services for the ETH and SOL ecosystems. This alone is enough to foreshadow what’s to come.

First Look: A Money Laundering Scheme?

When I first heard about World Liberty, I honestly thought it was just an elaborate money laundering operation by the Trump family.

In theory, this logic seems to hold true:

- Printing billions in profits via the $TRUMP memecoin;

- Launch a platform that provides liquidity services for traditional financial (TradFi) funds;

- Profits are transferred tax-free through this scheme;

- No supervision, no touch, perfect achievement.

But I overlooked a key point at the time – and today I finally understand it – World Liberty is much bigger than this!

HUUUUUGE

Cryptocurrency Liquidity Machine

World Liberty is positioning itself as a key liquidity provider in the on-chain ecosystem. Like it or not: Trump may be coming to the rescue of us “decentralization enthusiasts.”

We’ve been starving for liquidity, and now it’s finally here. Sounds great, right?

But here's the problem: whoever controls the inflow and outflow of funds also controls the rules of the game.

In the previous cycle, centralized exchanges (CEXs) played this role, acting as a bridge between banks (the real liquidity providers and the source of fiat currency) and traders.

But today, CEXs have become largely irrelevant. CZ and Brian saw this coming, which is why they started building their own on-chain layer.

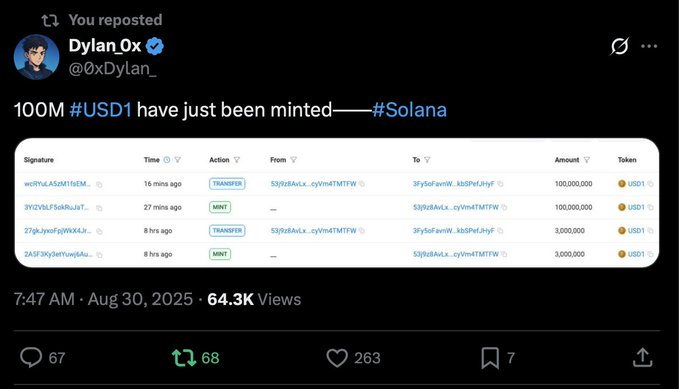

Meanwhile, as you read this, World Liberty has minted hundreds of millions of dollars in its stablecoin USD1.

"USD1 Wallet" Account Manager

The USD1 Problem

Exactly how these funds will be deployed remains a mystery so far.

Who can access these funds?

What are the standards?

Is it just about being close to the Trump family? Or does one need to give them 10% of the company in exchange for money?

No one knows for sure, but the key point is this: they control the flow of liquidity in the entire crypto space.

From this point on, every emerging trend is directly linked to Trump’s influence.

Don’t like Meme Meta? They’ll fund ICM projects instead.

Don’t like ICM this month? Maybe AI next month.

They can guide the direction of the entire cycle.

Married...with kids 2.0

The hidden dangers of centralization

In the short term, we win: attention, popularity, and liquidity. Decentralization enthusiasts will enjoy this feast.

But who are the real winners in the long run?

Is it the crypto natives, or the Wall Street bankers behind the game?

Ask yourself: How many of you still have the Bitcoins you once accumulated, or have you already gambled them away in the memecoin frenzy?

Don't tell me you're betting all our money on those Memecoins, Donny!

All my Bitcoins are gone.

Transparency, Control, and Penalties

We are no longer the Wild West.

We’ve traded freedom for liquidity, and fun for privacy. Now, every transaction you make on Solana is permanently visible.

Now, most people might be thinking, “I don’t care, they can’t touch me.”

But the fact is, they can find you, and they probably will. Groypers.

At some point, you might be punished for the assets you traded, the tokens you held, or even the words you said in 2025. This is the bitter aftermath of this game:

We are squeezed out by the pricing of the assets we once built;

We have lost ownership of the ecosystem we love;

Worst of all, we have given up our freedom in the space we depend on.

We need Degenspartan back!

Here are my initial suggestions

Make the most money you can while the window is still open.

But never forget: there is no free lunch. Liquidity is not free, and neither is Trump’s “support.”

We are swimming in a pool of sharks, and those sharks don’t want the “little guy” to win.

What does the future hold?

Which coin should I buy? The truth is, unless you have direct inside information from Trump's circle, it's all speculation. They control the market right now. As Rothschild once said, "He who controls the money controls the world."

My best guess is that as World Liberty begins TWAP (time-weighted average price) into the ecosystem, other foundations will follow.

It is expected that Chinese players and other forces will invest more aggressive returns (higher annualized returns, more leverage).

By late 2025 or early 2026, regulation will likely step in and lock it all down—not by weakening World Liberty but by consolidating its power.

At that time, real-world startups and technology projects will begin to deploy on-chain.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator