Perfect Beginners Handbook For 2025 Altseason – Here’s Which Tokens Will Create Millionaires

A new wave of digital coins could change many lives in the coming year. Some tokens are expected to grow fast and bring in big profits for early buyers. With new trends and ideas taking the spotlight, certain picks stand out from the rest. Find out which coins have the biggest potential for huge returns ahead.

Avalanche (AVAX)

Source: TradingView

AVAX holds between $23 and $27 after a choppy week. The token gained almost 5% in 7 days, cutting into last month’s 2% dip. Over 6 months it still shows nearly 10% growth, proof of a slow but steady climb rather than a sharp rally or crash.

The 10-day and 100-day averages sit close to $24, showing balanced pressure. Momentum gauges hover near neutral, so the next big move likely depends on fresh news. Traders watch the first ceiling at $29.48; a clean break could pull in more buyers and shift talk toward the next barrier near $34.

If bulls clear $29, price could pop about 20% from the current midpoint. A run to $34 would mark a 35% lift. On the flip side, dropping through 20.40 risks a 15% slide, and losing $15.86 opens the door to a 35% fall. With a green week and steady signals, odds tilt toward a push to $29 before the month wraps.

IOTA (IOTA)

Source: TradingView

The price of IOTA sits between $0.19 and $0.22 after a modest rise of 1.16% in the past week. That weekly gain trims the month drop of 1.47% and the six month slide of 1.04%. Short term traders see a coin that is trying to turn a flat trend into a mild climb.

The 10 day and 100 day moving lines both hover around $0.20 so cost and value are meeting in the middle. RSI at 62 hints that buying energy is slightly stronger than selling. The Stochastic reading near 91 shows the coin is near the top of its recent range yet momentum remains alive. MACD at plus 0.0009 confirms the thin but real upward push.

A clean break over $0.23 would invite a jump toward $0.26 which would add roughly 18% from the low end of the current band. Failing that, pullbacks may find a floor at $0.17 and then $0.15 which would cut the price by about 10% to 20%. Given the rising tilt in momentum and tight averages, the odds favor a slow climb toward the first ceiling, but buyers must show volume soon

Undervalued $XYZ Meme Coin Gears Up for Listing on a Major CEX

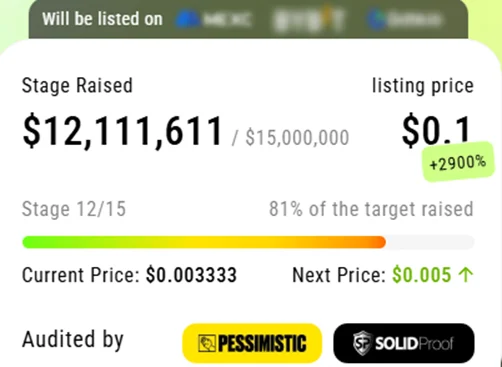

XYZVerse ($XYZ) is the meme coin that has grabbed headlines with its ambitious claim of rising from $0.0001 to $0.1 during a presale phase.

So far, it has gone halfway, raising over $15 million, and the price of the $XYZ token currently stands at $0.005.

At the next 14th stage of the presale, the $XYZ token value will further rise to $0.01, meaning that early investors have the chance to secure a bigger discount.

Following the presale, $XYZ will be listed on major centralized and decentralized exchanges. The team has not disclosed the details yet, but they have put a teaser for a big launch.

Born for Fighters, Built for Champions

XYZVerse is building a community for those hungry for big profits in crypto — the relentless, the ambitious, the ones aiming for dominance. This is a coin for true fighters — a mindset that resonates with athletes and sports fans alike. $XYZ is the token for thrill-seekers chasing the next big meme coin.

Central to the XYZVerse story is XYZepe — a fighter in the meme coin arena, battling to climb the charts and make it to the top on CoinMarketCap. Will it become the next DOGE or SHIB? Time will tell.

Community-First Vibes

In XYZVerse, the community runs the show. Active participants earn hefty rewards, and the team has allocated a massive 10% of the total token supply — around 10 billion $XYZ — for airdrops, making it one of the largest airdrops on record.

Backed by solid tokenomics, strategic CEX and DEX listings, and regular token burns, $XYZ is built for a championship run. Every move is designed to boost momentum, drive price growth, and rally a loyal community that knows this could be the start of something legendary.

Airdrops, Rewards, and More — Join XYZVerse to Unlock All the Benefits

Compound (COMP)

Source: TradingView

Compound has fallen 4.34% in the past week, 8.15% over the last month, and 11.75% across six months. It now trades close to $46, hovering just above both its 10-day and 100-day moving lines near $44-$45. The slide has slowed, and short-term averages are flat, hinting at a pause in the drop.

Market gauges sit in the middle. The strength index reads $50, the stochastic meter shows 50, and the trend line from the MACD has inched into positive ground. This neutral mood leaves price caught between the $40.27 support floor and the $53.05 ceiling. A clean push past $53.05 would open a run toward $59.44, roughly a 25% jump from current levels. If selling returns, a slip under $40.27 could invite a move to $33.87, about a 27% slide.

With no clear winner, COMP looks set for range trading. Bulls must clear $53.05 to flip sentiment and spark fresh demand. Bears will eye $40.27 to regain control. Until either side breaks those marks, expect sideways action with sharp, news-driven bursts.

Maker (MKR)

Source: TradingView

Maker has struggled this summer. The token lost 7.39% in the last 7 days, fell 28.8% over 30 days, and now sits just 2.79% below its level 6 months ago. The price swings between $1395 and $1743, showing nervous trade after sellers wiped out almost a third of its value in a month.

Short-term momentum is weak. The 10-day average at $1556 stands above spot, and the 100-day line at $1547 offers little cushion. Strength sits at 32 while an oscillator reading near 8 signals an oversold pocket, yet the trend bar is still negative at ‑9.1. If buyers stay away the chart points to $1269 support, a drop of about 12% from the lower edge of today’s band.

A bounce is possible from this oversold zone. A push through $1743 could target $1966, roughly 15% higher; reclaiming $2315 would add another 32%. That climb needs fresh demand. If the rebound fades, a slip under $1395 puts $1269 in play, and failure there opens $920, a further 27% slide. Right now the bias leans lower until $1556 is regained.

Conclusion

AVAX, IOTA, COMP, MKR offer solid upside, yet XYZVerse (XYZ) unites sport and meme culture, targets 20,000% gains, empowers community, and aims to surpass PEPE, becoming the bull run’s icon.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy