Ethereum Whale Profits Turn Negative: Will Whale Pressure Trigger a Sell-Off for ETH Price?

The post Ethereum Whale Profits Turn Negative: Will Whale Pressure Trigger a Sell-Off for ETH Price? appeared first on Coinpedia Fintech News

The crypto market has been bleeding red over the past few weeks, with Bitcoin hovering below $70K. This has resulted in a strong selloff in the altcoin market, with the ETH price now trading around monthly support levels. Things have worsened recently, as crucial on-chain data now points toward a potential significant decline in the ETH price in the coming weeks. As a result, this could trap bulls and cap any short-term recoveries.

ETH Whale Profit Turns Negative

Ethereum has been declining for over the past few weeks and it lost over 34% in a month. According to Coinglass data, ETH faced over $40 million in liquidation and sellers liquidated nearly $24 million as the altcoin rebounds.

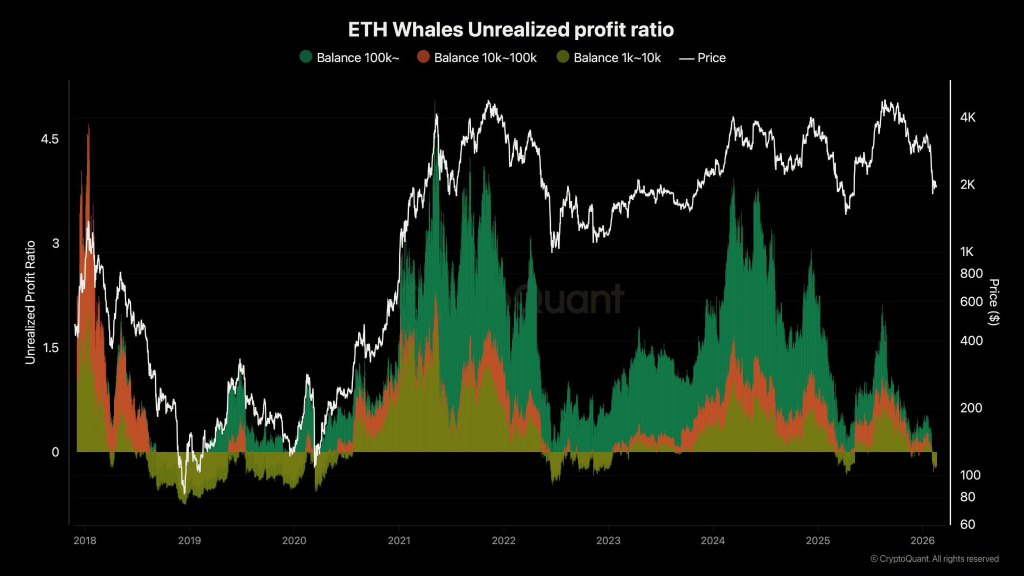

However, the overall sentiment for Ethereum remains negative, as revealed by Cryptoquant data. Ethereum (ETH) whales are now facing rising pressure as their unrealized profits have slipped into negative territory. Recent on-chain data indicates that Ethereum’s largest investors are no longer in profit. Whales are now seeing small unrealized losses instead of paper gains.

Unrealized Profit Ratio

Unrealized Profit Ratio

Looking at the breakdown, wallets holding between 1,000 and 10,000 ETH currently have an average unrealized profit ratio of -0.21. Those with 10,000 to 100,000 ETH are at -0.18. Meanwhile, the largest addresses, holding more than 100,000 ETH, are also slightly underwater, with a ratio of -0.08.

Unrealized profit refers to the gain or loss investors would have if they sold their ETH at today’s market price. When this number drops below zero, it means the current price is lower than the average price at which these whales accumulated their coins.

Also read: Expert Reveals How Low Bitcoin Could Crash If $65K Breaks

Historical data shows that it is not common for whale unrealized profits to stay negative for long periods. Similar situations in the past have usually happened during major market pullbacks, when prices were under heavy pressure.

As a result, Ethereum might face another decline in the coming days as whales might soon sell their holdings. This will be because of the continuous failures of Ethereum to surge above $2000 level.

What’s Next for ETH Price?

Buyers have managed to keep Ether above the key support level of $1,755, which shows that traders are stepping in to buy when the price dips. As of writing, ETH price trades at $1955, surging over 1.6% in the last 24 hours.

ETH Price Chart

ETH Price Chart

The next challenge for buyers is to push the price above the 100-day EMA at $2,100. If they can break through that level, ETH/USDT could gain momentum and move higher toward the 50-day SMA at $2,795.

On the other hand, if Ether fails to surge above the EMA100 trend line, it would suggest that sellers are gaining control. In that case, the price could slide toward the important support level at $1,750. Buyers are likely to strongly defend the $1,750 level, because if the price closes below it, ETH/USDT could decline further to around $1,500.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

‘Great Progress’: Cardano Founder Shares Update After CLARITY Act Roundtable

Read the full article at coingape.com.