Top 3 Tokens Gaining During $5 Trillion Market Rally – Corporate Treasury Champions

Massive capital is flowing, with a few tokens standing out for their sharp rise and strong ties to big companies’ finances. Which assets are leading, and why are they drawing corporate attention? Discover the tokens making the biggest impact.

Ethereum (ETH)

Source: TradingView

Source: TradingView

Ethereum traded between $4245 and $5136 this week. The coin is up 4.94% in 7 days, 26.08% in a month, and 88.36% over six months. The 10-day average sits at $4740.59, just above the 100-day line at $4593.48. That steady climb keeps eyes on the next move.

Energy is cooling. RSI at 40.22 shows demand has dipped, Stochastic at 12.33 points to oversold ground, and MACD is negative at −14.27. These signals hint at short pauses rather than panic. As long as buyers defend 4245, the longer trend that added almost 90% in half a year stays alive.

If ETH lifts through $5136, the first test waits at $5492, about 16% above the 10-day average. A clear break could open $6383, nearly 35% higher. Failure to hold $4245 risks a slide to the main support at $3710, roughly −22%, and in a harsher shakeout $2819, about −41%. The past month’s 26% jump suggests momentum favors another run, yet the chart warns that patience may be needed before the next leg.

Undervalued $XYZ Meme Coin Gears Up for Listing on a Major CEX

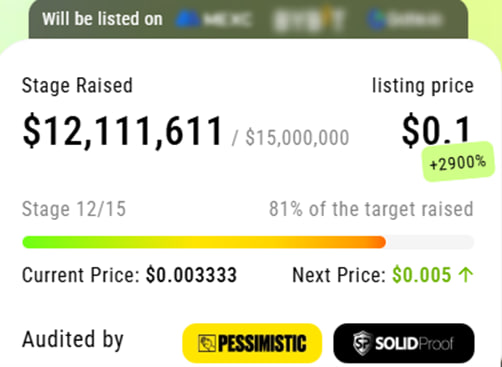

XYZVerse ($XYZ) is the meme coin that has grabbed headlines with its ambitious claim of rising from $0.0001 to $0.1 during a presale phase.

So far, it has gone halfway, raising over $15 million, and the price of the $XYZ token currently stands at $0.005.

At the next 14th stage of the presale, the $XYZ token value will further rise to $0.01, meaning that early investors have the chance to secure a bigger discount.

Following the presale, $XYZ will be listed on major centralized and decentralized exchanges. The team has not disclosed the details yet, but they have put a teaser for a big launch.

Born for Fighters, Built for Champions

XYZVerse is building a community for those hungry for big profits in crypto — the relentless, the ambitious, the ones aiming for dominance. This is a coin for true fighters — a mindset that resonates with athletes and sports fans alike. $XYZ is the token for thrill-seekers chasing the next big meme coin.

Central to the XYZVerse story is XYZepe — a fighter in the meme coin arena, battling to climb the charts and make it to the top on CoinMarketCap. Will it become the next DOGE or SHIB? Time will tell.

Community-First Vibes

In XYZVerse, the community runs the show. Active participants earn hefty rewards, and the team has allocated a massive 10% of the total token supply — around 10 billion $XYZ — for airdrops, making it one of the largest airdrops on record.

Backed by solid tokenomics, strategic CEX and DEX listings, and regular token burns, $XYZ is built for a championship run. Every move is designed to boost momentum, drive price growth, and rally a loyal community that knows this could be the start of something legendary.

Airdrops, Rewards, and More — Join XYZVerse to Unlock All the Benefits

Hyperliquid (HYPE)

Source: TradingView

Source: TradingView

HYPE slipped about 1% this week, but it still shows a 3% climb in the past month and a huge 126% jump over six months. The coin now trades between $41.97 and $48.51, sitting a touch under its 10-day average of $46.07 and slightly above the 100-day line of 43.48. That mix points to a market that cooled off short term yet keeps a long-run uptrend alive.

The nearest ceiling is $50.99. A close above it could unlock fresh bids toward $57.53, meaning roughly 8% to 22% upside from the middle of the current band. Support rests at $37.91, then $31.37. A slide through those floors would hand back about 15% to 30% of recent gains. Momentum signals lean neutral-to-positive: RSI sits near $52, the stochastic mirrors it, and MACD stays in green, hinting bulls still have a slight edge.

With the 10-day average above the 100-day and the long-term chart still doubling since winter, odds favor another push higher once the week’s pullback fades. Holding above $44 could trigger a run toward $51 in the near term and even $57 later, for an extra 10%-20%. A break under 38 would flip the script and likely drag HYPE back to the low 30s.

Sui (SUI)

Source: TradingView

Source: TradingView

Sui now trades between $3.38 and $3.92 after sliding 4.57% in 7 days and 8.99% in 30 days. Yet the coin holds a 21.71% gain over 6 months, so the longer track stays green. Momentum cooled last week, but buyers did not vanish.

The 10 day average is $3.66 while the 100 day average is $3.61, so price hugs its base lines. RSI near 40 and a 12.48 stochastic point to oversold ground. MACD at -0.0139 shows only mild downward push.

If buyers step in, SUI could climb to the $4.15 cap, about 14% up from the mid band. Clearing that may call $4.70, a 29% rise. A slip below $3.38 risks $3.07, down 16%, or even $2.53, a 31% fall. Right now the odds tilt to a rebound.

Conclusion

ETH, HYPE, SUI shine in the rally; yet XYZVerse (XYZ) leads next, the first all-sport memecoin mixing memes and sports, eyeing 20,000% community-led growth via GameFi and media links.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Top 3 Tokens Gaining During $5 Trillion Market Rally – Corporate Treasury Champions appeared first on Coindoo.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

NVIDIA Stock Price Analysis as OpenAI Issues Concerns About its Chips