Ethereum price prediction: Is ETH near a historic bottom? Analysts weigh in

Ethereum’s prolonged weakness has pushed key on-chain valuation metrics into territory historically associated with major market bottoms. This has prompted analysts to debate whether ETH is approaching a long-term inflection point or if further downside still lies ahead.

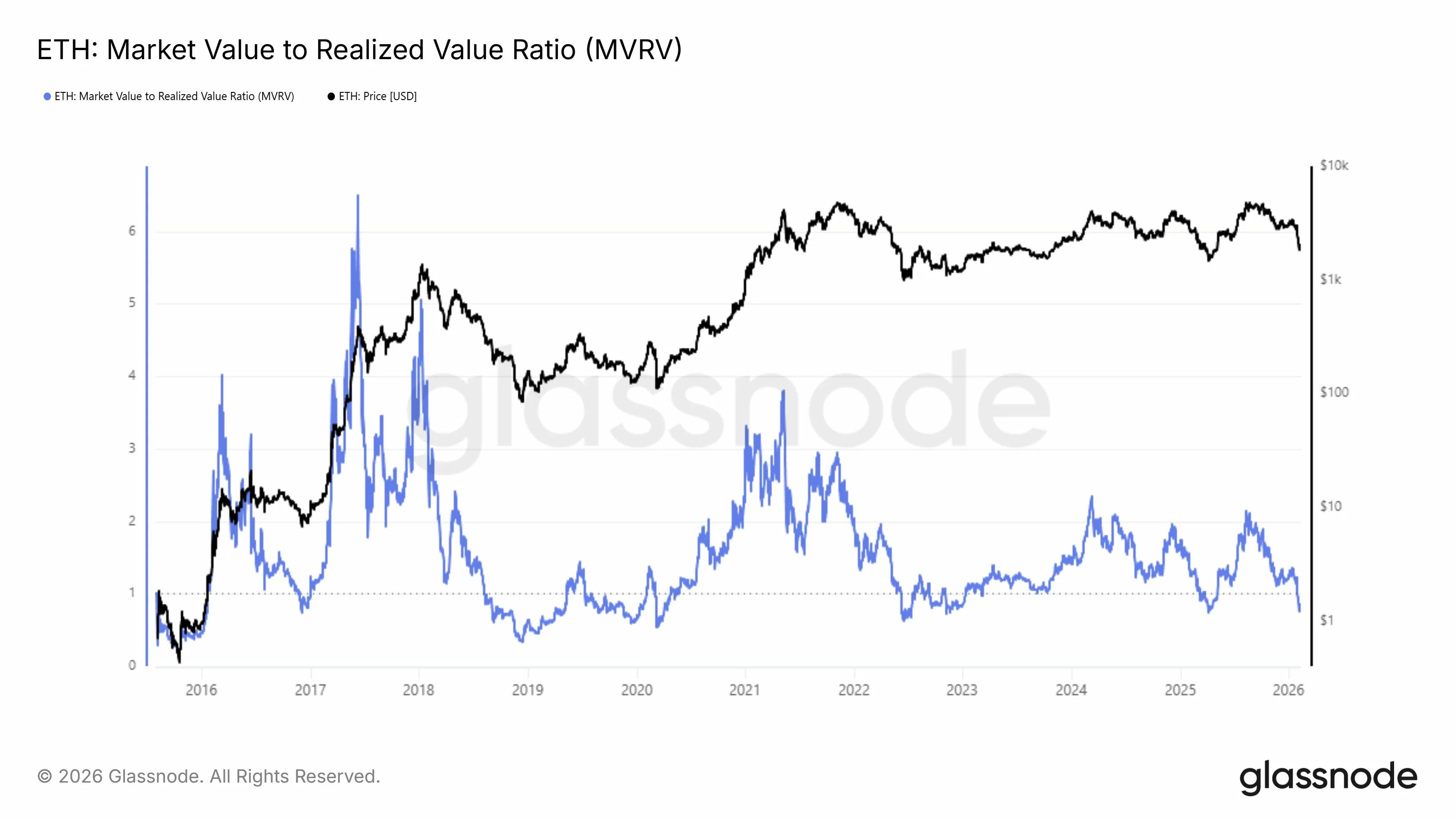

- Ethereum price prediction debates are intensifying as MVRV metrics show ETH trading at levels historically associated with major market bottoms.

- Analyst Michaël van de Poppe says Ethereum appears deeply undervalued, citing similarities to past crash periods that later delivered strong recoveries.

- On-chain analyst Jao Wedson cautions that while capitulation is underway, historical data suggests further downside is still possible before a definitive bottom forms.

Ethereum price prediction supported by deep undervaluation signals

As of press time, Ethereum (ETH) trades around $2,000 after failing to hold above $2,100 amid market chop.

Crypto analyst Michaël van de Poppe argues that Ethereum is trading at a substantial discount to its “fair value,” citing the Market Value to Realized Value (MVRV) ratio as a core indicator.

According to van de Poppe, ETH’s current valuation is comparable to periods that later proved to be exceptional long-term buying opportunities.

He pointed to four historical moments when Ethereum showed similar MVRV conditions: the March 2020 COVID crash, the December 2018 bear market bottom, the June 2022 capitulation following the Terra-Luna collapse, and the April 2025 market crash.

In each case, ETH was deeply undervalued before staging significant recoveries.

From this perspective, van de Poppe suggests Ethereum may once again be trading near levels that have historically marked the later stages of bear markets.

However, on-chain analyst Jao Wedson urges caution. He notes that Ethereum’s MVRV Z-Score has entered the capitulation zone, with the most recent low at -0.42.

While this confirms significant market stress, it remains above the extreme lows seen at definitive bottoms, such as -0.76 in December 2018.

Wedson emphasized that capitulation is typically a process rather than a single event. Past market bottoms have often involved multiple failed recoveries and extended volatility before a clear structural low was established, suggesting Ethereum may still face turbulence ahead.

On-Chain evidence leaves the bottom question open

Taken together, the data presents a mixed but compelling case. Valuation metrics indicate Ethereum is historically cheap relative to past cycles, supporting the idea that ETH could be nearing a long-term bottom.

At the same time, capitulation indicators show that the market has not yet reached the extreme exhaustion levels seen at prior cycle lows.

For now, the Ethereum price prediction remains finely balanced with on-chain data pointing to growing opportunity, while also warning that patience may still be required before a definitive bottom is confirmed.

You May Also Like

USD Weakness Reveals Surprising Relief: Dollar’s Decline Lowers Global Risk Scores, Says DBS Analysis

White House bitcoin regulation debate intensifies with new crypto market structure meeting