Ethereum Price Prediction: ETH Defends Macro Support Levels

TLDR

- ETH holds key $2,000 demand amid daily downtrend.

- Descending trendline keeps short-term bias cautious.

- Range between $1,980–$2,120 traps momentum.

- Weekly macro trendline supports broader uptrend.

Ethereum(ETH) is trading near a critical technical zone as multiple timeframes converge around long-term support. Analysts point to the $2,000 zone as a decisive level, with downside risk toward $1,500 if it fails. At the same time, a higher-timeframe structure suggests consolidation rather than structural collapse.

Ethereum Price Faces Daily Pressure Below Key Resistance

According to analyst CryptoWZRD, Ethereum price remains locked in a corrective structure on the daily timeframe. A clearly defined descending trendline continues to cap upside attempts, reinforcing a pattern of lower highs and lower lows. This dynamic resistance confirms that sellers still control broader price direction.

From a horizontal standpoint, Ethereum has lost several major support zones. The $3,700 and $2,800 levels have flipped into resistance, weakening bullish positioning. The recent sell-off drove price into the $2,100–$2,000 demand zone, which has historically attracted buyers.

Long lower wicks indicate reactive buying interest at this level. However, conviction remains limited without a trendline break. Holding above $2,000 could allow a relief bounce toward $2,400–$2,600. A failure would expose downside toward the $1,500 level.

Range-Bound Trading Dominates Short-Term ETH Conditions

Meanwhile, analyst Jip Molenaar highlighted a compressed range on the intraday chart. Ethereum price is oscillating around the $2,050 level, which acts as a short-term equilibrium level. Price behavior reflects rotation between liquidity zones rather than directional momentum.

The analysis points to potential liquidity sweeps on both sides of the range. Upside moves toward $2,120 may target stops before reversing. Similarly, downside probes toward $1,980–$2,000 could serve as liquidity grabs below equal lows.

Until ETH price moves outside this range, conditions remain reactive. False breakouts are likely without volume expansion. A sustained move above $2,120 would shift short-term bias toward $2,200. Acceptance below $1,980 would reopen continuation toward higher-timeframe demand.

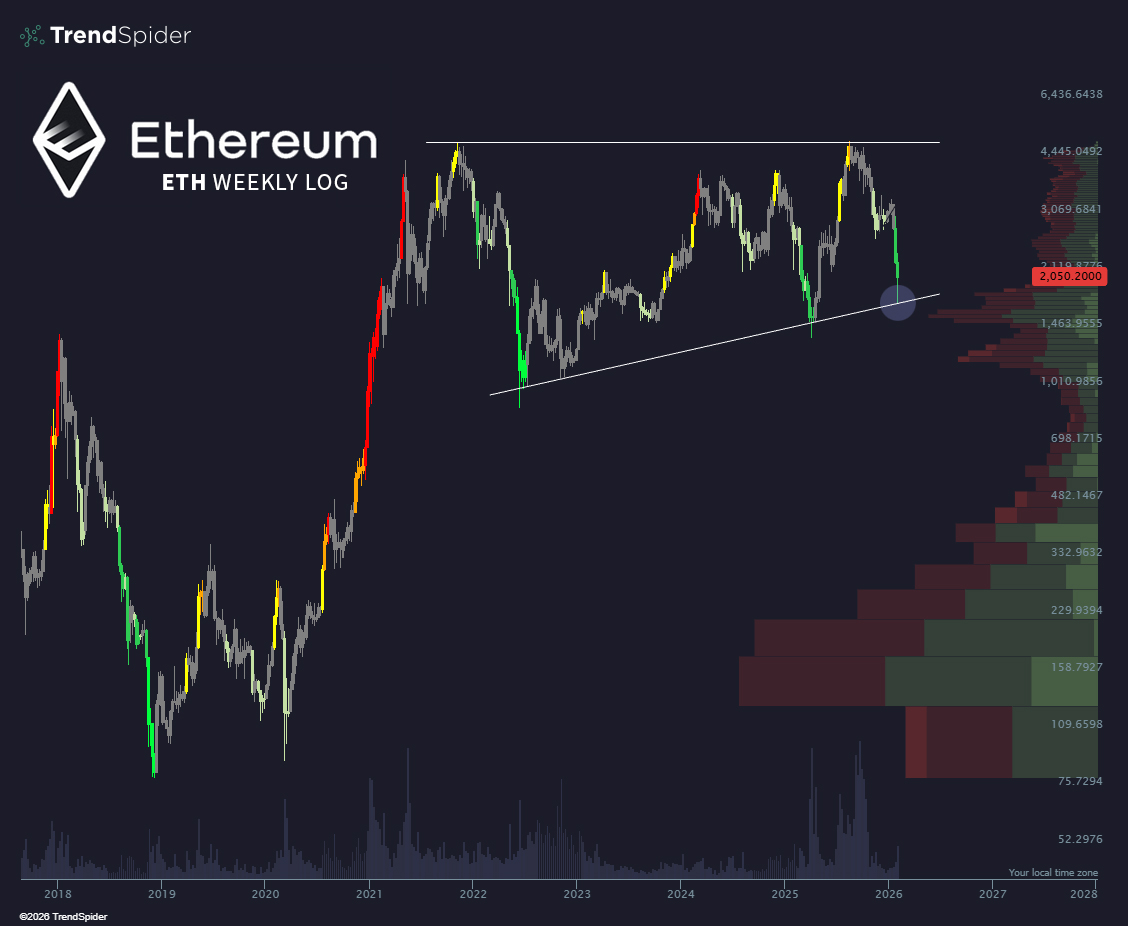

Weekly Chart Shows Ethereum Price Holding Macro Trend

Additionally, analyst TrendSpider’s weekly logarithmic chart presents a broader structural view. Ethereum price continues to respect a rising macro trendline that has guided price since the 2022 cycle low. Recent reactions from this support suggest long-term buyers remain active.

More so, the structure resembles a large consolidation within an established macro uptrend. Price continues to oscillate between ascending support and resistance near the $4,400–$4,500 zone. Volume profile data shows strong acceptance between $2,000 and $2,200, defining a high-value zone.

As long as the rising trendline holds on a weekly closing basis, the broader structure remains intact. A breakdown would significantly weaken the bullish framework and expose deeper retracement risk. For now, the chart supports consolidation rather than trend failure.

The post Ethereum Price Prediction: ETH Defends Macro Support Levels appeared first on CoinCentral.

You May Also Like

Coinbase Slams ‘Patchwork’ State Crypto Laws, Calls for Federal Preemption

Quantum Computing Crypto Threat Is Exaggerated: CoinShares Reveals Sobering Reality