Solana Network Hits Theoretical 100K TPS In Latest Stress Test

The throughput for the Solana network briefly reached a theoretical TPS (transactions per second) rate of 100K over the weekend after a stress load hit the layer-1 blockchain.

A block facilitated and written to the blockchain by a validator called “Cavey Cool” saw the network process 43,016 successful transactions and 50 failed ones. The peak TPS for this block reached 107,540 TPS.

Solana developer and Helius co-founder Mert Mumtaz commented on the milestone on X, and said that Solana has become the “first major blockchain with a recorded 100K TPS” on its mainnet.

However, critics have debated the validity of the reported TPS, especially since the transactions in question were mainly ones that don’t alter the network’s state.

One X user commented under the developer’s post, arguing that the “current state of Solana can’t handle organic traffic” at that level. “Things start to break down at a few thousand TPS,” the user added.

Another X user celebrated the milestone, but suggested that the next meme coin “mania” could cause the network to suffer another outage, similar to what happened with the launch of the Official Trump (TRUMP) token.

Up until the President’s meme coin launched, “Solana was flexing throughput,” but then “flatlined” under the overwhelming pressure, the user said.

Transactions Designed To Stress-Test Solana Point To High Theoretical Throughout

Critics pointed out that most of the transactions in this weekend’s block were not token exchanges or trades, but were rather no-operation or “noop” program calls, or instructions that don’t perform any meaningful computation on the network.

“Noop” program calls are lightweight instructions that are used to stress-test a network’s capacity, but do not directly reflect everyday payment or complex application use.

Mumtaz proactively addressed critics’ claims, and said that developers could still “deduce that you can also theoretically do about 80-100K tps in transfers, oracle updates, and similar” operations.

That’s largely due to the fact that the real cost of those transactions includes signature checks, data loading, and other overhead beyond execution itself, according to the Solana developer.

Solana’s True TPS Is Much Lower Than Mumtaz Argues

Solana’s throughput is currently much lower than the Helius co-founder said is theoretically possible.

Data from Solscan, the Solana blockchain explorer, shows that the network’s “True TPS” stands at 952, while its TPS including vote transactions stands at around 3,568.9.

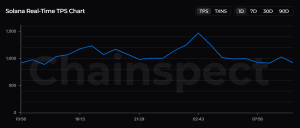

Chainspect and Solscan also peg the effective throughput for payments and applications on the Solana network at roughly 1,000 TPS.

Solana true TPS (Source: Chainspect)

Chainspect shows that Solana has a “Max” theoretical TPS of 65,000 transactions as well.

That’s still lower than the TPS of ICP, the layer-1 competitor that has a max theoretical TPS of 209,708 transactions, according to Chainspect. The blockchain also has a slightly higher “true TPS” of 1,082 transactions.

While ICP and Solana are neck and neck in terms of actual speed, they still lag far behind the throughput of centralized payments giant Visa, which achieves a true TPS equal to that of Solana’s theoretical throughput of 65,000 transactions.

Solana TVL Nears January All-Time High

Regardless of the type of transactions processed in this weekend’s block, the milestone could attract users to the Solana network, especially when combined with the blockchain’s low fees and high speeds.

Looking at the blockchain’s Total Value Locked (TVL), Solana is already nearing the all-time high (ATH) that was reached at the start of the year.

Back then, Solana’s TVL soared to above $11.989 billion, data from DefiLlama shows. After a pullback in the months that followed, the metric started to rise again at the beginning of April. Now, the network’s TVL stands at about $10.343 billion as of 8:35 a.m. EST.

Ethereum maintains a comfortable lead in terms of TVL, with more than $89.62 billion stored on its blockchain.

Solana Price Drops Amid Broader Market Downturn

Despite the recent TPS milestone, the Solana price was unable to withstand the bearish wave that hit the crypto market in the last 24 hours.

According to CoinMarketCap, the SOL price slid more than 4% to stand at $183.20 as of 9:10 a.m. EST.

SOL price chart (Source: CoinMarketCap)

You May Also Like

Trump MAGA statue has strange crypto backstory

Bitcoin 8% Gains Already Make September 2025 Its Second Best