Trump Emerges as Runner-up in Nobel Peace Prize Betting

Bettors on Polymarket and Kalshi see an interesting path for U.S. President Donald Trump to claim the Nobel Peace Prize. On both platforms, the sitting president holds the second-highest odds, putting him squarely in contention.

Prediction Markets Keep Trump in Close Race for Nobel Peace Prize

The Nobel Peace Prize is a prestigious international honor presented each year to an individual or organization recognized for extraordinary efforts to advance peace. Since its inception in 1901, only four U.S. presidents have earned the award: Theodore Roosevelt in 1906, Woodrow Wilson in 1919, Jimmy Carter in 2002, and Barack Obama in 2009.

On prediction markets, traders are betting digital assets on the possibility that Donald Trump, the 45th and 47th U.S. president, will secure the Nobel Peace Prize — though current odds place him in the runner-up position on both Polymarket and Kalshi. On both platforms, Yulia Navalnaya — the Russian economist who chairs the Human Rights Foundation and heads the Advisory Board of the Anti-Corruption Foundation — holds the top spot in the race.

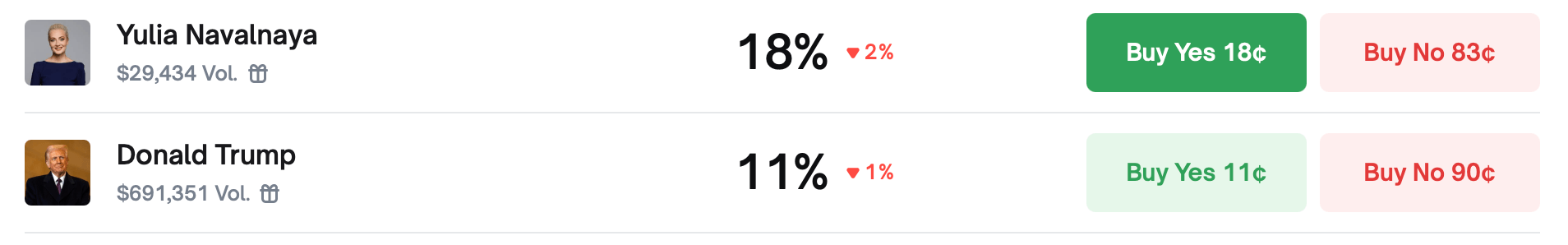

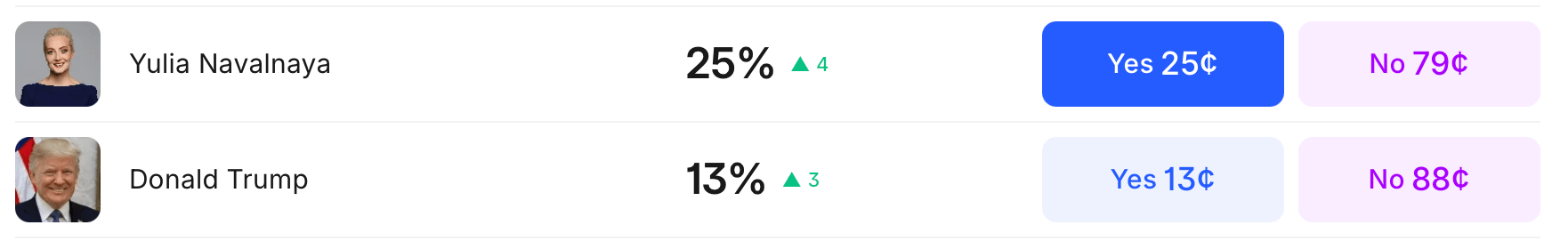

Navalnaya carries an 18% chance of winning on Polymarket, where more than $1 million has been wagered. Over on Kalshi, bettors give her a 25% shot at the Nobel Peace Prize, with $3.1 million riding on the outcome. Trump holds an 11% chance of winning on Polymarket, with supporters often pointing to his diplomatic interventions as justification for a Nobel Peace Prize nod.

On Polymarket, the United Nations Relief and Works Agency (UNRWA) holds a 9% chance, down 1%. Alexei Gorinov follows with 4%, slipping 2%. Volodymyr Zelensky sits at 3%, also down 2%, while António Guterres stands at 2%. María Corina Machado shares a 3% probability, gaining 1%, and Greta Thunberg holds 2% this weekend.

On Kalshi, Trump’s odds edge up to 13%. Other contenders for the prize include Doctors Without Borders (Médecins Sans Frontières) at 11%, the International Court of Justice at 8% — up 4 points — and Sudan’s Emergency Response Rooms at 7%, down 2 points. Amir Sheikh Tamim bin Hamad Al Thani holds 6%, while Pope Leo XIV, Francesca P. Albanese, and Greta Thunberg each sit at 5%, with Albanese gaining 3 points.

While prediction markets can’t forecast the Nobel Committee’s decision, Trump’s presence near the top of the odds signals a rare blend of political prominence and polarizing debate. His candidacy transforms the prize from a quiet diplomatic honor into a global talking point, ensuring his name will spark conversation regardless of the final announcement.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

Ethereum Fusaka Upgrade Set for December 3 Mainnet Launch, Blob Capacity to Double