Bitcoin’s Hashrate Roars to 976 EH/S — Just a Hair From 1 ZH/s Glory

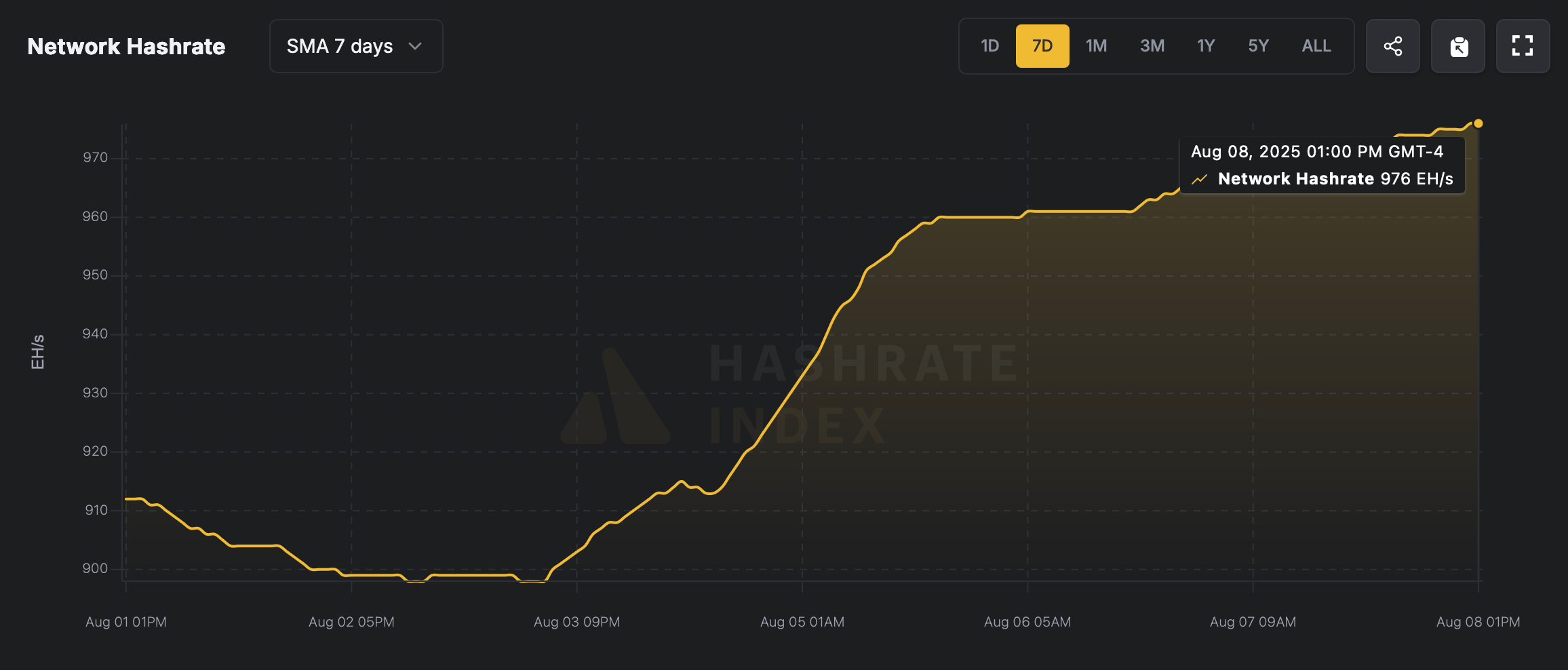

On Friday afternoon, after powering up to 970 exahash per second (EH/s) the day prior, Bitcoin’s computational force cranked even further, hitting 976 EH/s—just 24 EH/s shy of the colossal 1 zettahash per second (ZH/s) threshold.

Bitcoin’s Mining Might Continues to Flex

The hashrate kept pushing upward and, a mere ten blocks before the network’s next difficulty adjustment, the reading reached 976 EH/s based on the seven-day simple moving average (SMA), according to hashrateindex.com metrics.

Computational power metrics recorded by hashrateindex.com.

Computational power metrics recorded by hashrateindex.com.

The seven-day SMA metric smooths out short-term swings by averaging data over the set period, making it easier to spot true directional trends since pinpointing the exact hashrate is notoriously tricky.

The seven-day SMA has become the go-to measure in the industry, providing a standardized snapshot that keeps analyses consistent. For example, the three-day simple moving average (SMA) paints a much loftier picture of Bitcoin’s horsepower, showing that the network briefly touched 1 zettahash between Aug. 5 and 6 earlier this week.

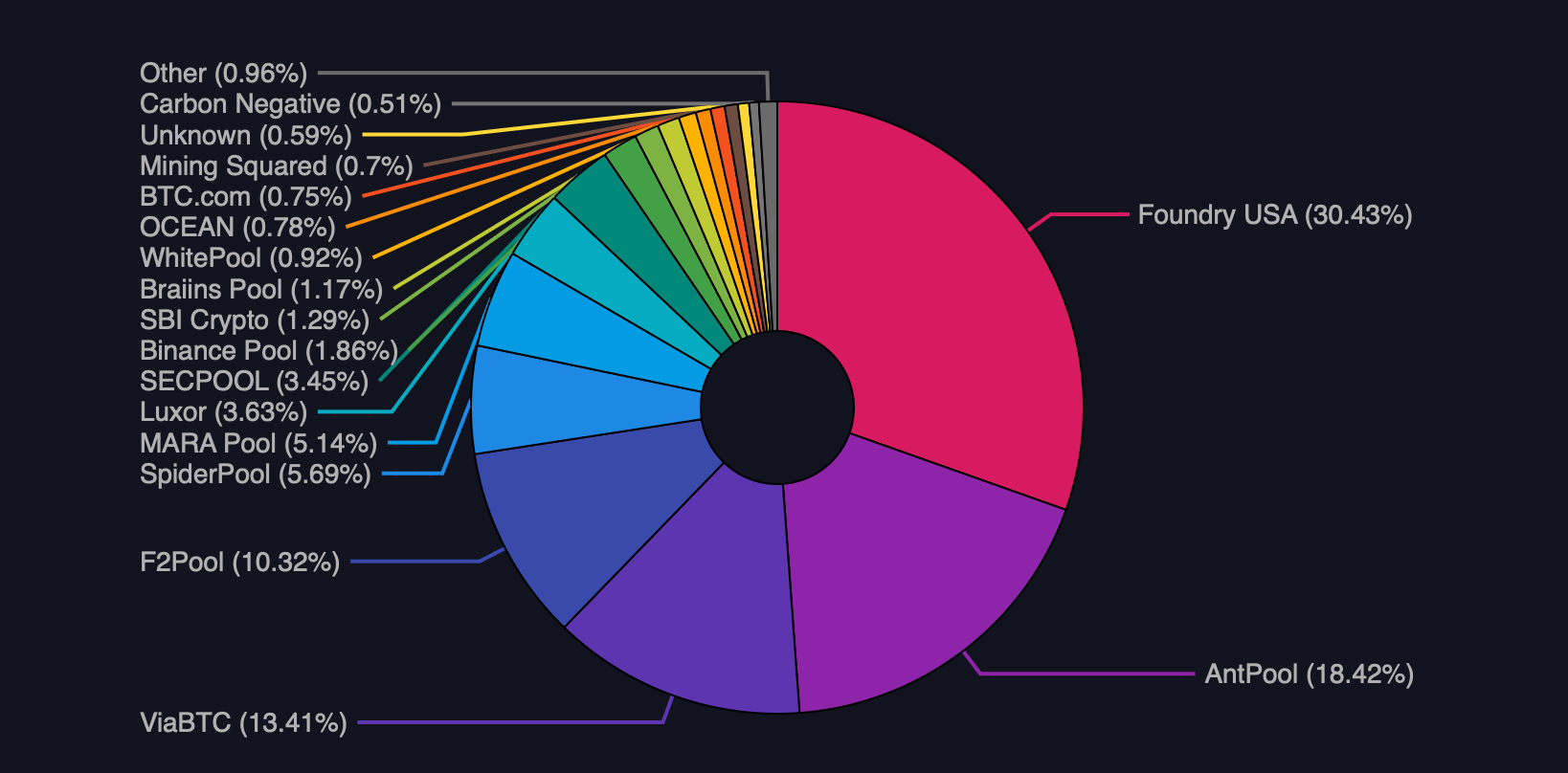

At 2:05 p.m. Eastern time, the live read-out clocked 972 EH/s, with Foundry powering a massive 278 EH/s—28.64% of the total. Antpool comes in second, steering 18.1% of the hashrate with more than 175 EH/s, while Viabtc follows with 128 EH/s (13.25%). F2pool holds fourth place, contributing just over 100 EH/s, or 10.35% of the network.

Mining pool distribution according to mempool.space.

Mining pool distribution according to mempool.space.

In fifth place, Spiderpool runs at 83 EH/s, claiming 8.5% of Bitcoin’s collective computing firepower. If growth continues at this pace, the milestone could soon be surpassed, potentially redefining industry benchmarks and reinforcing the protocol’s standing as the most secure and resilient blockchain on the planet.

Bitcoin’s climb toward the 1 zettahash mark (1 sextillion hashes per second) signals a pivotal moment for the network, hinting at the sheer scale of resources now backing its security. If growth continues at this pace, the milestone could soon be surpassed and be constant, potentially redefining industry benchmarks and reinforcing the protocol’s standing as the most secure and resilient blockchain on the planet.

Such computational intensity also reflects the increasing competitiveness among mining pools, where efficiency and scale can dictate dominance. As leading players edge forward with ever-higher contributions, the race for hashrate control could spark new investments in hardware, energy sourcing, and global mining infrastructure, reshaping the balance of power in the bitcoin mining arena.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise