Daily Market Update: Stock Futures Wobble as Bitcoin Fights Back From Weekly Lows

TLDR

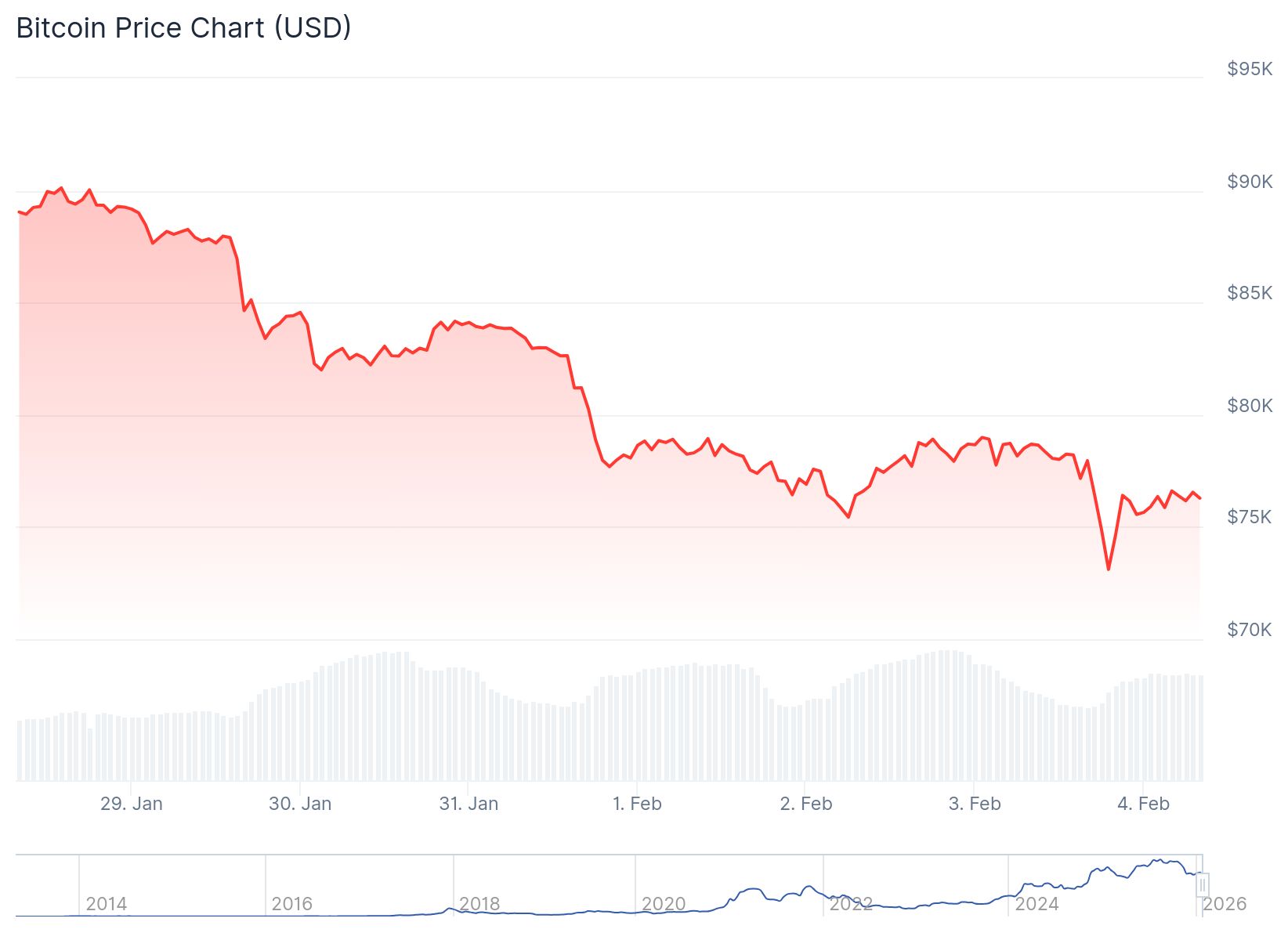

- Bitcoin rebounded to above $78,000, climbing roughly 5% from Monday’s lows, while the total crypto market cap rose 1.7% to $2.65 trillion

- Crypto investment products recorded $1.7 billion in weekly outflows for the second consecutive week, with Bitcoin funds seeing the largest withdrawals

- Long-term Bitcoin holders have moved into unrealized losses, a condition that CryptoQuant considers “extremely bearish” but may signal local bottoms

- U.S. stock futures remained mostly flat with S&P 500 contracts hovering near unchanged while Nasdaq 100 futures slipped 0.1% as tech stocks continued selling off

- AMD shares dropped over 7% in after-hours trading on weak guidance while Chipotle fell nearly 7% on declining customer traffic warnings

Bitcoin climbed back above $78,000 on Wednesday after sharp drops earlier in the week. The leading cryptocurrency gained about 5% from Monday’s lows during Asian and European trading hours. Total crypto market value increased 1.7% to roughly $2.65 trillion according to CoinMarketCap data.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The recovery followed heavy volatility at the start of the week. Thin liquidity and large liquidations pushed prices lower before buyers returned to the market. Bitcoin’s gains stalled near resistance levels that have limited upside since early February.

Altcoins showed mixed results during the rebound. BNB posted strong gains with support from Binance founder Changpeng Zhao. Dogecoin also advanced after fresh mentions from Elon Musk.

Most major tokens only saw modest recoveries. These coins remained well below their earlier 2025 highs. The choppy price action kept short-term traders cautious about the market’s direction.

Investment flows painted a defensive picture for crypto assets. CoinShares reported global crypto investment products saw $1.7 billion in outflows last week. This marked the second straight week of heavy redemptions.

Bitcoin funds accounted for most of the withdrawals. Ether and other major tokens also saw outflows during the period.

Market Positioning Turns Defensive

On-chain data showed traders adopting more defensive positions. Long-term Bitcoin holders moved into unrealized losses for the first time in months. CryptoQuant considers this condition “extremely bearish” though it can signal local price bottoms.

Corporate crypto holdings came under pressure from the price drops. BitMine’s unrealized losses approached $7 billion as Ether declined. Some institutional investors trimmed their positions in response.

Other institutions continued buying despite the volatility. Strategy kept accumulating Bitcoin throughout the downturn. The split approach highlighted divided sentiment among professional investors.

Stock Futures Hold Steady After Tech Selloff

U.S. stock futures remained near unchanged levels on Tuesday evening. S&P 500 contracts hovered above the baseline while Nasdaq 100 futures slipped 0.1%. Dow Jones Industrial Average futures inched up 0.1%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

The futures action followed a broad retreat in regular trading. The S&P 500 fell about 0.8% while the Nasdaq Composite dropped 1.4%. The Dow gave up nearly 170 points or 0.3%.

Technology stocks led the selling pressure. Nvidia and Microsoft each declined more than 2% during the session. Broadcom, Oracle, and Micron Technology also finished lower.

The tech sector posted losses of more than 2% in the S&P 500. Traders rotated money from growth-oriented technology companies into more defensive positions. The shift reflected concerns about rapid advances in artificial intelligence undermining traditional software business models.

After-Hours Trading Extends Losses

Several major stocks extended their declines in after-hours trading. AMD shares slid more than 7% as investors reacted negatively to its first-quarter outlook. Chipotle tumbled nearly 7% after reporting another quarter of declining customer traffic and warning that same-store sales growth could stall in 2026.

The post Daily Market Update: Stock Futures Wobble as Bitcoin Fights Back From Weekly Lows appeared first on CoinCentral.

You May Also Like

$683M to Nscale for 60,000 GPUs by 2026

Gold continues to hit new highs. How to invest in gold in the crypto market?