Gold Price Prediction as XAUUSD Faces Pullback After False Breakout

Gold Prices are gaining market interest as the metal failed to break through crucial resistance levels. According to the latest technical update provided by X user, CFA, the gold price may undergo a temporary correction before resuming its bullish trend. The analysis is based on the price action of the XAUUSD pair, with specific support and resistance levels identified for the near-term direction. Gold Price Prediction is being presented as the market assesses the stability of the gold price during active European session hours.

The analysis provided by the market analyst through social media updates indicates that the gold price is in a favorable market structure. The metal is still bullish, but the recent price action indicates that the metal may undergo consolidation before resuming its bullish trend.

Gold Price Prediction Signals Short-Term Consolidation Phase

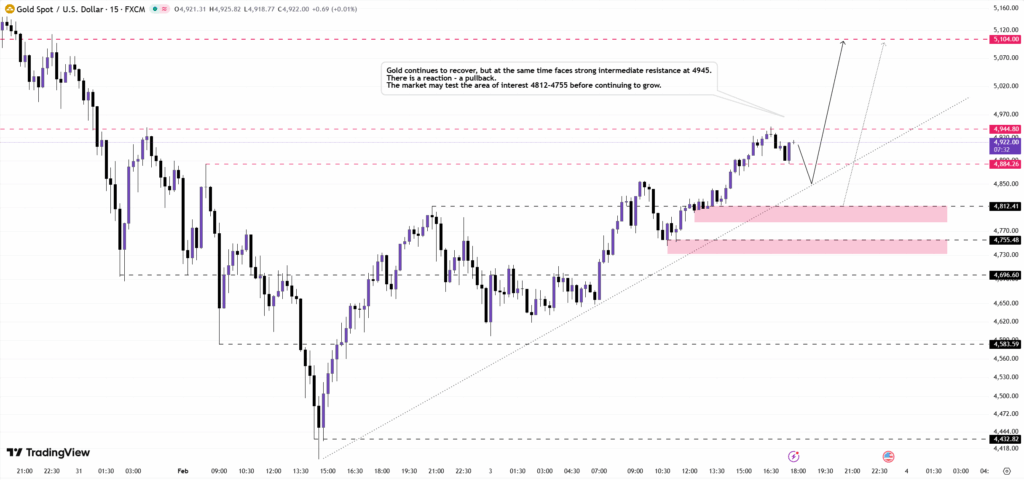

The current Gold Price Prediction indicates that gold prices could move in a defined range as momentum momentarily halts. After testing the resistance level at $4,944, prices were unable to sustain above it, resulting in what technical analysts term a false breakout. This has shifted market attention to corrective patterns instead of continuation.

Source: X/@Mary_CFA

Source: X/@Mary_CFA

Market structure suggests that gold prices could move in a defined range between levels of $4,950 and $4,750. This could allow prices to gain momentum before attempting another breakout. Analysts monitoring intraday charts suggest that this is a common phase that follows a strong breakout, particularly in the vicinity of a defined resistance level.

European market hours could support this market structure. Trading activity during this time frame often sets the tone for the remainder of the trading day. Consequently, market attention is focused on whether prices will drift lower toward support levels or remain in a defined range.

Support Zones Guide XAUUSD Price Outlook

Key support levels remain an important part of the Gold Price Prediction model. The analyst focuses on the $4,812 to $4,755 area as a significant zone. This region corresponds with a technical support line that has been increasing.

In case prices approach this region, it would be important to look for buying activity. If prices remain above $4,755, it would maintain the overall structure. If prices fall below this level, the next level would be near $4,696, which has previously shown a reaction level.

The support levels are simply used as benchmarks. The reaction of prices with respect to these levels can influence short-term market sentiment.

Resistance Levels Define Upside Boundaries

Resistance remains a limiting factor in the short term for gold’s upside potential. The Gold Price Prediction model has identified the first level of resistance at $4,884, followed by the second level at $4,944. The second level has attracted interest due to the price’s brief spike above it before declining again.

For the long term, the level of $5,100 is a resistance level. It is a level that has a psychological and technical component. It is a level that might need significant price momentum to challenge. Therefore, until the price approaches this level again, the focus is still on the reactions around the lower resistance levels.

Market Conditions Shape Gold Trading Direction

Market dynamics are also an integral part of the overall Gold Price Prediction scenario. This is where the analyst has identified the presence of an overall local uptrend, even as the pullback signals are being sent. At the same time, the relatively weaker U.S. dollar also continues to support the gold price.

This is one of the areas where the currency plays an important role, especially during the intraday trading scenarios. A weaker dollar environment also provides support for the gold price, even during the pullback phases.

It seems like the overall gold price is ready for a consolidation phase.

You May Also Like

Victra Named 2025 Recipient of Verizon’s Best Build Compliance Award

Stablecoins could face yield compression after Fed’s rate cut