Silver Miners vs. Silver: This Ratio Is Screaming Opportunity

Silver has been a mess lately. Big swings, fast reversals, and price action that keeps shaking out both sides. One day it looks strong, the next day it looks broken. That kind of tape pulls attention toward the metal itself and away from everything linked to it.

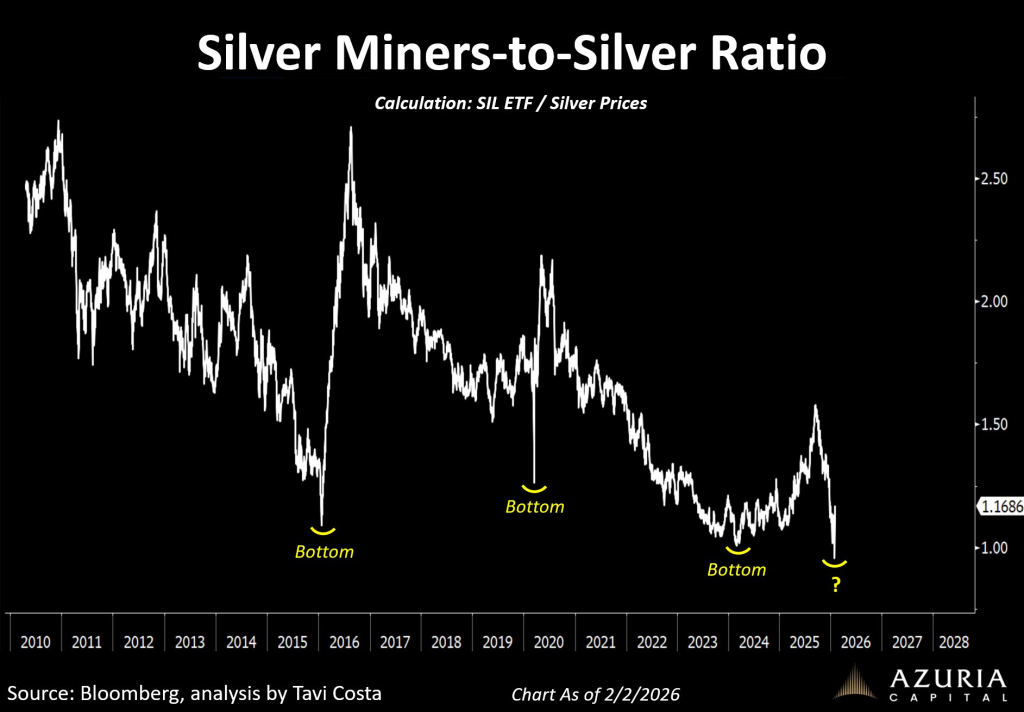

That’s why Otavio Costa flagged something most traders ignore during chaos: the silver miners-to-silver ratio. His point is simple. When silver gets all the headlines, miners can get left behind. And when that gap stretches to an extreme, it can mark a turning point.

What Costa Posted, In Plain English

Costa’s tweet is a direct hit at sentiment.

Not long ago, the crowd was obsessed with silver clearing $50. Now silver is above that area, yet miner valuations don’t look like they’re pricing in a strong metals tape at all. He also highlights something that matters more than hype: costs. Some producers, he says, are running at sub-$15/oz costs even with higher silver prices. That’s a wide operating spread.

His message isn’t “miners can’t lose.” It’s “the market is pricing miners like it’s still a weak environment, even though the underlying metal price is much higher than it used to be.”

What the Chart Is Measuring

The chart title tells you the whole method:

Silver Miners-to-Silver Ratio

Calculation: SIL ETF / Silver Prices

Source: X/@TaviCosta

Source: X/@TaviCosta

So this is not a chart of silver. It’s a relative performance chart. It tracks whether miners are outperforming or underperforming the metal.

- Ratio rising = miners are beating silver

- Ratio falling = miners are lagging silver

This matters because miners are leveraged to the metal in more ways than one. If silver holds up and operating costs stay controlled, miner earnings can expand fast. When the market starts pricing that in, miners can move harder than the metal.

Costa marks several “Bottom” zones on the chart. The ratio hit major lows around past stress periods and then bounced sharply after.

That pattern is the core idea here: extreme pessimism in miners can create a reset point. Miners often get punished for reasons that have little to do with the current silver price—equity market risk, financing fears, dilution worries, political risk, operational headlines. When investors get defensive, miners can be dumped even if the metal stays elevated.

A ratio near historic lows suggests one thing: the market has been willing to pay up for silver exposure, but not for the businesses digging it out of the ground.

Read also: Why Silver Price Just Had a Historic Crash: Paper Shorts Crushed the Market in a Coordinated Hit

The “Margins Like Tech” Line

Costa’s “tech-like margins” line is meant to wake people up.

If a producer’s all-in costs are near $15 and the realized price is far above that, the business can throw off serious cash. That’s the theory. The market usually rewards that setup, but it often waits for proof—clean quarters, improving guidance, stronger balance sheets, and capital returns.

The ratio being crushed implies the market is not paying for that possibility yet. It’s pricing miners like the good times are fragile.

This ratio needs miners to stop bleeding relative to the metal.

A few things typically push the ratio higher:

- Silver stabilizes instead of whipping around daily

- Risk appetite returns to equities

- Miners start printing stronger financial results

- Costs stay contained and guidance holds up

If those pieces line up, miners can start catching up fast.

The Risk That Can Break the Thesis

This is not a free trade.

Miners carry risks the metal doesn’t: jurisdiction issues, production misses, cost inflation, hedging mistakes, dilution, and broad stock market selloffs that hit everything with a ticker. Even if silver holds, miners can stay cheap longer than most expect.

That’s the real warning inside the chart. A low ratio can signal value, but it can also signal that investors don’t trust the sector.

If silver calms down and the tape stops punishing risk, miners don’t need a miracle to re-rate. They just need the market to stop treating them like a problem and start treating them like a business with real cash flow potential.

That’s the bet behind the tweet. Game on, but with eyes open.

Read also: Gold, Stocks, and Bitcoin Are Falling -Here’s What Might Be Breaking Behind the Scenes

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Silver Miners vs. Silver: This Ratio Is Screaming Opportunity appeared first on CaptainAltcoin.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator