What Bull Market? Bitcoin Closes 4 Consecutive Months in the Red

It’s hard to imagine now that just a few months ago, bitcoin was riding high, investors were hopeful about ‘Uptober,’ and the bulls dominated the market.

In that not-so-distant past, the cryptocurrency was trading confidently within a six-digit price territory, and had just printed a new all-time high above $126,000. The community was full of new predictions about $150,000 or $200,000 by the end of the year, based on historical performances.

The Monthly Closures in Red

The reality, though, was different. And brutal. Instead of going to those levels, BTC nosedived on October 10/11 in a $19B-wipeout, and the trend turned for the worse as the cryptocurrency was never actually able to recover from that crash. In fact, bitcoin ended 2025 in the red for the first time in a post-halving year.

2026 began with more hopes of a rebound and a renewed run, but they were halted mid-month when BTC was stopped at $95,000 and driven south hard. It was first pushed below $90,000, but that was just the beginning as the losses kept coming.

It dumped to $81,000 during last week, bounced off to $84,000, only to be rejected on Saturday. In the span of just several hours, bitcoin’s calamity worsened, and it slumped to roughly $75,000, leaving billions worth of liquidations. This meant that it had lost $20,000 in less than two weeks.

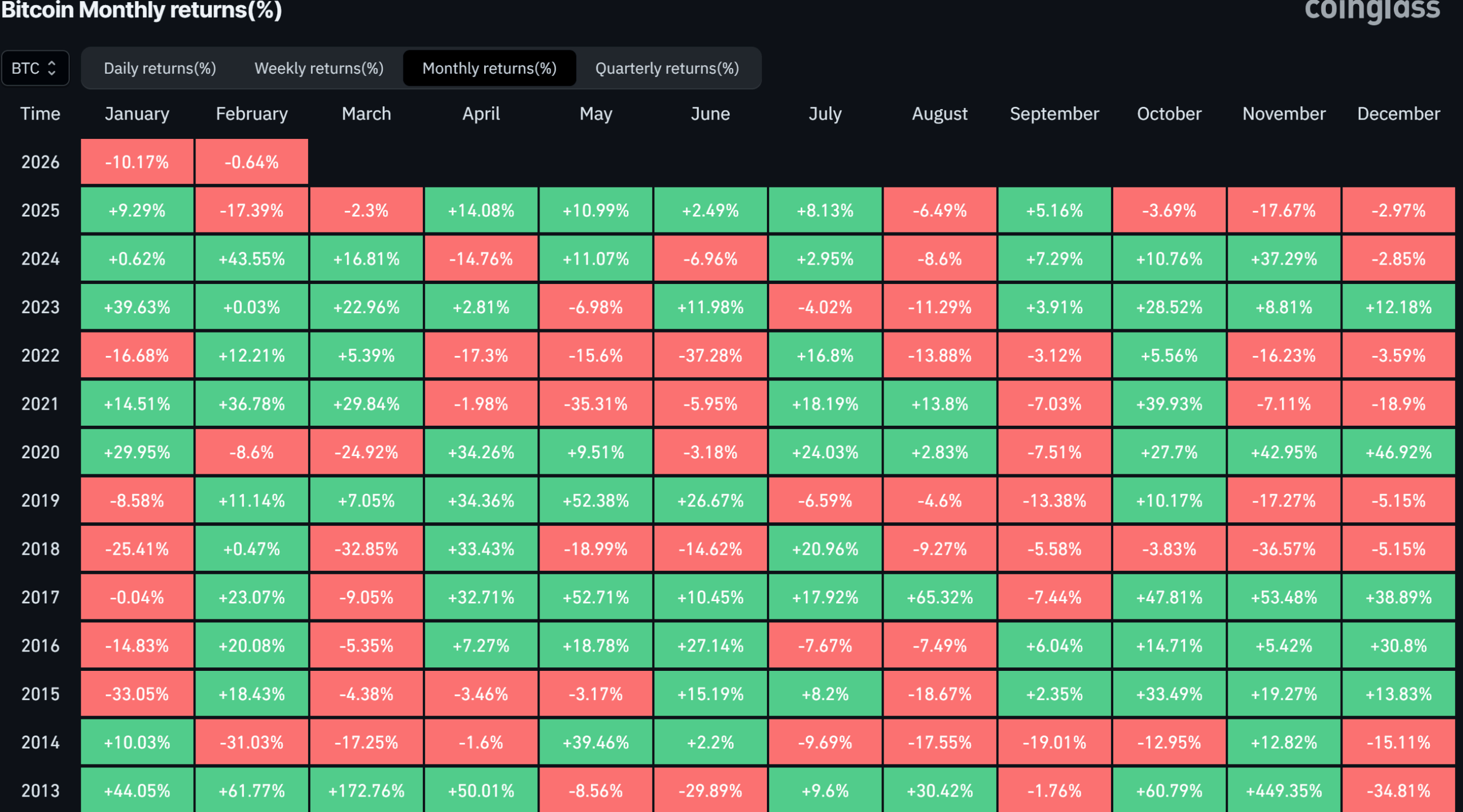

Data from CoinGlass shows that bitcoin closed January with a 10.17% loss, even though it rebounded slightly from that low. This made it the fourth consecutive month closed in the red and the worst since November.

Bitcoin Monthly Performance. Source: CoinGlass

Bitcoin Monthly Performance. Source: CoinGlass

What Bull Market?

Most crypto analysts have been split since October on whether the ongoing market phase is actually a bull market. But the data from above clearly demonstrates that BTC’s behavior is more in line with how it performs during bear cycles. After all, the last time it had four or more consecutive months in the red was at the end of 2018 and beginning of 2019.

At the time, BTC was digging new lows time and time again, before it finally bottomed in January after the sixth month in the red in a row. If history is to repeat itself now, the cryptocurrency has more room for losses before it finally stages a notable recovery as it did seven years ago.

Nevertheless, the light at the end of the tunnel shows that bitcoin might be due for a more favorable Q2 and Q3 if we rely on history. If we don’t, good news could come as soon as February, as most analysts agree that the four-year cycle has been broken and BTC now operates in a different manner.

The post What Bull Market? Bitcoin Closes 4 Consecutive Months in the Red appeared first on CryptoPotato.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon