Ethereum Price Shows Rising Leverage Risk as Market Participation Thins

The post Ethereum Price Shows Rising Leverage Risk as Market Participation Thins appeared first on Coinpedia Fintech News

Ethereum price has continued to trade under pressure in the late January 2026, due to multiple macro factors which is creating uncertainty in the market and investors are cautious regarding the market. That’s one of the primary reasons why Ethereum price volatility remains elevated. Also, onchain data shows that leverage usage has reached record highs even as overall exposure has declined, reshaping short-term market dynamics.

Ethereum Price Faces a Structural Shift in Derivatives Behavior

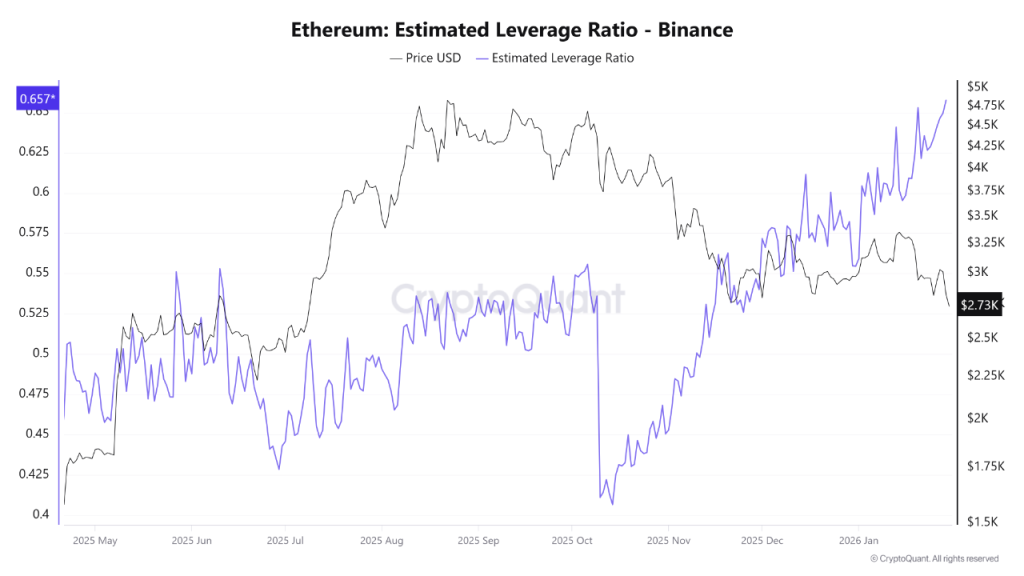

From a derivatives perspective, Ethereum price dynamics are increasingly shaped by leverage concentration rather than broad participation. Binance data shows the Estimated Leverage Ratio climbing to a new all-time high near 0.675, the highest level ever recorded for this metric.

This development stands out because it has emerged without a decisive bullish breakout. Ethereum price has hovered around $2,700 for extended periods, suggesting traders are deploying leverage to extract returns from relatively narrow price movements rather than committing fresh capital to long-duration bets.

Historically, leverage ratios approaching the 0.70 level have coincided with heightened sensitivity to volatility. In such environments, even moderate price fluctuations can trigger outsized liquidations, making Ethereum price action more fragile than headline levels may imply.

Open Interest Declines as Exposure Contracts

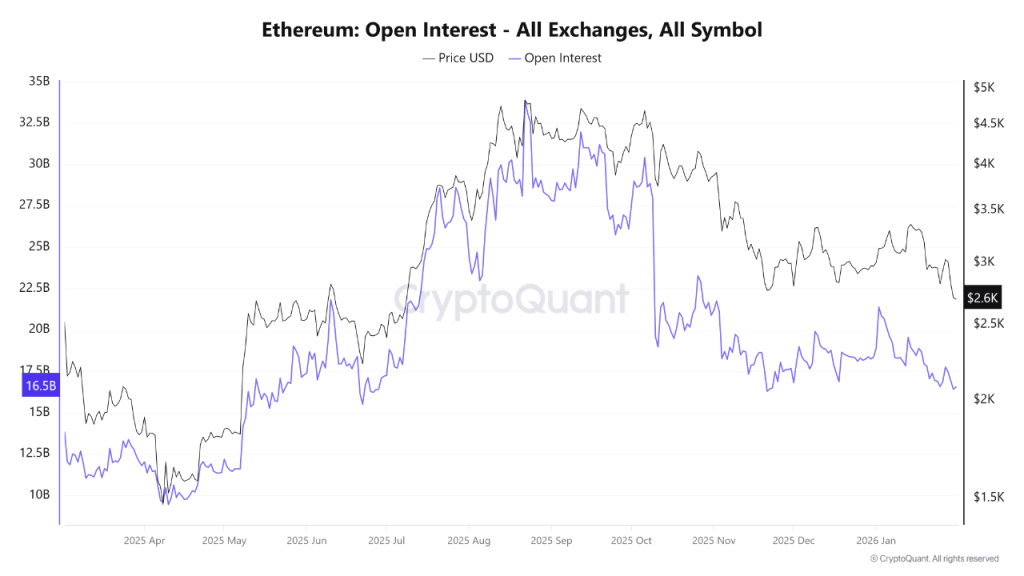

At the same time, Ethereum onchain chart data from derivatives markets paints a contrasting picture. Per CryptoQuant insights, its total open interest has fallen to roughly $16.4 billion, marking its lowest reading since November. This decline signals a broad reduction in the number of outstanding contracts rather than an expansion of market participation.

In practical terms, fewer positions remain active across futures and perpetual markets. However, those positions that do remain are increasingly leveraged. This divergence suggests a market undergoing repositioning instead of accumulation.

From an Ethereum price analysis standpoint, declining open interest typically reduces directional conviction. When paired with rising leverage ratios, it creates an environment where liquidity becomes thinner and price reactions sharper.

Ethereum Price Chart Highlights Key Technical Stress Zones

Still, price structure remains a central reference. The Ethereum price chart shows a sharp decline toward 200-day EMA band.

It suggests that if demand comes, it can reverse its decline, but if it breaks the 200-day EMA band, then horizontal support zones around $1,900 and $1,713 could be retested.

You May Also Like

New Viral Presale on XRPL: DeXRP Surpassed $6.4 Million

Tron Makes Bold Moves in TRX Tokens Acquisition