Polymarket Installs Jump 1,200% as Crypto Loses $150B – Are Crypto Traders Done With Tokens?

Crypto traders are abandoning token speculation in favour of prediction markets following a brutal $150 billion altcoin crash, with platforms like Polymarket seeing app installs surge from 30,000 to over 400,000 between January and December 2025, according to Bloomberg.

Source: Bloomberg

Source: Bloomberg

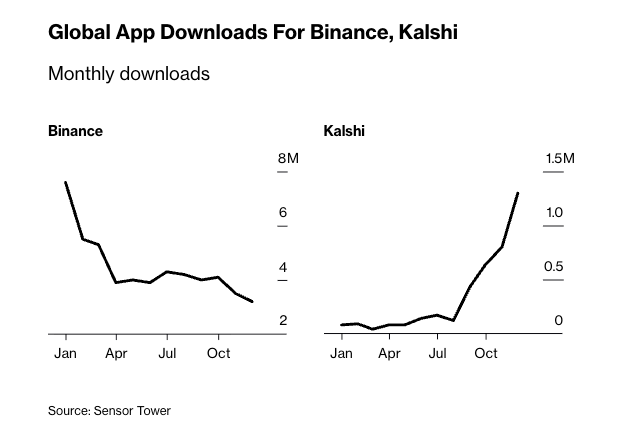

Weekly trading volume across prediction platforms, including Polymarket and Kalshi, exploded from $500 million in June to nearly $6 billion in January, data from Dune shows, while crypto exchange downloads collapsed by more than half during the same period.

The shift reflects deep fatigue across the token economy after Bitcoin plunged nearly 30% from its October peak and more than 11 million coins effectively died last year, marking the largest extinction event in crypto history, according to CoinGecko.

According to CoinShares, digital asset investment products shed $1.73 billion in the largest weekly outflow since mid-November 2025, driven by fading rate-cut expectations and persistent bearish sentiment.

Last week, Bitcoin spot ETFs also bled $1.62 billion over four consecutive trading days as hedge funds unwound basis trades that now yield below 5%.

Crypto Natives Migrate to Event Betting

Former memecoin traders are leading the exodus toward prediction markets that offer binary odds on real-world events rather than multi-year token roadmaps.

Nikshep Saravanan, who abandoned his digital creator startup to build HumanPlane, a prediction market research platform, said the shift made sense after losing traction without funding.

“Here I can do a lot more with no capital,” the 27-year-old Canadian explained. “There’s so much more interest here.“

Tre Upshaw followed a similar path after losing money on memecoins like SafeMoon, now running Polysights, an analytics dashboard for prediction markets.

“I realized that’s just hyper gambling,” he said. “I got burned so many times on memecoins.”

Yet losses remain widespread across prediction markets too, with 70% of trading addresses showing realized losses, while fewer than 0.04% of Polymarket addresses captured over 70% of total realized profits totalling $3.7 billion.

The infrastructure supporting these markets remains fundamentally crypto-powered despite traders fleeing token speculation.

On Polymarket, every key part of trades except order-matching happens on-chain, revealing blockchain technology’s most durable use case yet as belief-driven speculation cools.

Crypto contracts have become the second-busiest trading category on Polymarket, up from fourth place a year ago, with notional crypto volume increasing nearly tenfold across major platforms, according to Dune data.

Exchanges Rush Into Prediction Markets

Major crypto platforms are aggressively expanding into event contracts as user demand shifts.

Coinbase added prediction markets in December through Kalshi routing, with Clear Street analyst Owen Lau projecting the exchange could generate $700 million in prediction market revenue for 2025, while Robinhood’s annual run rate already approaches $300 million.

Gemini and Crypto.com have also launched their own prediction market efforts, with Crypto.com white-labeling services for Trump Media.

“As we add more instruments, they tend to complement each other,” said Max Branzburg, Coinbase’s head of consumer and business products, noting the firm has “seen tons of excitement” from users wanting a single venue to trade everything.

A Mizuho survey cited by Bloomberg found that Coinbase and Robinhood users were 9 times more likely to use prediction platforms than the general population.

Polymarket returned to the U.S. market following CFTC approval, launching with ultra-low 10 basis point taker fees and zero maker fees, the lowest among major platforms according to Clear Street analyst Owen Lau.

The platform also recently rolled out real estate bets that allow crypto traders to now speculate on housing prices

The company raised $205 million across two funding rounds and secured a $2 billion investment from Intercontinental Exchange at a valuation of nearly $9 billion.

Last month, Kalshi also closed a $1 billion round at an $11 billion valuation and secured CNN as its official prediction markets partner.

Despite near-term outflows, 70% of institutions view Bitcoin as undervalued in a recent Coinbase Institutional and Glassnode survey, and 62% maintain or increase crypto positions since October’s crash.

“Crypto markets are entering 2026 in a healthier state, with excess leverage having been flushed from the system,” said David Duong, Coinbase Global Head of Research.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!