From DeFi to DeETF: Who is quietly rewriting the underlying logic of DeFi asset allocation?

Introduction: From a geek’s toy to the new darling of Wall Street, how did DeFi do it?

In the past few years, there has been a hot word in the financial circle - DeFi (decentralized finance). A few years ago, when geeks just started to build some weird financial tools on Ethereum, no one thought that these "little toys" would eventually attract the attention of traditional financial giants on Wall Street.

Looking back at the period from 2020 to 2021, DeFi has risen at an astonishing speed. At that time, the total market value locked (TVL) soared from more than a billion US dollars to a peak of 178 billion US dollars. Protocols with strange-sounding names like Uniswap and Aave have become popular projects in the global crypto community.

However, for most ordinary investors, DeFi is always like a maze full of traps. Wallet operation is a headache, smart contracts are difficult to understand like Martian language, not to mention the daily fear of preventing assets from being stolen by hackers. Data shows that even though DeFi is so popular, the proportion of investment institutions in the traditional financial market that actually enter the market is less than 5%. On the one hand, investors are eager to try; on the other hand, they dare not act because of various barriers.

But the sense of smell of capital is always the most acute. Since 2021, a new tool has emerged to solve the problem of "how to easily invest in DeFi", which is the Decentralized ETF (DeETF for short). It combines the concept of ETF products in traditional finance with the transparency of blockchain, retaining the convenience and standardization of traditional funds while taking into account the high growth space of DeFi assets.

It can be understood that DeETF is like a bridge, with one end connecting the "difficult to enter" new world of DeFi and the other end connecting the vast number of investors familiar with traditional financial products. Traditional institutions can continue to invest with their familiar financial accounts, while blockchain enthusiasts can easily combine their own investment strategies like playing a game.

So, how did DeETF gradually emerge with the growth of DeFi? What kind of evolution has it gone through, and how has it become a new force in the field of on-chain asset management? Next, we will start from the birth of DeFi and talk about the story behind this new financial species.

Part 1: From DeFi to DeETF: The history of the rise of on-chain ETFs

1. Early Exploration (2017-2019): Those Initial Attempts and the Foreshadowing

If DeFi is a financial revolution, then its beginning must be inseparable from Ethereum. Between 2017 and 2018, several early projects on Ethereum, such as MakerDAO and Compound, showed the world the possibility of decentralized finance for the first time. Although the scale of the ecosystem was still very limited at the time, novel financial gameplay such as lending and stablecoins had already set off a small wave in the geek circle.

From the end of 2018 to the beginning of 2019, Uniswap emerged, providing an unprecedented "Automated Market Maker (AMM)" model, which made people no longer have to suffer from complex order books, and "trading" became much easier. From 2017 to 2018, MakerDAO and Compound demonstrated the possibility of decentralized lending and stablecoins. Subsequently, the automated market maker (AMM) model launched by Uniswap in late 2018 and early 2019 greatly simplified on-chain transactions. By the end of 2019, DeFi's TVL was close to $600 million.

At the same time, traditional finance also began to pay attention. Some keen financial institutions quietly laid out blockchain technology, but at this time, they were still troubled by complex technical problems and could not really participate. Although no one explicitly proposed the concept of "DeETF" at the time, the urgent need for a bridge between traditional funds and DeFi had already begun to emerge at this stage.

(II) Market explosion and concept formation (2020-2021): The eve of DeETF’s debut

In 2020, a sudden epidemic changed the direction of the global economy and prompted a large amount of funds to flow into the cryptocurrency market. DeFi exploded during this period, and TVL soared at an astonishing rate, from US$1 billion to US$178 billion a year later.

Investors poured in so frantically that the Ethereum network was jammed, and there was even an extreme situation where the transaction fee exceeded $100. A series of dazzling new models such as liquidity mining and yield farming made the market quickly hot, but at the same time exposed a huge threshold for user participation. Many ordinary users lamented: "Playing DeFi is much more difficult than stock trading!"

At this time, some traditional financial companies began to keenly seize the opportunity. Canadian listed company DeFi Technologies Inc. (stock code: DEFTF) is a typical example. The company originally engaged in traditional business that had nothing to do with encryption, but in 2020, it decisively transformed and began to launch financial products that track mainstream DeFi protocols (such as Uniswap and Aave). Users can participate in the DeFi world as easily as buying and selling stocks on traditional exchanges. The emergence of this product is also a sign that the concept of "DeETF" has officially sprouted.

At the same time, the decentralized track is also quietly moving. Projects like DeETF.org have begun to try to directly use smart contracts to manage ETF portfolios in a decentralized manner, but the attempts during this period are still in the early stages.

3. Market reshuffle and model maturity (2022-2023): DeETF formalization

The popularity of DeFi did not last long. In early 2022, Terra collapsed and FTX went bankrupt. This series of black swan events almost destroyed investors' confidence. The TVL of the DeFi market fell directly from US$178 billion to US$40 billion.

But crises often bring opportunities. The violent market fluctuations have made people realize that the DeFi field urgently needs safer and more transparent investment tools, which in turn has promoted the development and maturity of DeETF. During this period, "DeETF" is no longer just a concept, but has gradually developed into two clear models:

-

Traditional financial channels are further strengthened: institutions such as DeFi Technologies have taken advantage of the opportunity to expand their product lines, launch more robust ETPs (exchange-traded products), and list them on traditional exchanges, such as the Toronto Stock Exchange in Canada. This model has greatly reduced the threshold for retail investors to participate and is also favored by traditional institutions.

-

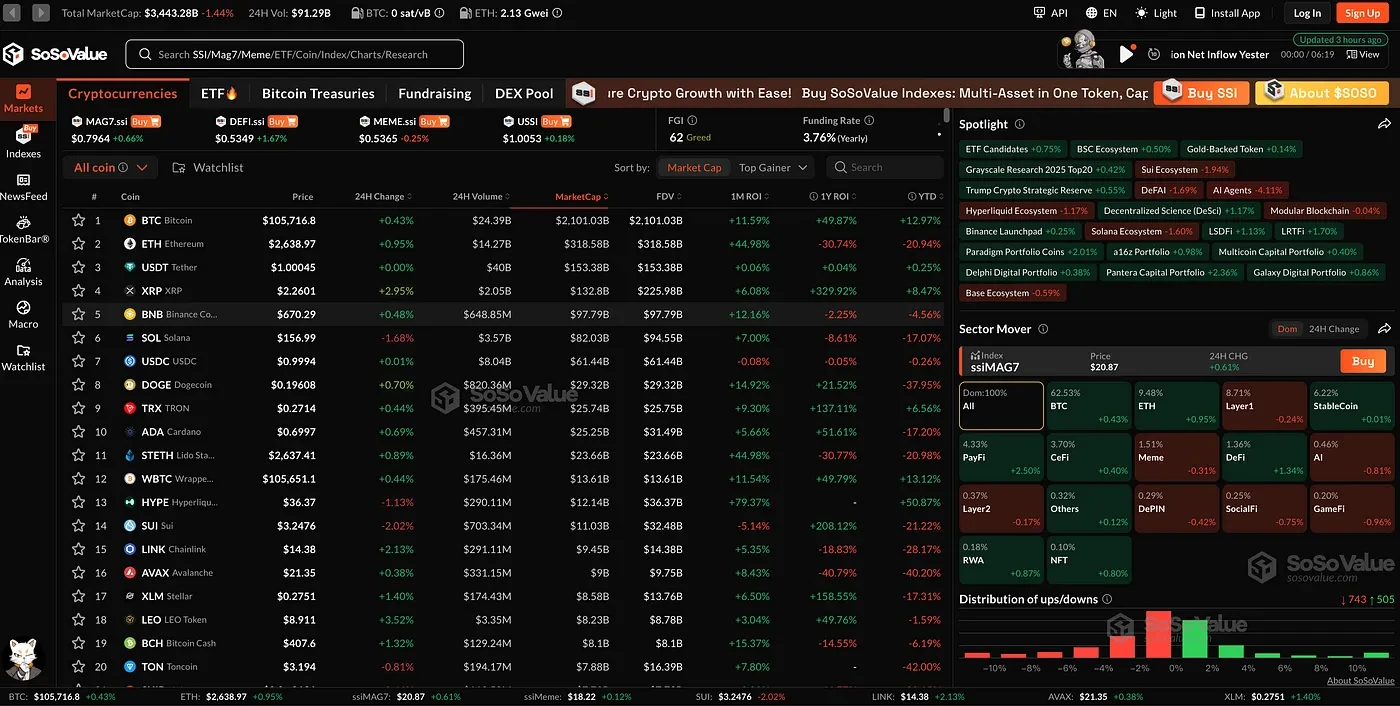

The rise of decentralized models on the chain: At the same time, on-chain platforms such as DeETF.org and Sosovalue were also officially launched, directly realizing asset management and portfolio trading through smart contracts. Such platforms do not require centralized custody, and users can create, trade, and adjust their investment portfolios by themselves. This is especially attractive to crypto-native users and investors who pursue absolute transparency.

At the same time, traditional finance also began to pay attention. Some keen financial institutions quietly laid out blockchain technology, but at this time, they were still troubled by complex technical problems and could not really participate. Although no one explicitly proposed the concept of "DeETF" at the time, the urgent need for a bridge between traditional funds and DeFi had already begun to emerge at this stage.

(II) Market explosion and concept formation (2020-2021): The eve of DeETF’s debut

In 2020, a sudden epidemic changed the direction of the global economy and prompted a large amount of funds to flow into the cryptocurrency market. DeFi exploded during this period, and TVL soared at an astonishing rate, from US$1 billion to US$178 billion a year later.

Investors poured in so frantically that the Ethereum network was jammed, and there was even an extreme situation where the transaction fee exceeded $100. A series of dazzling new models such as liquidity mining and yield farming made the market quickly hot, but at the same time exposed a huge threshold for user participation. Many ordinary users lamented: "Playing DeFi is much more difficult than stock trading!"

At this time, some traditional financial companies began to keenly seize the opportunity. Canadian listed company DeFi Technologies Inc. (stock code: DEFTF) is a typical example. The company originally engaged in traditional business that had nothing to do with encryption, but in 2020, it decisively transformed and began to launch financial products that track mainstream DeFi protocols (such as Uniswap and Aave). Users can participate in the DeFi world as easily as buying and selling stocks on traditional exchanges. The emergence of this product is also a sign that the concept of "DeETF" has officially sprouted.

At the same time, the decentralized track is also quietly moving. Projects like DeETF.org have begun to try to directly use smart contracts to manage ETF portfolios in a decentralized manner, but the attempts during this period are still in the early stages.

3. Market reshuffle and model maturity (2022-2023): DeETF formalization

The popularity of DeFi did not last long. In early 2022, Terra collapsed and FTX went bankrupt. This series of black swan events almost destroyed investors' confidence. The TVL of the DeFi market fell directly from US$178 billion to US$40 billion.

But crises often bring opportunities. The violent market fluctuations have made people realize that the DeFi field urgently needs safer and more transparent investment tools, which in turn has promoted the development and maturity of DeETF. During this period, "DeETF" is no longer just a concept, but has gradually developed into two clear models:

-

Traditional financial channels are further strengthened: institutions such as DeFi Technologies have taken advantage of the opportunity to expand their product lines, launch more robust ETPs (exchange-traded products), and list them on traditional exchanges, such as the Toronto Stock Exchange in Canada. This model has greatly reduced the threshold for retail investors to participate and is also favored by traditional institutions.

-

The rise of decentralized models on the chain: At the same time, on-chain platforms such as DeETF.org and Sosovalue were also officially launched, directly realizing asset management and portfolio trading through smart contracts. Such platforms do not require centralized custody, and users can create, trade, and adjust their investment portfolios by themselves. This is especially attractive to crypto-native users and investors who pursue absolute transparency.

The parallel development of these two models has gradually made the DeETF track clearer: on the one hand, it uses traditional financial channels, and on the other hand, it emphasizes complete decentralization and on-chain transparency.

4. Advantages are gradually emerging, but challenges cannot be ignored

Today, DeETF has gradually demonstrated its unique advantages:

-

Easy to use and greatly lowered participation threshold: Both the traditional model and the on-chain model have greatly lowered the participation threshold for retail investors.

-

Investment is more transparent and flexible: The on-chain model is traded 24 hours a day, and the asset portfolio can be adjusted at any time.

-

Risk control and investment diversification: Investors can easily build a multi-asset portfolio to reduce the volatility risk of a single asset.

But at the same time, challenges are gradually emerging:

-

Uncertain regulatory environment: The U.S. SEC has very strict supervision over crypto ETFs, and compliance costs remain high.

-

Smart contract security risks: Between 2022 and 2023, hacker attacks caused DeFi protocols to lose approximately US$1.4 billion, which still worries investors.

However, despite these challenges, DeETF is still regarded as one of the important innovations in the future financial market. It gradually blurs the boundary between traditional investors and the crypto market, making asset management more democratic and intelligent.

Part 2: Emerging projects are on the rise, and the DeETF track is flourishing

1. From a single model to diversified exploration: the new situation of DeETF

As the concept of DeETF is gradually accepted by the market, this emerging field has entered a stage of "a hundred flowers blooming" after 2023. Unlike the early single ETP (Exchange Traded Product) model, today, DeETF is rapidly evolving along two paths:

One is to continue to use traditional financial logic and issue ETPs through formal exchanges, such as DeFi Technologies, to continuously enrich DeFi asset categories, allowing traditional investors to invest in on-chain assets as easily as buying stocks;

The other is a more radical and closer to the spirit of encryption - a purely on-chain, decentralized DeETF platform. Users do not need a brokerage account or KYC, but only need a crypto wallet to create, trade and manage asset portfolios on the chain.

Especially in the past two years, platforms such as DeETF.org and Sosovalue have become pioneers in the field of on-chain native asset portfolios. Sosovalue supports multi-theme portfolio strategies (such as GameFi and blue chip portfolios), providing users with a "one-click buy + traceable" ETF product experience, trying to solve the portfolio management threshold problem in a lighter way.

In terms of institutional paths, in addition to DeFi Technologies, the influence of RWA leader Securitize cannot be ignored. It is tokenizing traditional financial assets such as US private equity, corporate bonds, and real estate in a compliant manner, and introducing primary market investors into the on-chain market. Although this approach is not directly called DeETF, its combined asset custody structure and KYC mechanism already have the core features of DeETF.

They proposed the concept of "24/7 all-weather trading, no intermediaries, and user-independent combinations", breaking the pattern of traditional ETFs being restricted by trading hours and custodians. Data shows that by the end of 2024, the number of active on-chain ETF combinations on DeETF.org has exceeded 1,200, with a total locked-up value of tens of millions of dollars, becoming an important tool for DeFi native users.

In the direction of professional asset management, organizations such as Index Coop have also begun to standardize and package DeFi assets, such as launching the DeFi Pulse Index (DPI), which provides users with an "out-of-the-box" DeFi blue-chip asset portfolio and reduces the risk of individual coin selection.

It can be said that since 2023, DeETF has evolved from a single attempt into a diversified competitive ecosystem, with projects with different routes and positioning flourishing.

(II) New trends in smart asset portfolio: Who is making DeETF more useful?

In the past few years, the DeETF track has experienced a phased evolution from "self-help free combination" to "one-click purchase of preset combinations". For example, DeETF.org advocates the combination mechanism of "user selection", while Sosovalue is more inclined to the productization path of "thematic strategy", such as GameFi blue chip package, L2 narrative combination, etc. Most of these platforms are aimed at users who already have an investment research foundation.

However, it is rare to actually let algorithms automatically handle "combination strategies".

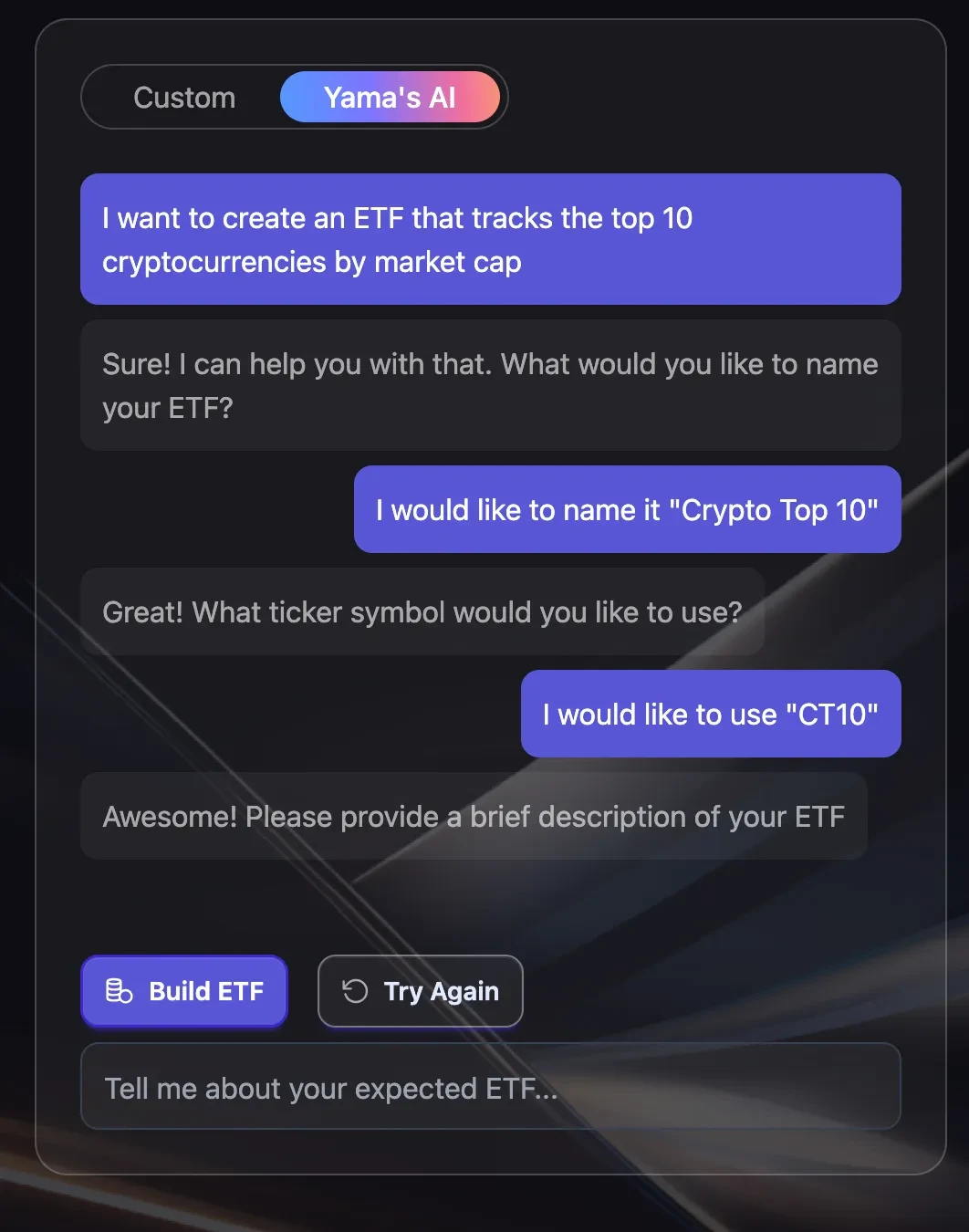

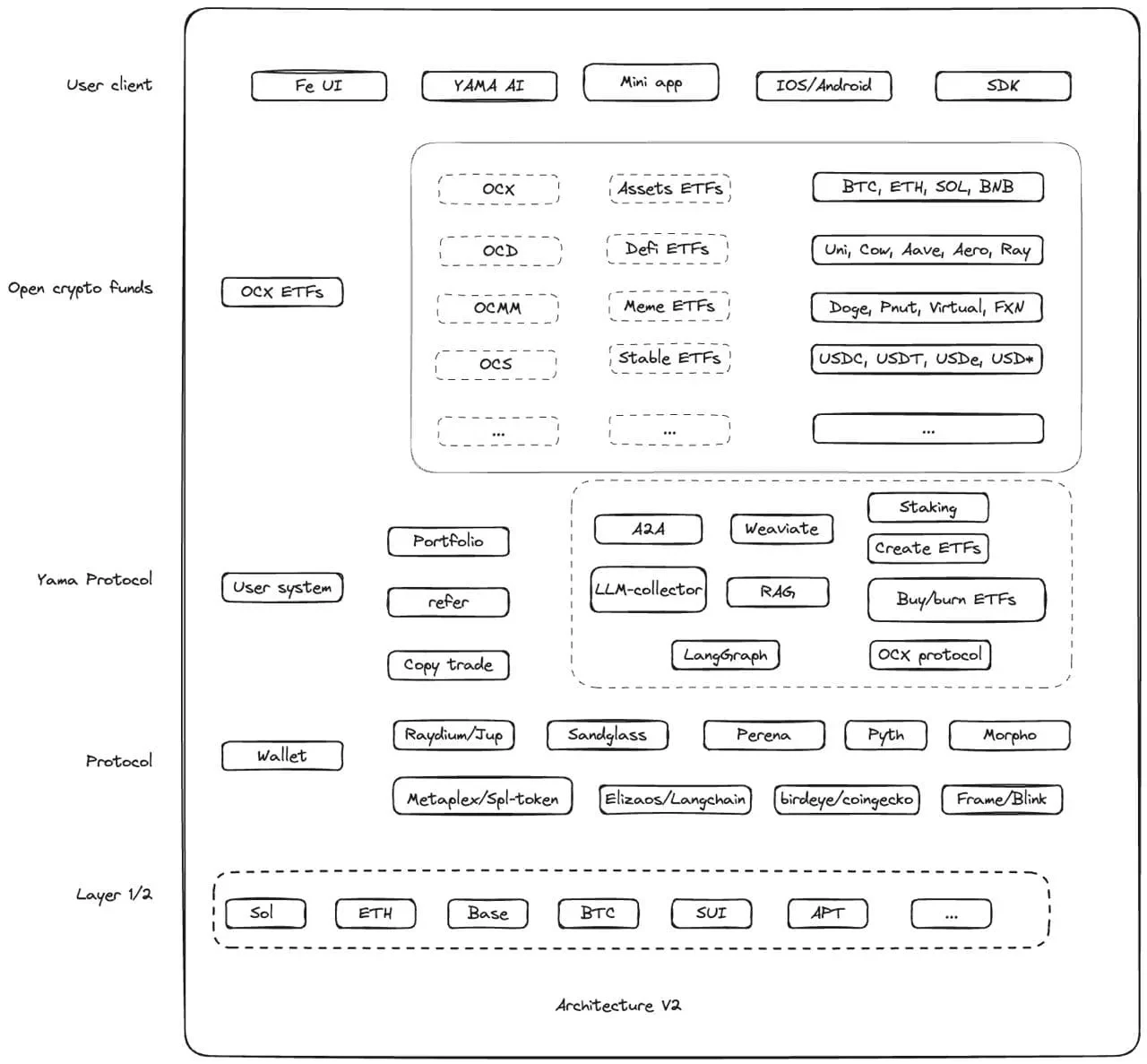

This is exactly the entry point of YAMA (Yamaswap), which has won the first Juchain hackathon competition: instead of stacking combinations on the basis of traditional DeFi, it tries to make DeETF more "smart".

Specifically, YAMA does not want users to bear all the investment research pressure, but instead builds an AI-driven asset allocation recommendation system. Users only need to enter their needs, such as "stable returns", "focus on the Ethereum ecosystem", "prefer LST assets", and the system will automatically generate a recommended portfolio based on on-chain historical data, asset correlation and backtesting models.

A similar concept has also appeared in Robo-advisor smart investment advisory services in the TradFi world, such as Betterment and Wealthfront, but YAMA moved it to the chain and completed the asset management logic at the contract level.

In terms of deployment, YAMA chooses to run on Solana and Base, which greatly reduces the cost of use. Compared with the Ethereum mainnet's GAS cost of tens of dollars, this architecture is naturally suitable for more daily asset portfolio interactions, especially for retail users.

In terms of portfolio security, YAMA's smart contracts support the disclosure of all portfolio components, weights, dynamic changes, etc. on the chain. Users can track the operation of strategies at any time, avoiding the "black box configuration" of traditional DeFi aggregation tools.

Unlike other platforms, YAMA emphasizes the combined experience of "self-service deployment" + "AI portfolio recommendation" for users - which not only solves the pain point of "not knowing how to invest", but also retains the transparency and independent management of "asset control".

This type of product path may represent the direction of the next stage of the DeETF platform moving from a "structural tool" to an "intelligent investment research assistant."

(III) The DeETF track is forming a bifurcated evolutionary path

As the structure of crypto users shifts from trading-oriented to "portfolio management" needs, the DeETF track has gradually differentiated into several different development paths.

For example, DeETF.org still emphasizes user self-configuration and free combination, which is suitable for users with a certain cognitive foundation; Sosovalue further productizes asset portfolios and launches on-chain theme ETFs, such as "Solana Infrastructure Portfolio" and "Meme Ecological Basket", which are similar to the style of traditional funds. Index Coop and others focus on standard index products, aiming at long-term and stable market coverage.

Among traditional DeFi projects, DeFi Technologies and Securitize are aimed at retail investors and institutions respectively, representing two different compliance exploration paths. The latter has become one of the first RWA platforms to obtain SEC exemptions, providing an example for the compliance process of on-chain asset portfolios.

But from the perspective of user interaction, a new trend is beginning to emerge in the entire track: a smarter and more automated asset allocation experience.

For example, some platforms have begun to try to introduce AI models or rule engines to dynamically generate configuration suggestions based on user goals and on-chain data, trying to lower the threshold and improve efficiency. This type of model also shows obvious advantages in the context of the continuous expansion of DeFi users and the increase in investment and research needs.

YAMA is one of the representatives on this path: it makes a structural integration between AI portfolio recommendation and on-chain self-service deployment, and adopts low-cost and high-performance public chain for deployment, so that ordinary users can complete asset allocation without complicated operations.

Although each path is still in its early stages, more and more DeETF platforms are beginning to shift from "pure tools" to "strategy service providers", which also reveals the underlying evolutionary logic of the entire crypto asset management track: not only decentralization, but also a financial experience that is less complicated and free of professional barriers.

Conclusion: From Trend to Practice: DeETF Reshapes the Future of On-Chain Asset Management

In the past few years, the crypto industry has experienced too many crazes and collapses. Every time a new concept is born, it is accompanied by market noise and doubts, and DeFi is no exception. However, DeETF, an originally niche and marginal cross-field, is quietly accumulating energy and becoming the next branch of on-chain finance that deserves serious attention.

Looking back at the development of DeFi, we can clearly see a main thread:

From the initial smart contract experiment to the construction of open trading and lending agreements, and then to the triggering of large-scale capital flows, DeFi has completed the journey that traditional finance has taken for decades in six or seven years. Now, DeETF, as the "user experience upgrade version" of DeFi, is taking on the task of further popularization and lowering the threshold.

Data shows that although the overall size of the DeETF track is still small, its growth potential is huge. According to a report by Precedence Research, the DeFi market is expected to grow from US$32.36 billion in 2025 to approximately US$1.558 trillion in 2034, with a compound annual growth rate (CAGR) of 53.8%. This means that in the next five years, with the rapid development of DeFi, DeETF will not only be part of the DeFi ecosystem, but is more likely to become one of the most important application scenarios for on-chain asset management.

At this point in time, we can already see different types of explorers:

-

There are companies like DeFi Technologies that try to cut into traditional finance and issue more compliant and familiar crypto ETP products;

-

There are platforms like DeETF.org that insist on on-chain autonomy, emphasizing free combination and full transparency;

-

There are also emerging forces like YAMA, which not only continues the spirit of decentralization, but also introduces AI-assisted portfolio construction on this basis, trying to make on-chain asset management truly "intelligent and personalized."

If early DeFi solved the problem of "whether finance can be decentralized", today's DeETF and projects like YAMA are solving the problem of "whether decentralized finance can be affordable and used well by more people".

In the future, on-chain asset management should not only be an arbitrage tool for a few people, but should become a capability that any ordinary investor can master. And DeETF is the key.

From MakerDAO to Uniswap, from DeFi Technologies to YAMA, every progress in decentralized finance is a renewal of the concept of financial freedom, transparency and inclusiveness. Today, DeETF is redefining the way of on-chain asset management, and innovative projects like YAMA are also injecting new imagination into this path.

The story is far from over, but the future is slowly taking shape.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm