July Altcoin Outlook: Hyperliquid Eyes $100, Solana Rides ETF Wave, and Stablecoins Heat Up

Key Takeaways:

- Hyperliquid surged 250% in three months and could hit $80 by Q3, analysts say.

- Solana’s staked ETF has been approved in the U.S., boosting ecosystem optimism. Raydium and Orca remain strong short-term plays as spot ETF approval odds reach 95% in 2025.

- Raydium ranked fifth among Solana DeFi projects in June with $6.17M revenue, while Pump.Fun stays the top earner despite falling numbers.

- Ethena flagged as a short-term watch due to regulatory shifts and its growing USDe stablecoin.

The first month of summer has passed, with Bitcoin (BTC) holding firm at the top while the rest of the market stays quiet, waiting for a real altseason to arrive.

In this monthly report, we look at the altcoins that analysts say could show the most potential in July.

- In This Article

-

Hyperliquid Eyes $100 – Too Ambitious or Within Reach?Solana’s ETF Wave – Which Projects Could Surf It?Stablecoin Summer – Set to Sizzle or Stay Cool?Conclusion

- In This Article

-

Hyperliquid Eyes $100 – Too Ambitious or Within Reach?

-

Solana’s ETF Wave – Which Projects Could Surf It?

-

Stablecoin Summer – Set to Sizzle or Stay Cool?

- Show Full Guide

-

Conclusion

Hyperliquid Eyes $100 – Too Ambitious or Within Reach?

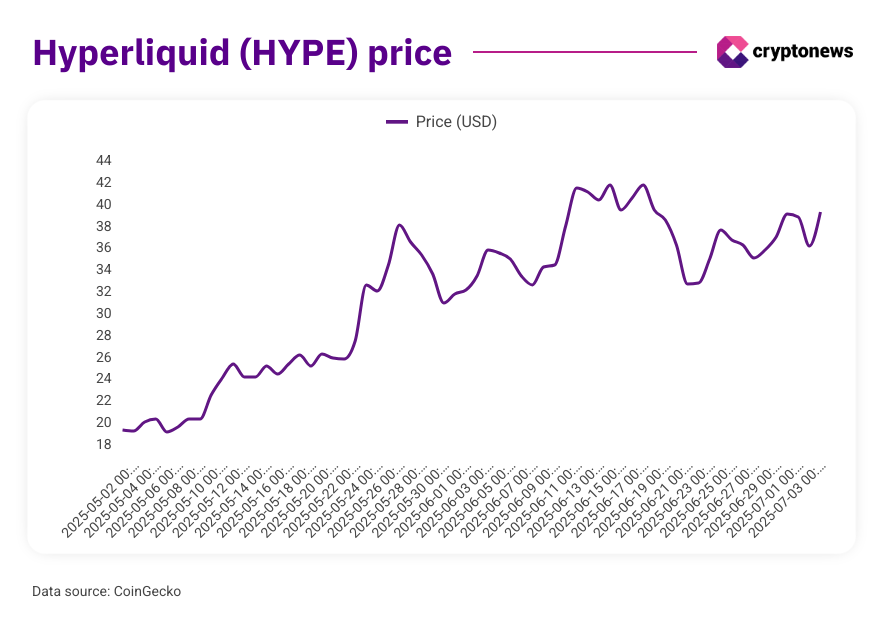

Hyperliquid (HYPE) has become one of the most talked-about new crypto projects. Its price has jumped nearly 250% over the past three months, while Bitcoin and many altcoins remain in a holding pattern.

On June 16, HYPE hit its all-time high of $45.57. Eneko Knörr, CEO and co-founder of Stabolut, told Cryptonews that the altcoin may keep climbing:

In 2025, crypto projects with real value and utility often struggle to grow, while meme coins continue to lead the market. Hyperliquid hasn’t broken this pattern entirely, but shows that non-meme projects can also rally. Its gasless perpetual trading platform has secured a strong niche.

Daniil Kozin, Head of Business Development at EASY MM and CBDO, shared his view with Cryptonews:

Solana’s ETF Wave – Which Projects Could Surf It?

Eneko Knörr also noted that Solana’s (SOL) ecosystem could become more attractive soon, thanks to the first Solana staked exchange-traded fund (ETF) registered in the U.S.:

Raydium (RAY) and Orca (ORCA) are decentralized exchanges (DEXs) on Solana with their own tokens listed across platforms. Raydium remains one of the most popular projects, especially after launching its meme coin launchpad, LaunchLab.

In June, Raydium ranked fifth among Solana’s top 15 DeFi projects by revenue, earning $6.17 million. Pump.Fun continues to lead in revenue, although a recent Cryptonews study showed its numbers have dropped significantly from peak levels.

Meme coins and their “infrastructure” remain some of the most profitable segments on Solana. For example, Axiom ranked second by revenue in June. It’s a wallet and platform mainly used for meme coin trading. However, with the Solana staked ETF, this picture could change.

Moreover, a spot Solana ETF approval is expected this year, potentially bringing even more liquidity and institutional interest. This could help shift Solana’s reputation away from being just a meme coin blockchain and attract a new class of investors. Knörr added:

Stablecoin Summer – Set to Sizzle or Stay Cool?

Stablecoins remain one of crypto’s most promising markets. They serve as a bridge between traditional finance and crypto while also adding liquidity to DeFi. In 2024, they even surpassed Visa in transaction count.

Knörr highlighted Ethena (ENA) as a short-term project to watch amid regulatory shifts. Ethena issues its own stablecoin, USDe (USDE), along with its ENA token.

USDE launched in April 2024 and is already among the top five stablecoins by market cap. While it’s still far behind giants like Tether (USDT) and USDC, no project can compete with their scale for now. Ethena, however, is part of Ethereum’s (ETH) ecosystem and offers its own protocol and yield programs.

Frank Combay, COO of Next Generation, told Cryptonews:

Conclusion

July could bring strong momentum for Hyperliquid and select Solana projects, while stablecoins continue to cement their role as crypto’s backbone. But as always, liquidity flows and regulatory headlines will shape where altcoins go next.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!