Trading time: The altcoin market rebounded and rose across the board, and Bitcoin encountered resistance in the supply-intensive area at $97,000

1. Market observation

Keywords: SOL, ETH, BTC

The macroeconomic environment is undergoing an important transformation. Cleveland Fed President Hammack said that the Fed is less likely to cut interest rates in May, but if clear economic data is obtained before June, it may take action to cut interest rates as early as June. She reiterated that the Fed intends to keep interest rates stable until it has a better understanding of the Trump administration's policies. On the same day, Fed Governor Waller also said that tariffs are unlikely to trigger sustained inflation and that we should be wary of overreacting. He also emphasized that action will be taken if the labor market declines sharply. This is the first time that the Fed has given a specific time for rate cuts since Trump took office. The next Fed meeting will be held on May 6-7, and the market generally expects that the status quo will be maintained at that time.

Bitcoin is currently fluctuating around $94,000. Glassnode analysis points out that if Bitcoin wants to break through the $100,000 mark, it must first overcome the dense supply area of about 392,000 Bitcoins at $97,000. Crypto analysis company Swissblock also holds a similar view, believing that Bitcoin faces obvious resistance in the $94,000 to $95,000 range, and expects the market to pull back to the $89,000 to $90,000 range to accumulate further upward momentum, but based on the structural strength of Bitcoin, these pullbacks should be seen as buying opportunities rather than trend reversals.

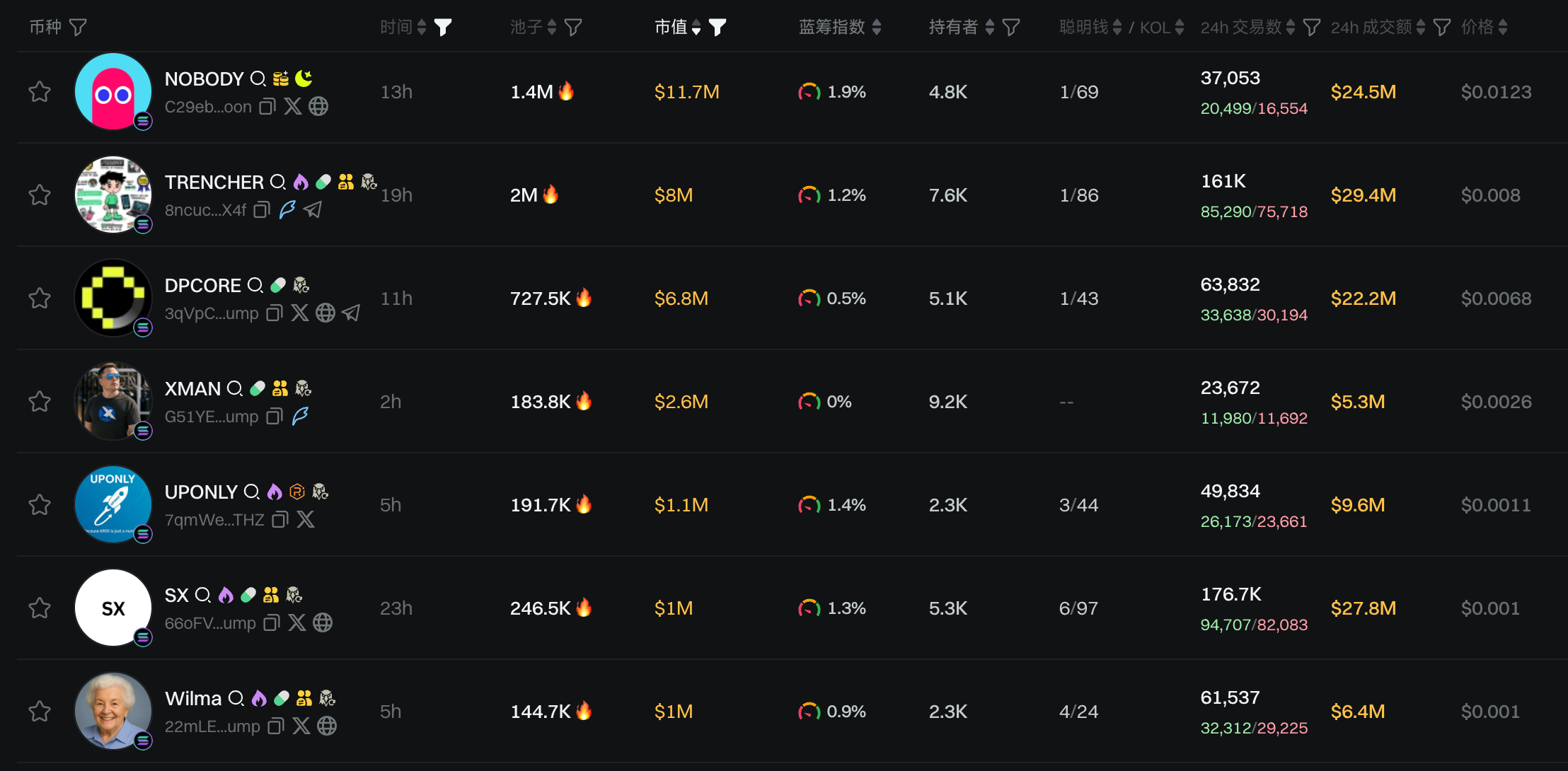

More and more listed companies are increasing their holdings of Solana. Currently, the listed companies holding more SOL include Sol Strategies (holding about 270,000 SOL), Upexi (holding SOL reserves worth $100 million), DeFi Development Corporation (formerly Janover, holding about 320,000 SOL) and SOL Global Investments (holding 260,000 SOL). It is worth noting that SOL is much more attractive to listed companies than ETH. In addition, the activity on the Solana chain has rebounded significantly, and the trading volume has increased significantly. After breaking through $150, SOL is expected to challenge the $180 mark. Many projects in the ecosystem have performed well. DARK rose by more than 30% in 24 hours after being forwarded by Solana officials, and its market value exceeded $40 million; DPCORE and NOBODY reached a maximum market value of $10 million and $30 million in 24 hours. At the same time, the altcoin market generally rose, and the AI sector and SUI ecosystem performed outstandingly.

2. Key data (as of 12:00 HKT on April 25)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $93,213.44 (-0.46% YTD), daily spot volume $31.745 billion

-

Ethereum: $1,765.13 (-46.94% YTD), with daily spot volume of $14.265 billion

-

Fear of Greed Index: 60 (Greed)

-

Average GAS: BTC 1.01 sat/vB, ETH 0.67 Gwei

-

Market share: BTC 63.3%, ETH 7.3%

-

Upbit 24-hour trading volume ranking: ARDR, XRP, AERGO, TRUMP, BTC

-

24-hour BTC long-short ratio: 1.0157

-

Sector gains and losses: DePIN sector rose 5.82%, AI sector rose 4.93%

-

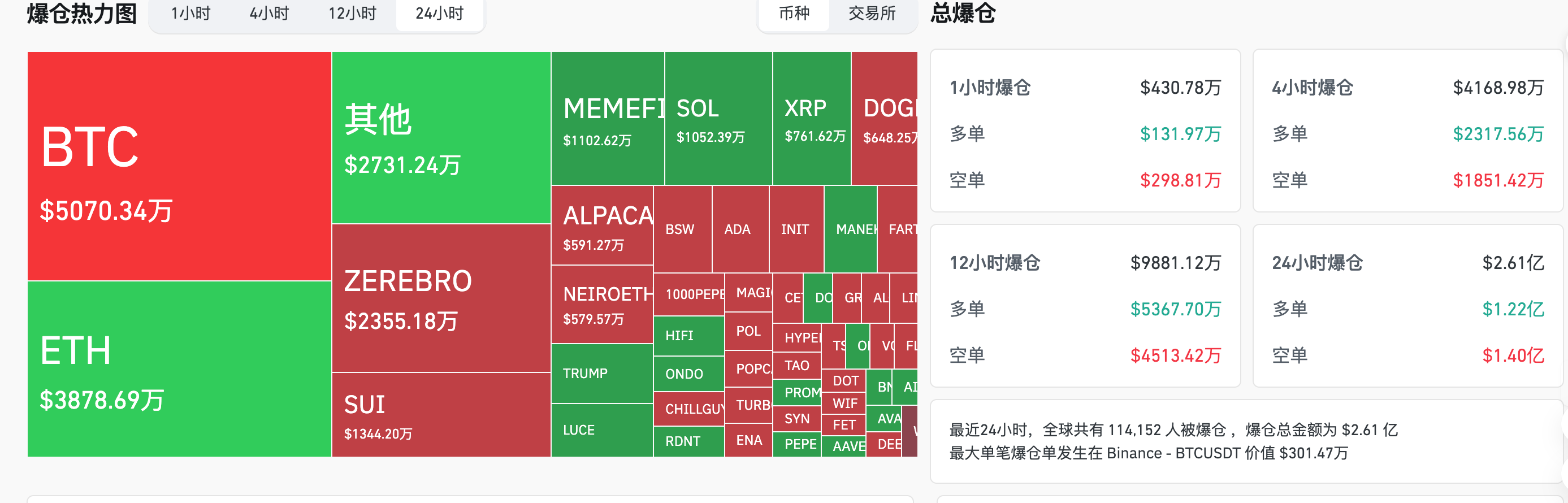

24-hour liquidation data: A total of 114,152 people were liquidated worldwide, with a total liquidation amount of US$261 million, including BTC liquidation of US$50.7 million, ETH liquidation of US$38.78 million, and ZEREBRO liquidation of US$23.55 million

-

BTC medium- and long-term trend channel: upper channel line ($89,325.60), lower channel line ($87,556.78)

-

ETH medium and long-term trend channel: upper channel line ($1688.80), lower channel line ($1655.36)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 24 EST)

-

Bitcoin ETF: $442 million

-

Ethereum ETF: $63.49 million

4. Today’s Outlook

-

The U.S. SEC held its third crypto policy roundtable, focusing on custody issues

-

Binance will adjust the collateral ratio of some assets such as ZEC and TWT in the unified account on April 25

-

Boshi Ethereum has been approved and can participate in staking activities from now on

The biggest gains among the top 500 stocks by market value today: XYO up 40.58%, CETUS up 36.53%, INIT up 34.94%, KEEP up 28.41%, and PENGU up 25.66%.

5. Hot News

-

El Salvador added 1 Bitcoin, bringing its total holdings to 6,157.18

-

ARK raises Bitcoin's 2030 bull market target price to $2.4 million

-

Deloitte report: Global real estate tokenization market may reach $4 trillion by 2035

-

Mantle (MNT) is included in the Coinbase asset roadmap

-

Cumberland deposited 2,261 BTC to CEX, worth over $200 million

-

US SEC meets with Ondo Finance to discuss compliant issuance of tokenized securities

-

FLock.io announced a partnership with Alibaba Cloud to create an AI model. FLOCK's 24-hour increase was nearly 48%.

-

CME Group announces plans to launch XRP futures on May 19, pending regulatory review

-

Polygon launches aggregator program, successful projects will airdrop 5%-15% of native tokens to POL stakers

-

Ether.fi transforms into a new DeFi bank and launches cash card in the United States

-

Fed's Hammack: Fed may take action in June if economic data is clear

-

Securitize Launches New Crypto Index Fund, Backed by $400 Million from Mantle

-

Solana’s Early Backer RockawayX Launches New $125 Million Fund

-

The top 10 whales at the Trump dinner lost $1.26 million, and the top whale is suspected to belong to Wintermute

-

Deribit: $8 billion of BTC and ETH options are about to expire, and BTC’s biggest pain point is $85,000

-

SNX is included in the trading warning list by DAXA, Upbit suspends its deposit service for evaluation

-

Binance will delist ALPACA, PDA, VIB and WING on May 2

-

DeFi Development Corporation Increases Its Holdings to $9.9 Million in Solana

-

Twenty One announces it will launch with over 42,000 BTC in holdings

-

SOL Strategies secures up to $500 million in convertible note financing to buy more SOL

You May Also Like

Victra Named 2025 Recipient of Verizon’s Best Build Compliance Award

Stablecoins could face yield compression after Fed’s rate cut