Toncoin Price Prediction: TON Slips 2% Despite xStocks Launch as Bearish Risks Surge

Highlights:

- Toncoin price has slipped almost 3% to $1.44 as the bearish grip strengthens.

- xStocks has launched on TON, enabling tokenized US equities to be held directly in wallets.

- The TON technical outlook indicates intense bearish pressure, as a break below $1.42 support may cause further downside to $1.31.

Toncoin (TON) price is trading at $1.44, marking a slight 2% drop over the past 24 hours. The bearish trend continues even though xStocks launched on TON, a move that has the potential to enhance the long-term fundamentals of the network. On the technical front, the declining momentum indicators are pointing to further downside in the TON market.

xStocks has joined TON this Thursday with tokens to US equities on the wallets. Applicants to major US corporations like Apple, Tesla, and Microsoft, as well as hundreds of other stocks, can now be traded in TON Wallet, Tonkeeper, and MyTONWallet. This is without individual trading applications, brokerage accounts, and geographic limitations.

This long-term trend is a positive sign because it will increase the real-life utility of Toncoin and accelerate on-chain activity, and increase the adoption of TON. Despite the bullish news, the TON price has kept on correcting by almost 3% to a low of two months, the previous day at $1.42.

Toncoin Derivatives Market Analysis

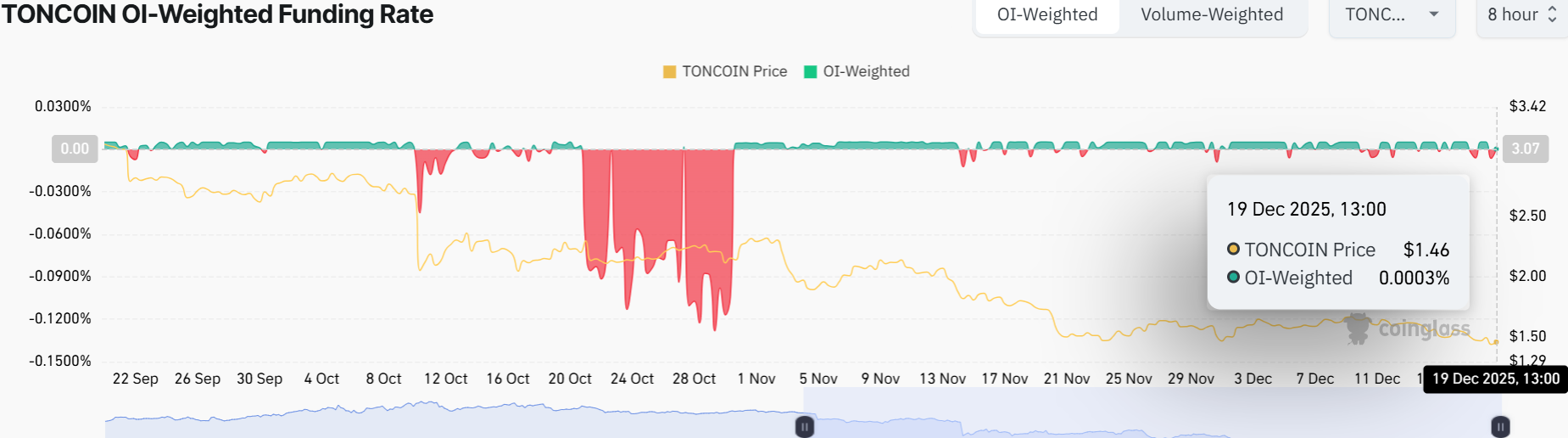

Toncoin has dropped almost to the negative according to the derivatives data. The OI-Weighted Funding Rate data presented by Coinglass reveals that there are more traders who are betting that the price of TON will fall further than those who are betting that the price of Toncoin will go up.

Toncoin OI-Weighted Funding Rate: CoinGlass

Toncoin OI-Weighted Funding Rate: CoinGlass

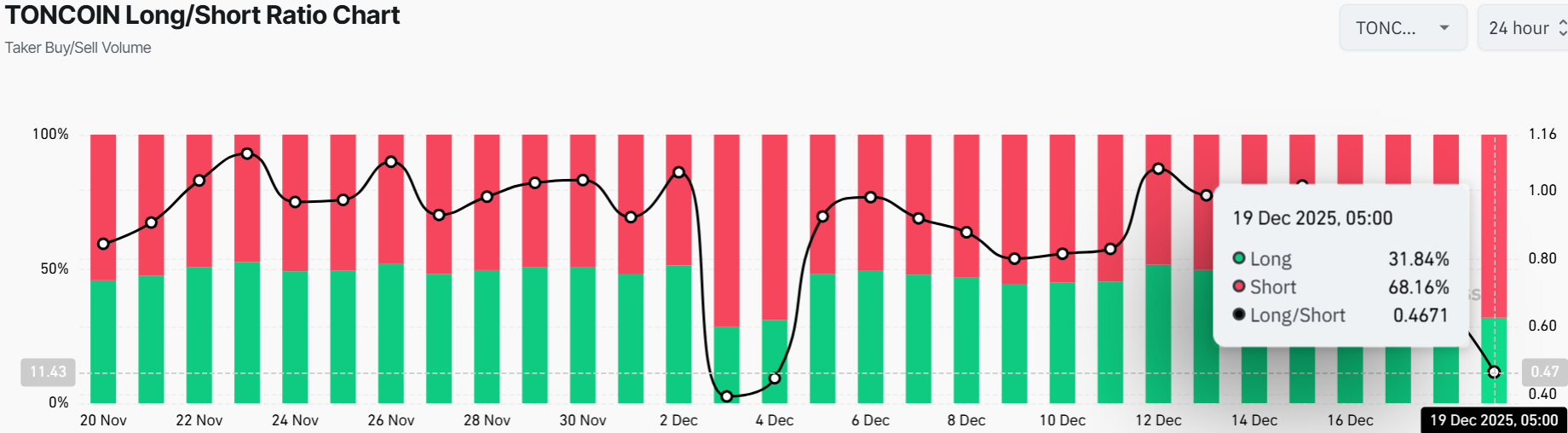

The metric is currently at 0.0003% implying that longs are paying shorts. Besides, the long-short ratio of TON is 0.46. A ratio of less than one is a sign of increased bearishness, with the traders placing their bets on the depreciation of the asset price.

Toncoin Long/Short Ratio: CoinGlass

Toncoin Long/Short Ratio: CoinGlass

Toncoin Price Signals Weak Momentum

The Toncoin price is now trading at $1.44, below the 50-day simple moving average (SMA) at $1.74 and the 200-day SMA at $2.66. Bears are in control as the coin struggles to hold above the critical $1.42 support zone. The 50-day SMA at $1.74 has become strong resistance after the recent breakdown. The 200-day SMA is acting as the long-term resistance for the bulls at $2.66, suggesting a great tussle ahead for the bulls.

TON/USD 1-day chart: TradingView

TON/USD 1-day chart: TradingView

The Relative Strength Index (RSI) is at 34.09, showing that Toncoin is not yet oversold, but the trend is bearish, and momentum is lacking. The MACD indicator is negative. This signals that sellers are still in charge.

Toncoin’s price is currently stuck at $1.43, with the $1.42 area now acting as key support. If bears break this level, the price could drop quickly to $1.31. However, for any rebound, Toncoin price must reclaim $1.74 resistance first, then try to flip it into support. Meanwhile, only a close above $1.74 will improve the TON outlook to bullish, with upside targets near $2.66.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Workforce 2026: Outsourcing to Optimization with AI-Powered Remote Teams

Zcash (ZEC) Jumps 12% in Most Unusual Comeback