Hyperliquid (HYPE) Crashes 60% From ATH: What’s the Next Stop?

Hyperliquid (HYPE) is trading near $24 at press time, showing a sharp drop of more than 60% from its all-time high. The token has lost over 10% in the last 24 hours and nearly 13% in the past week. Market data shows weak momentum and further downside risks unless buyers return soon.

As a result, its 24-hour volume is over $550 million, while its market cap stands around $6.6 billion. HYPE is ranked #25 among cryptocurrencies by market value.

Breakdown Below Channel Support

HYPE/USDT has fallen through the lower boundary of its descending price channel. This trendline had previously held for several months but has now been broken, as shown in recent charts shared by analyst Duo Nine. He noted that the price action reflects an “extremely bearish pattern,” and added, “$22 is on the books next.”

The asset is now sitting below the 50% Fibonacci retracement level of $26. That level has turned into resistance. So far, there is no strong reaction from buyers.

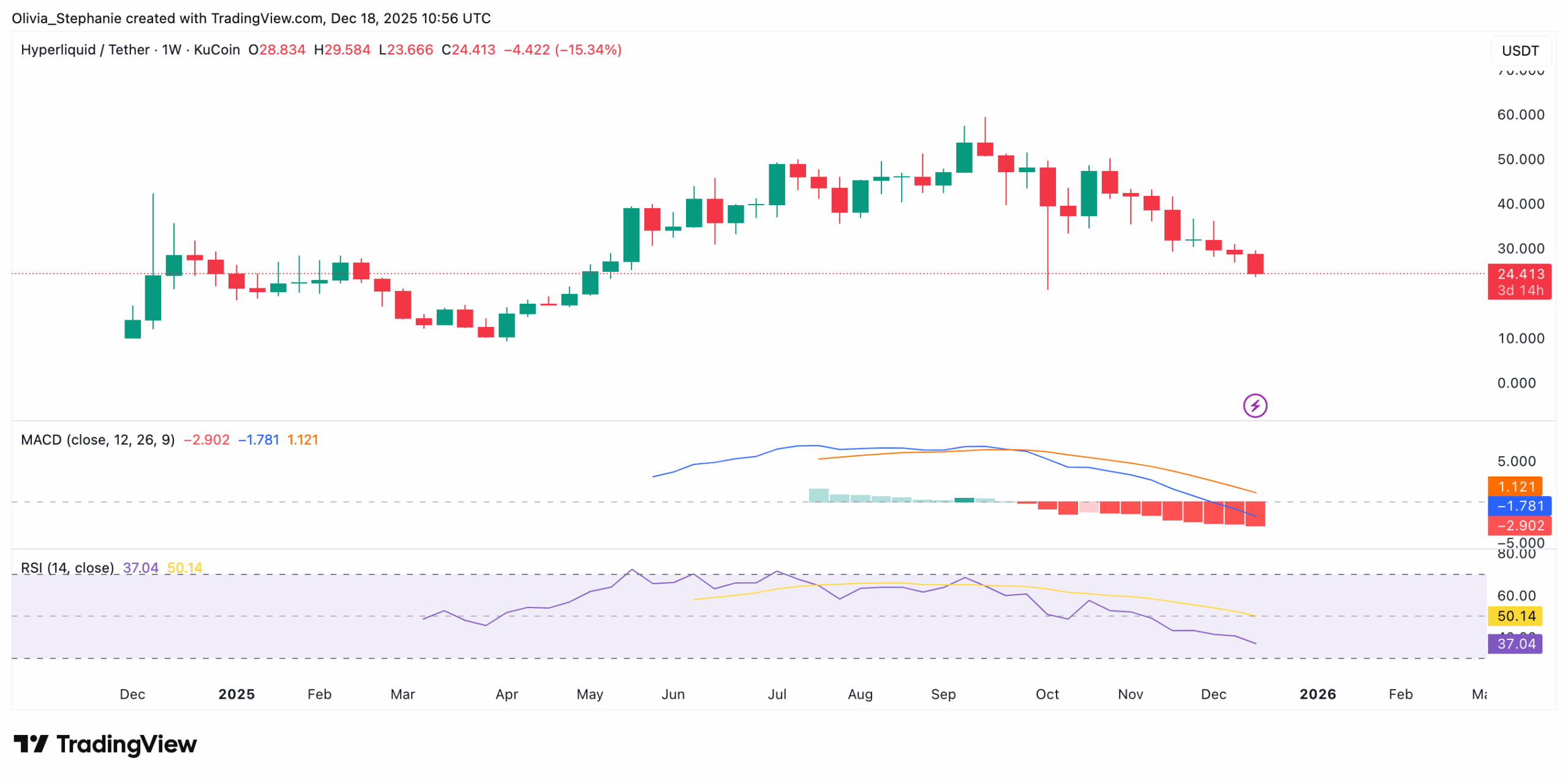

Besides, the weekly chart presents negative momentum in major indicators. MACD depicts a broader gap between MACD and the signal line, with the values at -1.78 and 1.12. The bars in the histogram are red and increasing, which implies that downward momentum is accumulating.

HYPE Price Chart 18.12. Source: TradingView

HYPE Price Chart 18.12. Source: TradingView

Meanwhile, the RSI is at 37, which shows weak buying interest. Although this level is not yet oversold, it is nearing that territory. Traders are watching for signs of a local bottom, but there is no clear signal of reversal at this stage.

Whales Accumulate Amid Supply Events

On-chain data shows increased whale interest. According to Bitcoinsensus, three large buyers deposited a combined $37 million USDC into Hyperliquid, placing large buy orders between $15 and $25.6. One wallet alone now holds over $22.4 million worth of HYPE.

In addition, the Hyper Foundation has suggested burning 37 million HYPE tokens or approximately 10% of the supply in circulation. This would have a long-term supply impact on the market, in the event that it is passed.

Furthermore, Ali Martinez reported that another 10 million HYPE tokens will unlock this month, adding to the 10 million already released since November. This adds more supply to the market, which could pressure the price further.

CryptoPotato also reported that Hyperliquid Strategies, a fund launched under the ticker $PURR, began trading in early December. The fund holds 12.6 million HYPE tokens and over $300 million in cash, serving as a treasury reserve linked to the Hyperliquid ecosystem.

The post Hyperliquid (HYPE) Crashes 60% From ATH: What’s the Next Stop? appeared first on CryptoPotato.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

Who’s Building the Next Phase of Artificial Intelligence? 20 Innovators Shaping the AI Industry in 2026