Crypto Market Selloff Deepens as Fed Uncertainty and AI Bubble Fears Trigger $500M in Liquidations

This article was first published on The Bit Journal.

The crypto market has grown increasingly risk-averse amid paranoia about potential U.S. Federal Reserve changes in leadership, as well as tightened liquidity conditions and heightened fears of an artificial intelligence (AI) bubble.

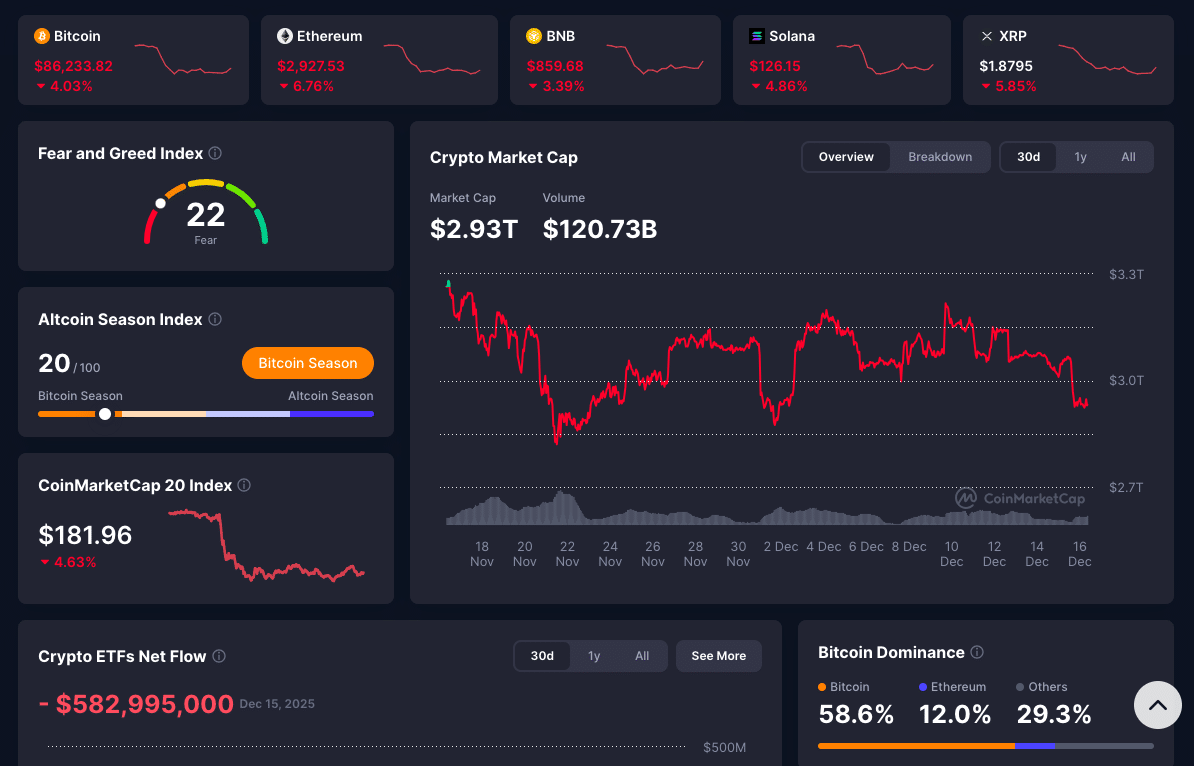

Cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH), moved sharply lower as positions were forcefully liquidated and sentiment deteriorated.

This crypto market selloff seems to be a function of the overlap between macroeconomic uncertainty, changing views on monetary policy and pressure in leveraged futures markets.

Recent data indicates that crypto exchanges witnessed liquidations of over $500 million in 24 hours, suggesting widespread de-risking among leveraged traders and adding to the brutal sell-off.

Fed Leadership And Macro Background

Financial markets have been roiled by fresh speculation about who would take over as the next chair of the U.S. Federal Reserve after Jerome Powell announced his expected departure from the job.

The changing expectations on who will lead the Fed raised uncertainty about riskier assets, including cryptocurrencies. The U.S. Dollar Index (DXY) was supported at the 98 level following a drag lower for weeks, with investors eying safer assets in the face of uncertain future monetary policy.

The U.S. government extension of the debt ceiling by about $5 trillion and technical reserve-management operations by the Fed at the same time provided support for short-term Treasury liquidity, although policymakers stressed these were not a return to large-scale quantitative easing.

These have come as survey data in the U.S. shows that consumer confidence is fading, with a decent chunk of Americans saying they expect to scale back their spending for the holidays because things are getting more expensive.

This all-encompassing macro uncertainty, coupled with the defensive nature of positioning in Treasuries led to a context in which crypto assets faced liquidation as market participants favored safer instruments.

Bitcoin and Ether Lead the Crypto Market Sell-Off

Throughout the selloff, Bitcoin tested critical support levels several times at around the mid-$80,000 mark. $BTC price has revisited the $85K territory in steep decline from recent peaks. Ethereum was also down, falling to just above $2,900.

Crypto Market Selloff: Fed Shift and AI Fears Trigger Sharp Drop in Bitcoin and Altcoins

Crypto Market Selloff: Fed Shift and AI Fears Trigger Sharp Drop in Bitcoin and Altcoins

According to on-chain and price data, sharp declines triggered forced liquidations totaling roughly $592 million in one session, as automatic stop-loss executions and margin calls cascaded through futures markets.

The price action showed renewed fragility in the largest cryptocurrencies after demonstrating strength in October and November.

Downward Moves Magnified by Leverage and Liquidations

Leverage is likely magnifying the selloff in the crypto market. Futures open interest in cryptocurrencies remained high, with tens of billions of dollars worth of leveraged positions outstanding.

When prices move against heavily leveraged long bets, exchanges automatically shut such positions to safeguard lenders from suffering losses through forced liquidations.

New figures indicate that over $527 million worth of bulls’ leveraged positions have been liquidated within 24 hours, indicating a rapid unwinding of exposure and buttressing the downsides.

These liquidations show that leveraged traders, especially those with little to no hedging, have seen their positions decimated by a wider pullback and liquidity tightening.

Worries Over AI Bubble and Risk Sentiment

Apart from monetary policy and liquidity, global risk sentiment was also influenced by increased skepticism about the AI technology boom’s sustainability.

Hedge fund titan Bridgewater Associates issued a public warning that excessive dependence on external capital for AI expansion had moved into a “dangerous” stage, and likely to place markets in a bubble.

Crypto Market Selloff: Fed Shift and AI Fears Trigger Sharp Drop in Bitcoin and Altcoins

Crypto Market Selloff: Fed Shift and AI Fears Trigger Sharp Drop in Bitcoin and Altcoins

Greg Jensen, Bridgewater’s co-chief investment officer, pointed out that AI initiatives often require capital far beyond internal cash generation, creating uncertainty about the profitability and long-term valuations within the tech sector.

These warnings added to market fears as disappointing earnings estimates on the part of big tech firms including Oracle showed that excessive AI infrastructure spending still wasn’t materializing into profit, denting risk appetites in equity and crypto markets.

Conclusion

The crypto market selloff has been fueled by new leadership speculations at the Federal Reserve, tightening liquidity conditions, and escalating concerns over an AI bubble occurring within the tech sector.

Bitcoin and Ethereum tested Major support levels, intensified by forced liquidations of leveraged positions that egged on the downward movement.

Meanwhile, macro indicators and risk sentiment remained in adjustment mode as well, showing a more general pull-back from specialized to safe assets.

This intersection of trends has manifested as a significant dump in digital currencies, stressing the intertwined relationship between international economic changes and crypto-market moves.

Glossary

Crypto market selloff: An extended bearish trend in digital currencies as result of a generalised risk-off approach by investors.

Liquidation: Exchange-forced closing of margin positions when collateral to do so has been exhausted.

Leverage: The use of credit or borrowed funds to increase one’s trading position, potentially increasing gains and losses.

Risk sentiment: The general tendency of investors to take on risk, based on macroeconomic and market factors.

AI bubble: A scenario in which the market overheats, leading to a high investment-to-return ratio, with particular relation to AI areas.

Frequently Asked Questions About Current Crypto Market Selloff

What caused the recent Bitcoin and altcoin sell-off?

The recent crypto market sell-off is a combination of uncertainty over who would head the Federal Reserve, tighter liquidity in markets and macroeconomic headwinds, prompting traders to de-risk.

What impact do liquidations have on crypto prices?

Liquidations happen when leveraged bets are automatically unwound as losses hit margin-calling thresholds, often intensifying downward price movements in the process of a sell-off.

Did the AI sector fears influence the markets for crypto?

Yes. Cautions from big investors over an AI bubble and soft earnings outlook in the tech sectors damped risk appetite across stocks and crypto.

How does the Federal Reserve factor into crypto markets?

The Fed’s policy affects the liquidity and risk sentiment, these changes in expected cuts or leadership can cause a notable impact on the price of digital asset.

References

The Economic Times

Reuters

Reuters

CoinDesk

AInvest

BTCC

Read More: Crypto Market Selloff Deepens as Fed Uncertainty and AI Bubble Fears Trigger $500M in Liquidations">Crypto Market Selloff Deepens as Fed Uncertainty and AI Bubble Fears Trigger $500M in Liquidations

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Kodiak Sciences Announces Pricing of Upsized Public Offering of Common Stock