Best Meme Coins to Buy: Pepe Price Prediction

Pepe holders recently experienced one of the month’s most turbulent periods. Bitcoin’s drop below $90k triggered liquidations across high-risk assets, sending meme coins into sharp declines.

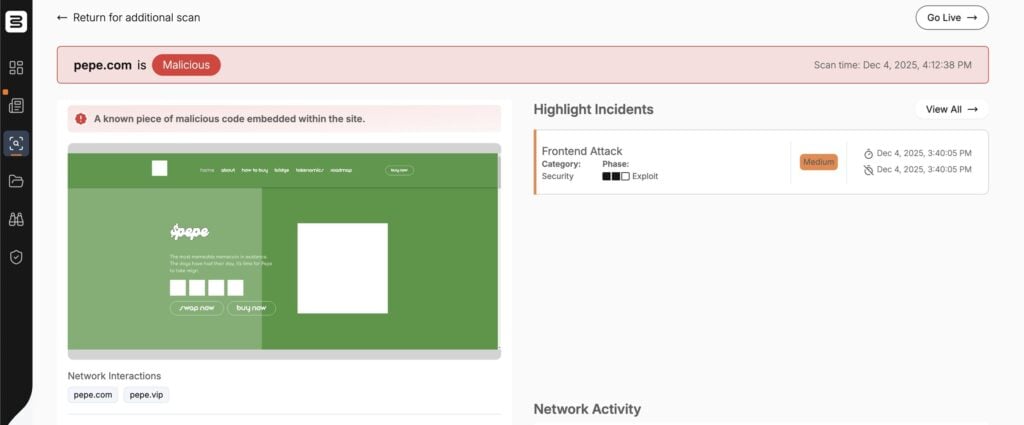

Pepe’s slide worsened when its official website was compromised, redirecting users to phishing links. The token briefly fell toward a $1.8 billion valuation, shaking confidence and sparking fear across the community.

Yet in crypto, sentiment can shift quickly. Fresh price action and community insights hint that Pepe may be stabilizing, offering early signs of recovery.

Source – Cryptonews YouTube Channel

Pepe Shows Early Signs of Recovery After Security Breach

The Pepe website was recently compromised by “inferno drainer” code, which redirected users to malicious links.

Security experts and Blockaid have advised avoiding the site until it is fully restored. The breach caused financial losses for some investors, emphasizing the need for strong security measures in the crypto space.

The exploit occurred during a month-long downtrend, with Pepe falling about 26% and remaining well below its $10 billion peak market cap.

Despite this, Pepe continues to attract attention, and analysts and the community remain optimistic about its long-term potential as one of Ethereum’s strongest meme coins.

A chart shared by community analyst Pepe Whale indicates that $PEPE is beginning to reclaim a key structural level, suggesting the downtrend may be slowing.

On the 4-hour chart, the market has shifted from aggressive sell-offs to a tighter accumulation range, with dips defended more consistently. An unfilled liquidity gap above the current price makes the $0.0000065–$0.0000070 range a likely upside target if support holds.

Overall, $PEPE may be entering the early stage of a broader trend shift, with the next key test above recent swings.

Macro Conditions Favor a Potential Rally

The timing of this shift is important because the broader market is approaching a major macro decision. The Federal Reserve’s upcoming rate announcement has the potential to inject fresh liquidity into risk assets.

Bitcoin’s daily and weekly indicators are also moving into oversold territory, a zone where reversals often begin. If Bitcoin manages to reclaim momentum and retest the $100k region, the usual pattern tends to unfold.

Bitcoin rises first, Ethereum follows, and meme coins surge afterward with amplified volatility. This is the phase where retail traders return aggressively, seeking high beta opportunities that react faster than the large caps.

Pepe sits at the center of that ecosystem. But as interest in meme culture grows again, traders are also looking beyond the main tokens to locate new projects that could benefit from the same narrative wave.

A New Pepe-Themed Contender Emerges: Pepenode

One project in particular is gaining attention: Pepenode, a Pepe-themed ERC20 token entering the market just as the meme coin space prepares for its next phase.

Pepenode features a browser-based mine-to-earn system. Users acquire virtual nodes, upgrade them to increase mining power, and earn rewards based on their progression. The system is simple and accessible, designed to keep users engaged without requiring technical expertise.

The tokenomics set Pepenode apart. 70% of all tokens spent on in-game upgrades are burned instantly, meaning that the more users interact with the platform, the faster the total supply decreases.

This deflationary mechanism maintains active demand while gradually reducing supply, creating potential for strong price responsiveness if market liquidity returns.

Staking is another key feature, available even during the presale. Early investors can lock their tokens and earn rewards before the token officially lists, promoting long-term holding and reducing initial sell pressure.

Despite market uncertainty, Pepenode has already raised over $2 million, positioning it among the best meme coins to buy for investors tracking emerging projects in the Pepe ecosystem.

Why Pepenode Fits the Current Market Cycle

Meme coins with strong branding tend to perform best when the market regains momentum. The Pepe theme already dominates cultural spaces across social platforms, making new projects under this identity instantly recognizable.

Pepenode benefits from this familiarity while offering mechanics that go beyond humor. Its combination of meme culture and a gamified mining system positions it as a high-beta token capable of strong performance when Bitcoin recovers.

If Bitcoin pushes upward from oversold territory and Ethereum continues toward breakout levels, the market environment becomes ideal for meme and GameFi hybrids. Pepenode sits perfectly at this intersection, ready to capture attention and potential upside.

For those interested in investing in Pepenode, following their official X and Telegram channels is recommended. Using secure wallets is essential, and platforms like Best Wallet provide a reliable, non-custodial solution for participating in presales and safeguarding digital assets.

Visit Pepenode

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy