DraftKings Launches Predictions Markets Using Polymarket’s Clearinghouse

Prediction markets are experiencing a surge in activity this October, driven by strategic moves from major players like DraftKings and Polymarket. As the industry reaches new heights, these developments demonstrate the increasing integration of blockchain technology within mainstream sports betting and crypto markets, signaling a maturing sector with vast potential for growth and innovation.

- DraftKings partners with Polymarket to launch a new prediction market platform, marking a significant push into crypto-enabled betting.

- The platform will utilize Polymarket’s advanced clearinghouse system to ensure secure, transparent trade verification and settlement.

- DraftKings’ prediction market app aims to debut soon on mobile, covering various sectors from finance to entertainment.

- Polymarket’s expansion continues through acquisitions and notable industry collaborations, including a major investment from the NYSE’s parent company.

- Cryptocurrency-based prediction markets are seeing record trading volumes this month, surpassing $4.6 billion across key platforms.

American sports betting giant DraftKings is entering the prediction market scene by partnering with Polymarket, a notable player in the blockchain-based prediction space. The collaboration will enable DraftKings to leverage Polymarket’s decentralized clearinghouse, a core component responsible for verifying trades, managing collateral, and ensuring fair settlement of bets, thereby reducing counterparty risk and bolstering trust among users. This move marks the company’s first major step into the crypto ecosystem since discontinuing its NFT marketplace earlier this year.

As part of this integration, DraftKings announced the upcoming launch of “DraftKings Predictions,” a mobile app set to roll out in the coming months. The platform promises to cover a broad spectrum of markets, from sports and entertainment to finance and culture, providing users with diverse opportunities for engagement. The prediction markets industry has been growing rapidly, with platforms like Polymarket evolving to connect with multiple exchanges, increasing market flexibility and user options.

This strategic move by DraftKings underscores their commitment to integrating blockchain technology into mainstream sports betting and prediction markets. It also highlights the broader trend of crypto adoption in the industry, following the acquisition of Railbird — a CFTC-regulated prediction platform — for an undisclosed sum. Polymarket’s technological and regulatory advancements have positioned it as a dominant force, especially after its acquisition of US derivatives exchange QCEX for $112 million in June, a move that marked its reentry into the U.S. market after over two years of absence.

Polymarket’s Expanding Influence and Market Activity

Polymarket’s expansion pace has been notable this month, with new integrations including the identity-focused World App and the crypto wallet MetaMask, set to be integrated before year-end. Its recent collaborations and strategic investments, such as a $2 billion injection from the Intercontinental Exchange (NYSE’s parent firm), have propelled its valuation to $9 billion, positioning it as a key player in the prediction markets space amidst stiff competition from Kalshi, which also commands significant trading volumes.

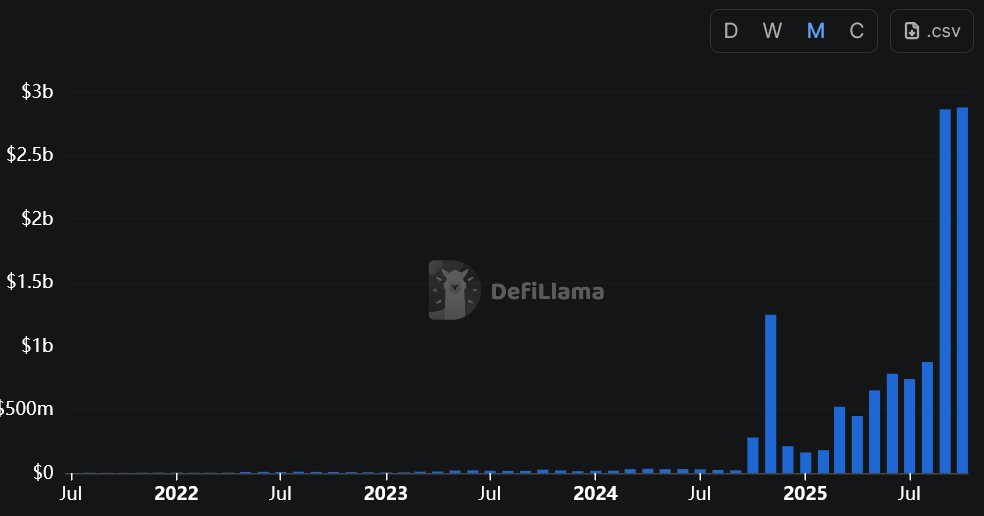

In October alone, prediction markets powered by Polymarket and Kalshi have seen combined trading volumes surpass $4.63 billion, shattering previous records of $4.17 billion. Kalshi’s record-setting $2.87 billion in monthly trade volume is its highest to date, reflecting the rising mainstream popularity of crypto-powered financial products and speculative markets.

Monthly trading volume on Kalshi since July 2021. Source: DeFiLlama

Monthly trading volume on Kalshi since July 2021. Source: DeFiLlama

The growth of prediction markets in the crypto sphere illustrates the increasing acceptance and integration of blockchain technology within traditional finance and entertainment sectors. As these platforms continue to see record volumes, they reinforce the potential of decentralized finance (DeFi) to reshape how individuals engage with financial and speculative products.

This article was originally published as DraftKings Launches Predictions Markets Using Polymarket’s Clearinghouse on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Kraken's Big Hint: Pi Coin Set for Exchange Listing In 2026

US Stock Market Could Double By End Of Presidential Term