Solana Hits $2.85B as ETFs and Treasuries Drive Institutional Demand

As the cryptocurrency landscape continues to evolve, Solana has emerged as a significant revenue-generating blockchain platform, with recent reports highlighting its impressive financial performance over the past year. Driven largely by activity on trading platforms and various ecosystem applications, Solana’s revenue showcases its growing influence within the broader crypto markets.

- Solana earned approximately $2.85 billion from trading activity and ecosystem fees between October 2024 and September 2025.

- Trading platforms like Photon and Axiom contributed nearly 40% of Solana’s total revenue, with peaks during meme coin surges.

- Compared to Ethereum, Solana’s monthly revenue at a similar development stage is 20–30 times higher, reflecting its efficiency and user engagement.

- Over $4 billion in SOL tokens are now held on public company balance sheets, with several firms focusing on Solana treasury growth.

- Multiple Solana ETF applications are pending approval in the United States, with market confidence high despite potential delays due to the US government shutdown.

Solana’s Revenue Milestone

According to a recent report from 21Shares, Solana generated an estimated $2.85 billion in revenue over the past year, primarily fueled by trading platform activity. Between October 2024 and September 2025, the network averaged roughly $240 million in monthly revenue, reaching a peak of $616 million in January during the meme coin frenzy sparked by tokens like TRUMP. Even as the hype subsided, monthly revenue has stabilized between $150 million and $250 million, reflecting sustained activity within its ecosystem.

Validators on the Solana network earn fees generated from transactions, which come from a broad array of use cases such as decentralized finance (DeFi), decentralized exchanges, memecoins, artificial intelligence (AI) applications, DePIN, launchpads and trading tools. The dominant source remains trading platforms, accounting for 39% or approximately $1.12 billion of the accumulated revenue, driven by apps like Photon and Axiom.

Solana’s 12-month revenue by sector. Source: 21SharesSolana’s Competitive Edge Over Ethereum

The report emphasizes that Solana is currently ahead of Ethereum at a comparable point in its development. While Ethereum’s monthly revenue five years post-launch remained below $10 million, Solana now boasts monthly revenues 20 to 30 times higher. This financial momentum stems from its high efficiency, low transaction fees, and a vibrant user base of approximately 1.2–1.5 million daily active addresses — nearly triple Ethereum’s activity levels at a similar lifecycle stage.

21Shares, a prominent Swiss-based asset manager and one of the leading providers of crypto exchange-traded products (ETPs), launched the first European Solana (SOL) ETP back in 2021, reflecting institutional interest in the network’s growth.

Solana ETFs and Corporate Holdings

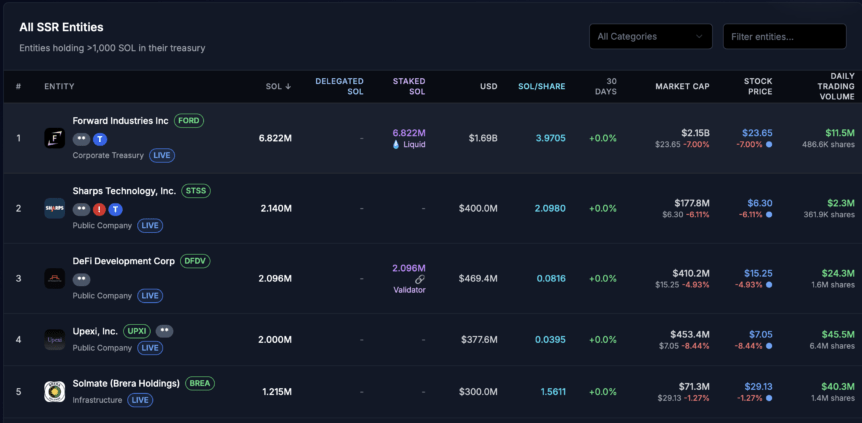

Recent developments show that several companies have rebranded or established treasury holdings in SOL, with nearly $4 billion currently held across various public firms. Notably, Nasdaq-listed Brera Holdings rebranded to Solmate following a $300 million oversubscribed PIPE fundraising round. This move aims to develop a dedicated Solana-focused digital asset treasury and infrastructure platform.

Top Solana treasury companies’ holdings. Source: StrategicSolanaReserve.org

Top Solana treasury companies’ holdings. Source: StrategicSolanaReserve.org

Current data shows that 18 entities collectively hold about 17.8 million SOL tokens, with Forward Industries leading the pack with 6.8 million SOL tokens, followed by Sharps Technology with approximately 2.1 million SOL.

Top Solana treasury holders. Source: StrategicSolanaReserve.org

Top Solana treasury holders. Source: StrategicSolanaReserve.org

Furthermore, several Solana ETF proposals are in the pipeline, awaiting approval in the United States. If approved, these could significantly boost retail and institutional participation in Solana-based assets. Market sentiment remains optimistic; polls indicate a 99% likelihood of ETF approval before year’s end, despite delays caused by the US government shutdown. Trading platforms and notable firms suggest strong confidence that regulatory hurdles will be overcome, catalyzing a new phase of growth for Solana and the broader DeFi ecosystem.

This article was originally published as Solana Hits $2.85B as ETFs and Treasuries Drive Institutional Demand on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Trump swears he'll donate winnings in $10 billion lawsuit against his own IRS