As Bitcoin Starts Bull Run, Traders Are Turning to Top Altcoins like Bitcoin Hyper

However, the Bitcoin bullrun could come with a few problems. The Bitcoin network is already struggling under the number of transactions pushed through the network, especially when compared against high-speed blockchains like Ethereum or Solana.

If left as is, the fees you pay to trade Bitcoin are only going to get worse.

This is why a new altcoin is making waves with its presale. Bitcoin Hyper is stepping in with a Layer-2 (L2) for Bitcoin. Based on a Solana Virtual Machine (SVM) integration that brings high-speed and smart contract scalability, this new tech project is planning to turn $BTC into a Web3-compatible asset.

Analysts expect the value of Bitcoin to pump beyond $125K, and a Bitcoin rally usually ends with an altcoin season. Projects like Bitcoin Hyper, which add value to the Bitcoin network, could be the first to stand out and grow alongside it.

Recent whale buys of $196.6K and $145K confirm that the market is excited about the potential of Bitcoin Hyper as EOY nears.

Read on for the full story on how the Bitcoin Hyper L2 could transform the Bitcoin experience.

Why Is Bitcoin’s Network So Slow?

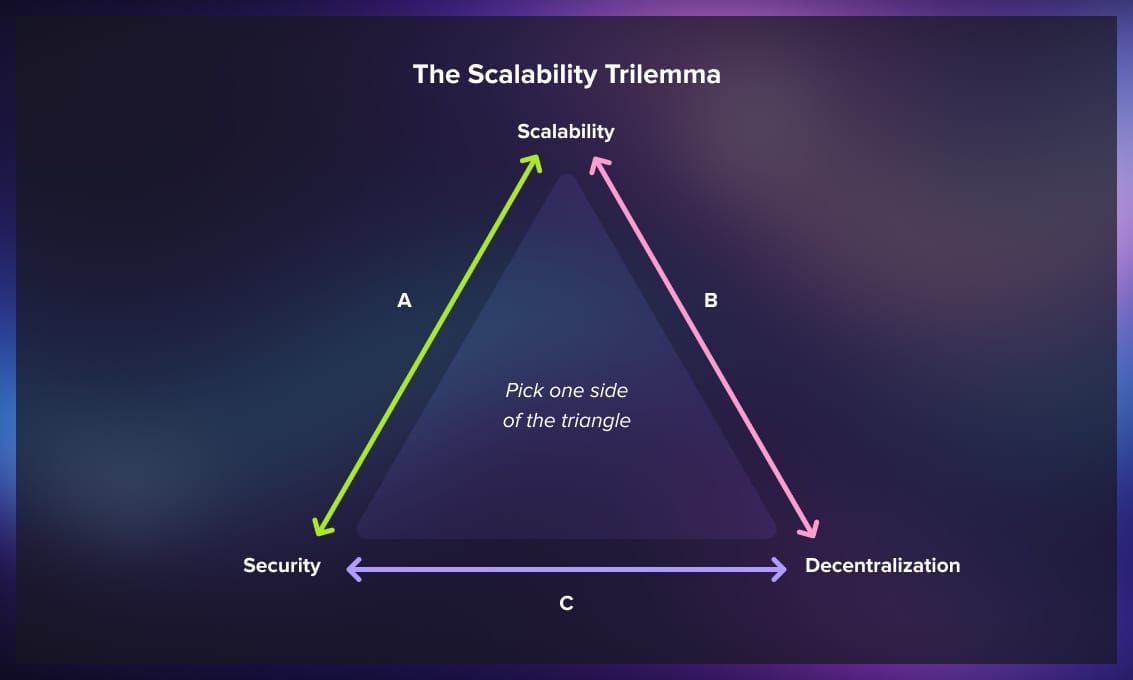

Security is a priority for the Bitcoin network. As it’s a decentralized blockchain, that comes at the cost of reduced scalability. As such, to some extent, the Bitcoin network is slow by design.

Each transaction is added to a block, which is then committed to the blockchain by miners. This process takes around ten minutes to work as each block needs to be validated by the majority of the network.

There’s a maximum file size cap for each block, meaning that the Bitcoin network can only process so many transactions per second. Its output estimated to be around 7 to 10 transactions per second, compared with the thousands possible through the Solana network.

Because of the competition for transaction slots, fees on the Bitcoin chain are going up and time to clear is getting worse as network activity increases.

The Scalability Trilemma diagram shows security and decentralization cause scalability to suffer. (Source: serokell.io)

This scalability limitation isn’t really a problem if you’re buying $BTC with the intention to HODL. But it becomes an issue if you’re using Bitcoin for regular transactions and trading, as the clearing speeds make it nigh unusable for retail users.

It’s a known problem for blockchain development, but there’s a solution that doesn’t require moving off-chain.

Adding Solana’s programmability into the mix with a L2 preserves Bitcoin’s security on the Layer-1, while adding in high-speed parallel processing capabilities.

This makes hybrid crypto projects like Bitcoin Hyper the perfect solution to Bitcoin’s woes. Let’s have a look at how it all works.

How Does $HYPER Solve Bitcoin’s Scalability Woes?

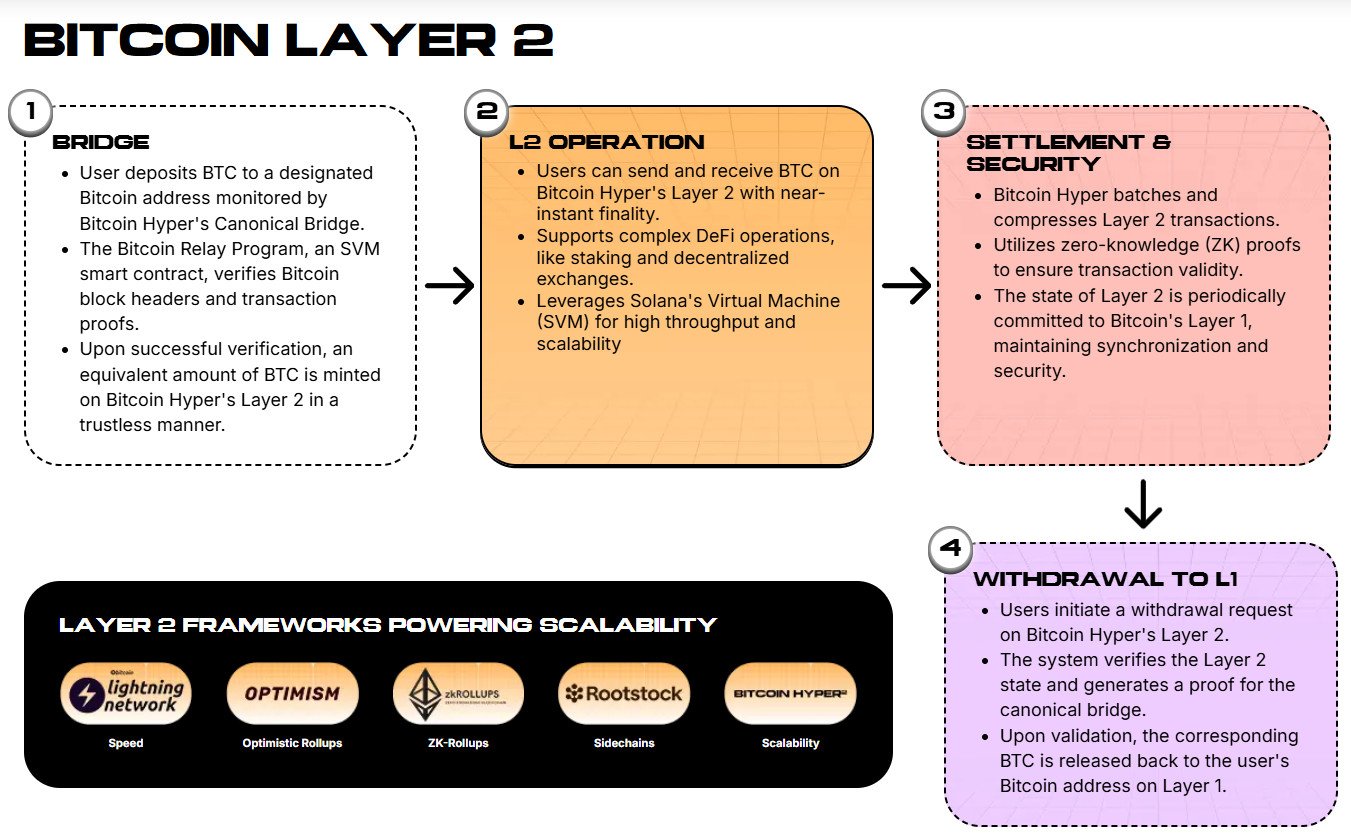

Bitcoin Hyper speeds up the Bitcoin blockchain by reducing the number of transactions being processed on the Layer-1 (L1).

Instead, the Hyper L2 acts as a temporary ledger powered by Solana, which collects and processes transactions, then commits them back to the L1 for secure settlement.

This keeps pressure off the Bitcoin L1 without compromising on security. As the value of $BTC grows, more users will onboard to the Bitcoin network, making scalability solutions like Bitcoin Hyper essential.

The off-chain processing and L1 settlement work via a Canonical Bridge.

When $BTC is sent to the Canonical Bridge, it’s held in a custody wallet on the L1 for safe keeping. Meanwhile, the same amount of wrapped $BTC ($wBTC) is minted on the Bitcoin Hyper network.

Once minted, you can use the $wBTC across DeFi protocols and other Web3 platforms onboarded on the Hyper blockchain. Learn more about the project’s features and what it can do with this full Bitcoin Hyper review.

The bridge works the other way, too. To unlock your $BTC from custody, you send back an equivalent amount of $wBTC which is burned. Then, your $BTC is sent back to your wallet.

Visit $HYPER’s token presale to support the project.

Why Is the $HYPER Token Presale Booming?

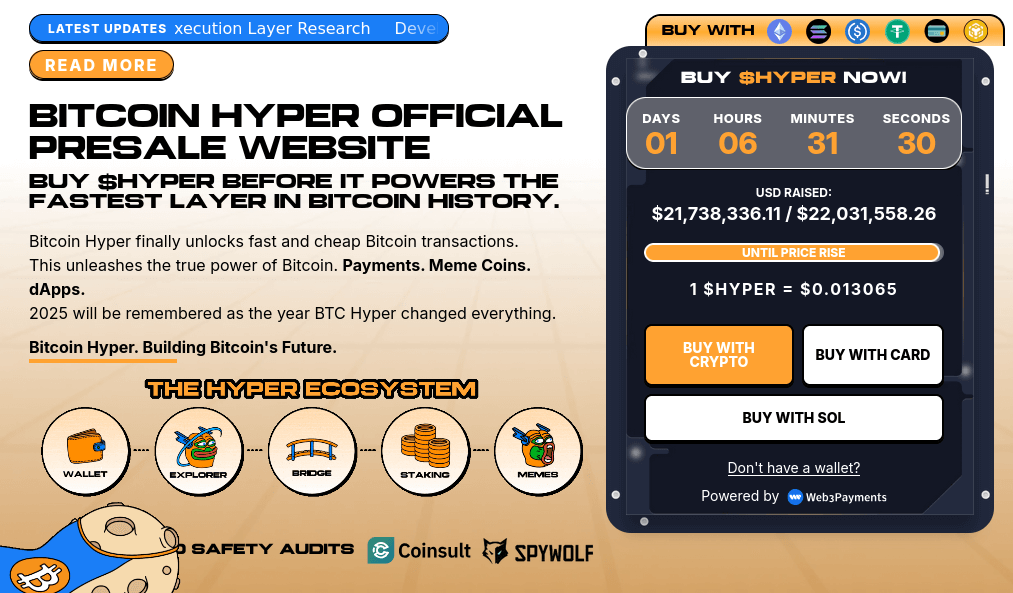

Bitcoin Hyper ($HYPER) is the official utility token of the upcoming Bitcoin Hyper network. Although still in presale, it’s recently earned a spot on the best altcoins list this year. Here’s why.

Bitcoin is doing better than ever. This means a greater need for solutions like Bitcoin Hyper as $BTC’s network activity soars. This early stage project has already gained significant traction, as seen from its token presale success.

We’ve seen recent whale buys of $196.6K and $145K that show strong market interest as the $HYPER presale as it heads to a close. So far, the project has raised $21.7M+, and we don’t expect this momentum to slow down anytime soon.

The token fuels the development of the new SVM chain, with 50% of the tokens going towards dev updates and the treasury.

Beyond this, the $HYPER token brings several perks, like:

- Lowering transaction fees on the L2, so you to get more out of your $wBTC.

- Unlocking priority access to the first onboarded dApps and network features.

- Granting you voting rights on the project’s future (through the Hyper DAO).

- Earning dynamic staking rewards throughout the presale (now at 55% APY).

It’s also a reward token for blockchain devs building on Hyper’s L2, so it holds plenty of promise and utility if the ecosystem expands successfully in 2025–2026.

So, if you want to buy $HYPER while it’s still cheap, now’s the time. The $HYPER presale is due to end by Q4 2025, with the current price of $0.013065 set to increase in 30 hours.

Quick Recap & $HYPER’s Price Potential Moving Forward

As $BTC is showing signs of an upcoming rally, the OG crypto could once again break past $125K and establish a new ATH. This means a potential altcoin rally is coming, and new projects centered around Bitcoin could shine.

Right now, Bitcoin Hyper ($HYPER) is the #1 contender with its SVM-powered L2 and 21.7M+ strong presale. The most conservative price prediction for $HYPER is $0.03 by the end of 2025 (a ~129% potential increase from today’s price).

However, if Bitcoin continues on the bullrun we’ve seen so far, $HYPER could get even more attention, potentially hitting $0.2 after a 15x surge.

Buy Bitcoin Hyper ($HYPER) today.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy