New Crypto to Buy as Bitcoin Hits $125K Igniting a New AI-Driven Altcoin Rush

Traders are rotating capital out of $BTC into the next wave of altcoins, but this time they’re hunting projects with real utility, especially ones leveraging AI, analytics, and novel tokenomics.

Here’s a roundup of new crypto to buy in 2025, each with a twist on AI, community data, or on-chain utility. Think of it like picking stock in a robot arms race, but in digital tokens.

The Big Picture

Bitcoin’s breakout above $125K didn’t happen in a vacuum. Over $65B in daily trading volume and over $200M in short liquidations show how much fresh money has flooded back into crypto.

Source: CoinMarketCap

Institutional buyers, retail traders, and prediction markets all see momentum continuing – Standard Chartered even expects $BTC to hit $200K by year-end.

But while Bitcoin dominates headlines, the real story is how that capital spills into altcoins.

The AI agent market alone is projected to surpass $50B within five years, according to Boston Consulting Group – and crypto is becoming a major testing ground for that growth.

Despite agents still making rookie mistakes in live trading, investors are betting on smarter, more practical applications of AI in crypto. The focus is shifting toward new crypto projects using AI for analytics, automation, and user experience – the kind that can survive beyond the hype.

1. Bitcoin Hyper ($HYPER) – Turning Bitcoin Into a Full-Blown Ecosystem

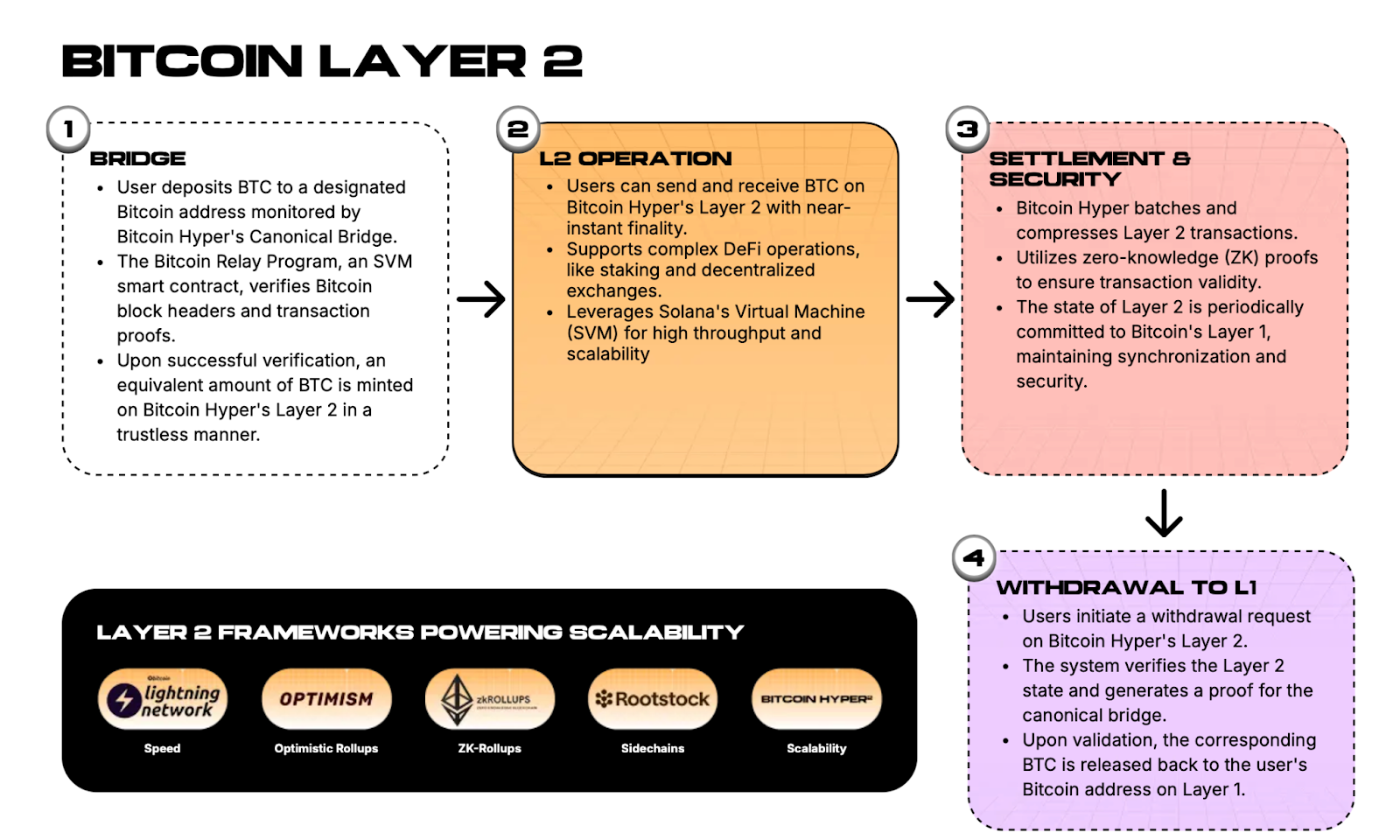

Bitcoin Hyper ($HYPER) is pitching itself as the fastest Bitcoin Layer-2 ever built. Not a sidechain, not a workaround, but a full blockchain designed to finally scale Bitcoin.

While $BTC dominates headlines after hitting $125K, Bitcoin Hyper wants to take that momentum and turn the ‘store of value’ narrative into something much bigger: a platform for speed, DeFi, and culture.

Built on the Solana Virtual Machine (SVM), Bitcoin Hyper delivers sub-second transactions with near-zero gas fees and full compatibility with Solana dApps.

It acts as Bitcoin’s execution layer – payments, trading, dApps, meme coins, and governance all live here while the Bitcoin mainnet remains the monetary base layer.

Assets can move freely across Bitcoin, Ethereum, and Solana from day one, making Hyper a truly cross-chain environment.

At $0.013055 per $HYPER and with $21.5M raised in presale, early demand is strong. With whales already moving in, this could become the launchpad for the next generation of Bitcoin-native DeFi.

Presale buyers get staking access, airdrops, and launch rights – the kind of early advantage you don’t see twice.

Join the Bitcoin Hyper ($HYPER) presale before it scales out.

2. PEPENODE ($PEPENODE) – The World’s First Mine-to-Earn Meme Coin

If Bitcoin is stealing the spotlight at $125K, PEPENODE ($PEPENODE) is quietly mining its own fame.

$PEPENODE is the world’s first mine-to-earn meme coin, turning the hype around memes into an interactive earning system.

Priced at $0.0010874 per token and already past $1.6M raised in presale, PEPENODE invites users to become virtual miners of meme coins – no rigs, no electricity bills, just pure digital hustle.

Here’s how it works: users build and upgrade virtual mining nodes in a gamified environment that blends memes with mining. Each node earns rewards while burning token supply, keeping the economy deflationary and engagement high.

Running on Ethereum, it combines security, transparency, and easy wallet integration, all while tapping into the network that just saw $ETH hit a fresh all-time high.

As investors chase new crypto opportunities with real utility, $PEPENODE turns staking into a fun, meme-powered game. The token is already audited, live, and gathering momentum fast.

You can join the presale today and start mining meme coins before it hits exchanges.

3. Blazpay ($BLAZ) – The AI Assistant That Makes DeFi Actually Easy

As Bitcoin rockets past $125K and AI starts creeping into every corner of crypto, Blazpay ($BLAZ) is carving out a sweet spot between both worlds.

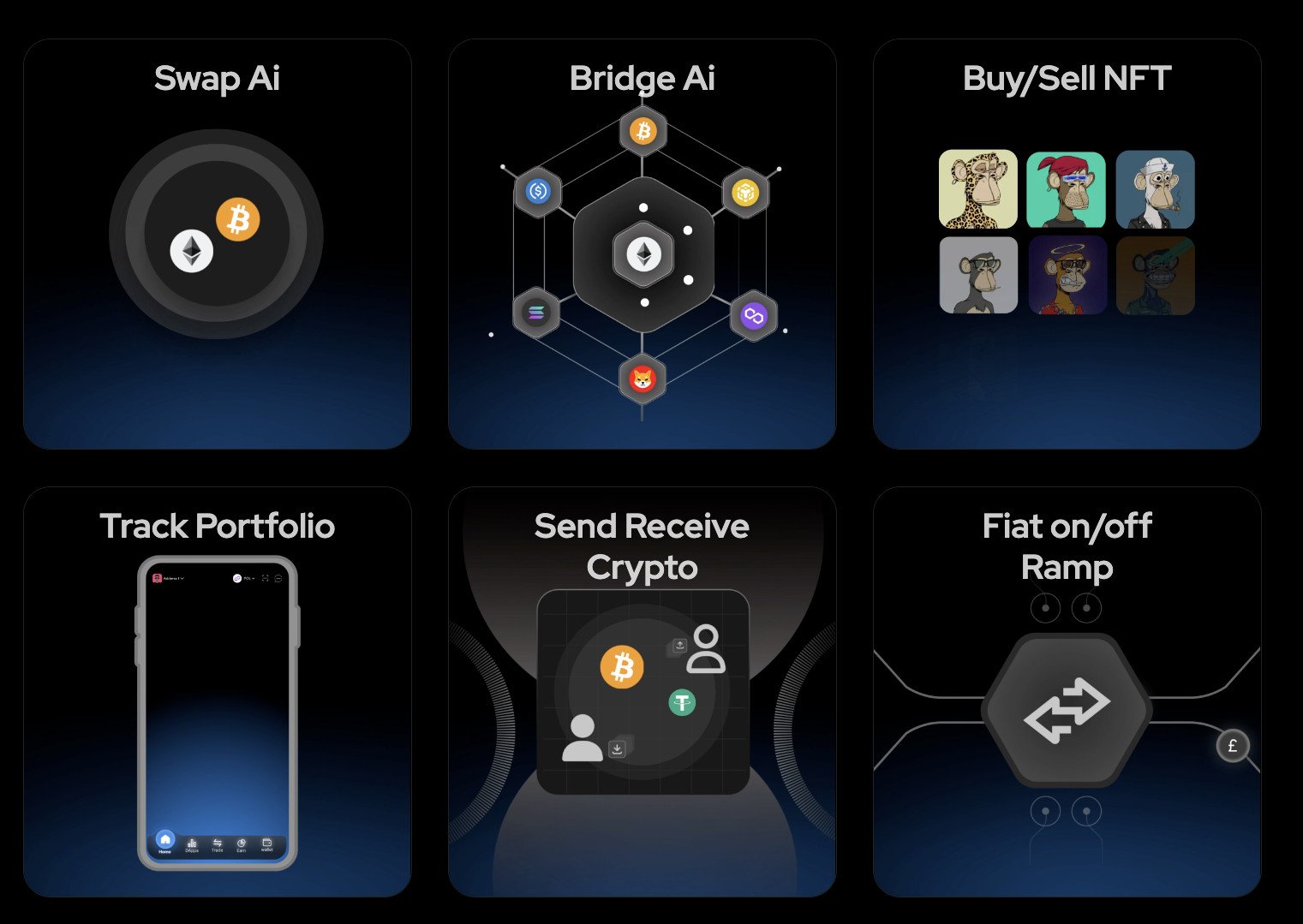

Built as an AI-powered DeFi platform, it lets users perform complex blockchain actions just by typing natural-language commands.

Imagine saying ‘stake my $ETH for best yield’, and BlazAI handles the bridging, swapping, and staking across chains in seconds. No dashboards. No multi-tab chaos. Just a chat interface that does the hard work for you.

Currently priced at $0.006 and already having raised $13.8K in its presale, Blazpay plans to roll out a fully multi-chain DeFi assistant supporting everything from yield farming to portfolio tracking.

As investors pour capital into smarter AI-integrated crypto tools, Blazpay fits the 2025 narrative perfectly – automation, accessibility, and AI-driven utility all in one place.

If AI trading bots still stumble, BlazAI might just be the one that listens.

You can join the Blazpay presale now while it’s still early in Phase 1.

New Crypto Projects Powering the Post-$125K Rally

Bitcoin’s surge past $125K has reignited the hunt for the best new crypto plays of 2025.

Bitcoin Hyper ($HYPER) is scaling Bitcoin into a full ecosystem, PEPENODE ($PEPENODE) is gamifying meme coin mining, and Blazpay ($BLAZ) is fusing AI with DeFi simplicity.

Together, they reflect the smarter, utility-driven wave defining this bull cycle.

This article is for informational purposes only and is not financial advice. Always do your own research (DYOR) before investing in crypto.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy