Best Crypto to Buy Now Before Tether Goes Public in Potential $500B Raise

Crypto heavyweight Tether is reportedly in early-stage discussions to raise between $15-20B in a private equity round, offering about 3% of its equity.

If successful, the deal could peg the company’s valuation at nearly $500B, placing it among the world’s most valuable private firms alongside names like OpenAI and SpaceX, and joining elite company at a stroke.

This would likely raise crypto adoption and investor interest in the industry, creating hype.

It should be high time you paid attention to the best cryptos to buy (like Bitcoin Hyper) if you don’t want to miss this speeding train.

Fundraise Reveals the Scale of Tether’s Ambition

Tether’s deal would involve new equity issuance, rather than existing shareholders selling down their stakes, according to the source.

Cantor Fitzgerald is reported to be the lead advisor; the company owns roughly a 5% stake in Tether already, a share worth $25B if Tether’s IPO achieved the upper range of its valuation.That’s speculative, of course – the final terms and valuation of the IPO may differ substantially.

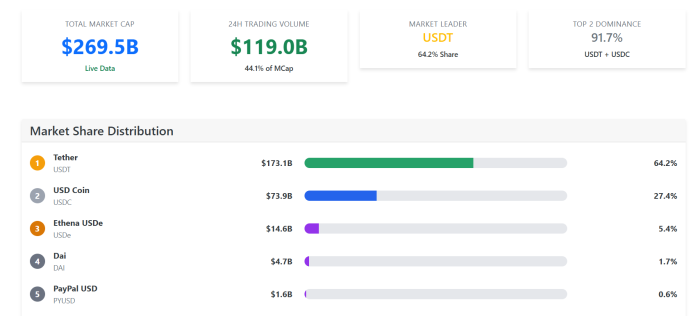

Still, the proposed terms indicate just how ambitious Tether’s plans are. Tether issues the $USDT stablecoin, the largest such crypto, with a circulating supply of $173B. That supply has increased steadily over the past year, as demand for stablecoins has grown.

More growth means more profits in Tether’s case; the company reported exceptionally strong profitability of $4.9B in Q2 2025 alone. That financial strength gives Tether a powerful base for any IPO plans.

U.S. Push and Regulatory Context

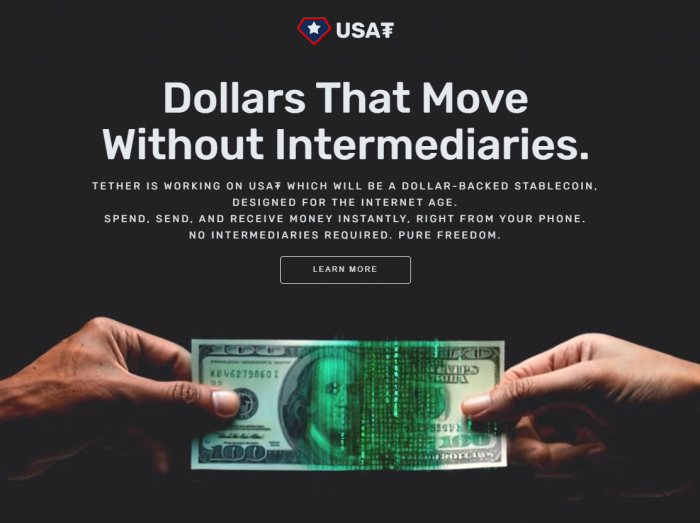

Part of those plans include a move into the U.S. market. Tether appointed Bo Hines, a former U.S. crypto policy official, as strategic adviser, and plans to launch a U.S.-oriented $USAT stablecoin.

Why now? Regulatory headwinds that historically restrained its U.S. operations largely vanished earlier this year with the passing of the GENIUS stablecoin act.

That has created an opportunity for Tether – currently headquartered in South America – to expand and cater its operations to the US market.

Despite the hype, there are several uncertainties. The deal is still preliminary, so the valuation, stake dilution, and raise amount could all shift materially.

There’s also a bigger question; with Tether already highly profitable, why go public at all? Possible reasons include accelerating U.S. expansion, regulatory compliance, product diversification, or building reserves, but investors will want transparency over how the funds are deployed.Regardless of how this plays out, even rumors of Tether’s move are enough to surge investors’ interest. Here are three of the best cryptos under $1 that could explode soon.

1. Bitcoin Hyper ($HYPER) – Faster, Cheaper, Better Bitcoin Layer 2

Bitcoin’s big, bad, and beautiful, with a $2.2T+ market cap and constant predictions of $150K, $200K, or even $1.5M.

But it’s also slow, with an average of 7 TPS, and has a low throughput; add a lot of traffic, and congestion can cause transaction speeds to drop and fees to jump. That’s where Bitcoin Hyper ($HYPER) comes in.

Leveraging a Canonical Bridge on the Solana Virtual Machine, Bitcoin Hyper introduces a Layer 2 that allows investors to bridge Bitcoin and create wrapped Bitcoin.

On the Hyper Layer 2, that wrapped Bitcoin can be swapped, traded, and deployed across the full range of decentralised finance in a way Bitcoin couldn’t be before now.

dApps, smart contracts, DAOs, NFT marketplaces, even GameFi applications: they could all come alive on Bitcoin through Bitcoin Hyper’s L2.

The Bitcoin Hyper presale just passed $18M raised in the presale and shows no sign of slowing down.The token price is now set at $0.012975 but it won’t stay this cheap for too long. Our Bitcoin Hyper price prediction estimates a 2,366% increase by the end of the year.

Learn how to buy $HYPER, and check out our complete guide on what Bitcoin Hyper is and how it works.

Visit the $HYPER presale page to join before the next price increase.

2. Snorter Token ($SNORT) – Buy. Sell. Snipe. Win.

The best meme coins never see the light of day. They trade underground, rising and fading away again, but not before savvy investors make millions. The hardest part of trading them is finding them, and that’s where the Snorter Bot changes the game.

Snorter Bot and the Snorter Token ($SNORT) provide a cutting-edge meme coin trading tool.

Native to Telegram and focused on Solana meme coins, Snorter sniffs out the best small-cap gems and gives traders all the tools they need to make winning plays. Those include:

- Automated sniping

- Rugpull protection

- Copy trading

- Honeypot detection

- Limit orders

What is Snorter Token? It’s the tool that powers the best crypto trading bot. With over $4M raised, the presale continues to power forward towards the TGE.

Buy $SNORt at just $0.1053 before the presale ends in less than 26 days.

3. Aster ($ASTER) – 2,500% Gains for Up-and-Coming DeFi Platform

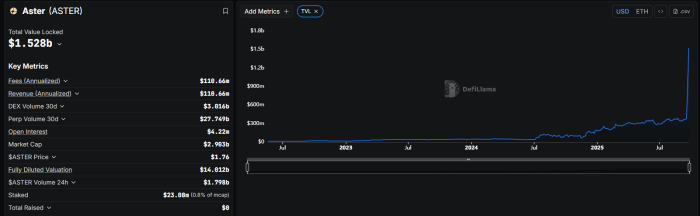

Back by CZ and benefiting from a wave of incoming TVL, Aster (the platform) has been on a roll recently. But $ASTER, the native utility token, has done even better.

In a single month since launch, $ASTER’s price increased over 2,500%.

That makes $ASTER one of the best plays of the resurgent DeFi scene. The platform, a decentralized perpetual contracts tool, has even drawn interest away from longstanding competitors in the field like Hyperliquid.

While $ASTER isn’t likely to grow at this rate forever, it’s already a proven contender.

Tether’s influence extends beyond its crypto business, holding tens of billions in U.S. Treasury bills, making it one of the largest non-sovereign purchasers of U.S. Treasuries.

Tether’s move might prompt re-assessments of how stablecoin issuers are valued compared to more traditional financial firms – and open the door for projects like $HYPER and $SNORT to skyrocket.

Recap: Bitcoin Hyper ($HYPER) is a utility-heavy altcoin focused on upscaling Bitcoin to modern demands, while Snorter Token ($SNORT) gives you the fastest and cheapest trading bot on Solana. And Aster ($ASTER) is a top DeFi buy right now.Authored by Bogdan Patru, Bitcoinist – https://bitcoinist.com/best-crypto-to-buy-now-before-tether-goes-public

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

Microsoft Corp. $MSFT blue box area offers a buying opportunity