Interpretation of the IPO of mining finance company Antalpha: A key move in Bitmain’s financial chess game?

Author: Frank, PANews

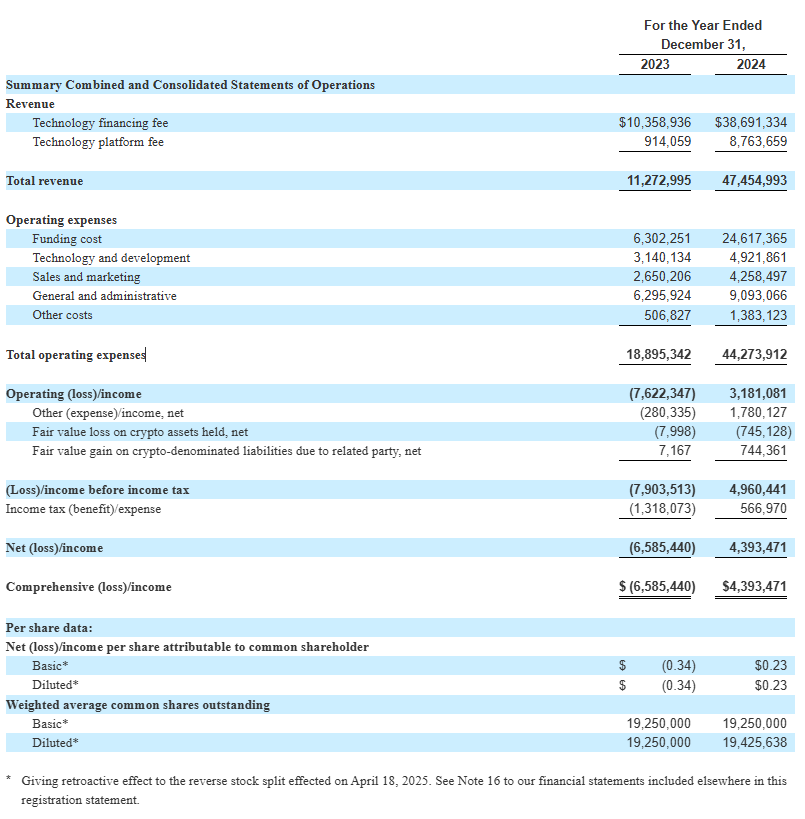

Recently, a financial technology company called Antalpha submitted a prospectus to Nasdaq, planning to conduct an initial public offering (IPO) with the code "ANTA". Antalpha is a financial solution provider in the field of Bitcoin mining. However, the close relationship with mining giant Bitmain and the intricate relationship with Bitmain co-founder Zhan Ketuan disclosed in its prospectus make this IPO full of meanings worth further investigation. In addition to the appearance of a financial technology company going public, is it also a key step for Bitmain to expand its financial territory?

The “Financial Transfusion” Behind Bitcoin Mining

Antalpha was founded in 2022. There is little information about itself on its official website, except for its strategic partnership with Bitmain. According to its prospectus and public information, Antalpha's core business is to provide financing, technology and risk management solutions to digital asset institutions, especially Bitcoin miners. Its goal is to help miners scale up their operations and enable them to better manage the impact of Bitcoin price fluctuations by providing financing solutions, such as supporting miners' "HODLing" strategies.

Antalpha's core products and services are mainly realized through its technology platform Antalpha Prime. The platform allows customers to initiate and manage their digital asset loans and monitor collateral positions in near real time. Its main sources of income include two aspects.

The first is supply chain financing, which is reflected in the "technology financing fee" and is the main source of Antalpha's revenue. Specifically, it includes: mining machine loans, which provide financing for the purchase of Bitcoin mining machines (usually listed mining machines purchased from Bitmain), and use the purchased mining machines as collateral. Computing power loans: provide financing for mining-related operating costs (such as hosting fees), and the collateral is usually mined Bitcoin. According to data disclosed by Antalpha, as of December 31, 2024, a total of US$2.8 billion in loans have been facilitated, of which approximately 97% of the loans of supply chain loan customers are secured by BTC.

In addition to providing financing loans directly, another major business of Antalpha is Bitcoin loan matching services: this part of the income is reflected in the "technology platform fee". Antalpha provides Bitcoin margin loan services to its non-US customers through the Antalpha Prime platform. It is worth noting that the funds for these loans have historically been mainly provided by its affiliate Northstar. In this model, Antalpha plays the role of a technology and service provider, earning platform fees and not bearing the credit risk of these loans.

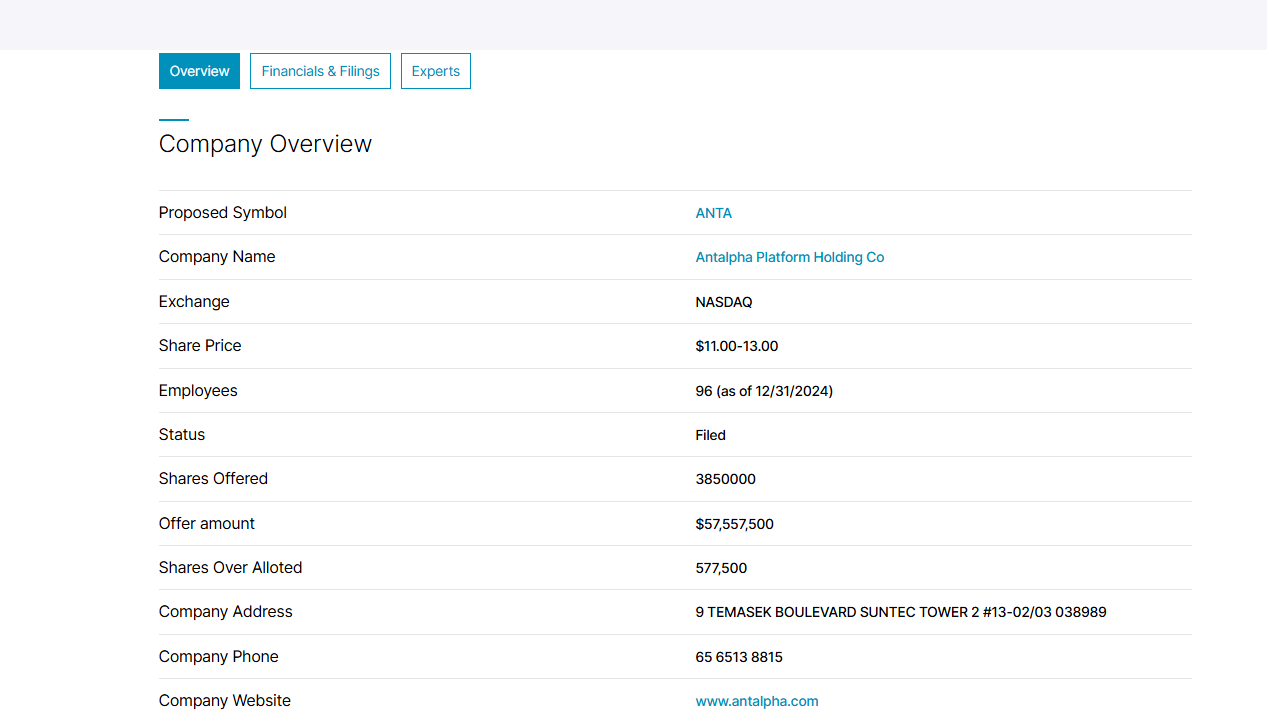

Financial data shows that Antalpha's total revenue in the most recent fiscal year (ending December 31, 2024) reached US$47.45 million, a year-on-year increase of 321%. Among them, technology financing fees were US$38.7 million, a year-on-year increase of 274%; technology platform fees were US$8.8 million, a year-on-year surge of 859%. The company also successfully turned losses into profits, achieving a net profit of US$4.4 million, while it had a net loss of US$6.6 million in the previous fiscal year.

In terms of loan size, as of December 31, 2024, Antalpha's total loan book size reached US$1.6 billion. Among them, the supply chain loan portfolio (mining machine loans and computing power loans) issued by Antalpha increased from US$344 million at the end of 2023 to US$428.9 million, a year-on-year increase of 25%. The scale of Bitcoin loans it serves for Northstar has rapidly increased from US$220.8 million at the end of 2023 to US$1.1987 billion, a year-on-year increase of 443%. In terms of geographical distribution, its loan business is highly concentrated in Asia. As of the end of 2024, 77.4% of the loans (approximately US$1.26 billion) went to Asian customers.

Bitmain’s “Financial Special Forces”

Antalpha made no secret of its close relationship with Bitmain in its prospectus, calling itself "Bitmain's main lending partner." The two parties even signed a memorandum of understanding, stipulating that Bitmain will continue to use Antalpha as its financing partner, the two parties will recommend customers to each other, and as long as Antalpha offers competitive terms, Bitmain will grant Antalpha the right of first refusal to serve its customers seeking financing.

This priority purchase right means that Antalpha can have priority access to Bitmain's huge customer base of mining machine buyers, thereby greatly reducing customer acquisition costs and obtaining a steady stream of business. The prospectus also mentioned that Antalpha and Bitmain work closely together at all levels from sales to operations to senior management, and is an indispensable part of Bitmain's sales and business initiation process.

However, Antalpha’s connection with Bitmain does not stop at the level of business cooperation. The deeper connection is with Bitmain’s co-founder Zhan Ketuan.

The prospectus describes Antalpha’s complex relationship with Northstar. Northstar has historically provided almost all of the funds for Antalpha’s loans and provided Bitcoin margin loans to Antalpha’s non-US customers through the AntalphaPrime platform. The key point is that Antalpha and Northstar were originally sister companies, belonging to the same parent company ultimately controlled by Zhan Ketuan.

After the "2024 Reorganization", Antalpha was spun off and transferred to the current listed entity Antalpha Platform Holdings. Subsequently, the former parent company disposed of all its interests in Northstar. Currently, Northstar is owned by an irrevocable trust, and Zhan Ketuan is the trustee and beneficiary of the trust, which is managed by a professional trust company. The prospectus emphasizes that Zhan Ketuan is not involved in the operation of Northstar.

Despite the restructuring, Northstar remains an important funder of Antalpha’s bitcoin loan service business. As the ultimate beneficiary of the Northstar Trust, Zhan Ketuan’s economic interests are still indirectly but significantly linked to Northstar’s business performance and even Antalpha’s business scale.

Therefore, although Antalpha Platform Holding Company may have been separated from Zhan Ketuan’s direct control in legal form, from the perspective of business logic, capital flow and strategic synergy, Antalpha can still be regarded as an important part of Bitmain’s financial landscape. It is more like a carefully designed and separated “financial special forces” that focuses on providing financial ammunition for Bitmain’s mining machine empire.

Bitmain’s strategic chess piece in the post-halving era

The deep strategic significance of Antalpha's listing is closely related to the industry environment and its own strategic adjustments that Bitmain will face after the Bitcoin halving in 2024.

The Bitcoin halving in April 2024, as expected, has compressed the block rewards for miners, posing a direct challenge to the profitability of the entire mining industry. For Bitmain, this means that the market demand for its products will focus more on high efficiency and low power consumption. In the past year, in order to consolidate its leadership in the field of mining hardware, Bitmain has accelerated the launch of a new generation of high-efficiency mining machines represented by the Antminer S21 series. Procurement agreements for the S21 series of mining machines signed with partners such as BitFuFu and Hut8. By continuing to deepen cooperation with large mining farms, Bitmain strives to secure large orders for its latest mining machines.

On the one hand, the mining industry has become more and more competitive after the halving. In order to maintain their income, miners must improve the performance of their mining machines, which has significantly increased their operating costs. This is a potential business growth risk for Bitmain in the future. On the other hand, as the price of Bitcoin continues to rise, more and more external companies and even listed companies have begun to join the mining industry, which has also brought new opportunities to Bitmain, but this opportunity also depends on the price changes of Bitcoin. Therefore, Antalpha provides loan support for Bitmain's customers to purchase new generation mining machines such as S21. It can not only directly promote Bitmain's sales performance, but also indirectly help the miner group to smoothly overcome the capital difficulties caused by equipment iteration.

Antalpha's IPO also attracted some well-known investors. Among them, Tether expressed interest in subscribing to $25 million of Antalpha common stock at the issue price in this IPO. If calculated at the midpoint of the issue price range of $12 per share, this investment will account for approximately 54.1% of the total number of shares issued, equivalent to approximately 2.08 million shares. According to the prospectus, Antalpha's loan business is usually settled in USDT. This investment is also another move by Tether's multi-line layout. However, the prospectus also stated that this intention "is not a binding purchase agreement or commitment."

In addition, Antalpha mentioned in its prospectus that it plans to explore financing solutions for GPUs needed in the AI field. For Bitmain, Antalpha's expansion capabilities are also a barbell configuration to resist the uncertainty risks in the crypto industry. If Antalpha can succeed in new areas such as AI GPU financing, its own growth will indirectly enhance the resilience of Bitmain's entire ecosystem.

Therefore, Antalpha’s IPO is not a simple listing of a fintech company, but more like a key step for Bitmain to consolidate its mining empire, optimize its financial instruments, and reserve strength for its long-term strategic development in the post-halving era.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm