Oracle (ORCL) Stock: Jumps on Potential $20 Billion Meta AI Cloud Partnership

TLDR

- Oracle in advanced talks with Meta for $20 billion multi-year AI cloud deal to power large language models

- Oracle stock jumped 4% on Friday, bringing year-to-date gains to 85% on strong cloud demand

- Deal would add to Oracle’s recent wins including $300 billion OpenAI contract and xAI partnership

- Meta seeks to reduce reliance on Microsoft Azure by diversifying cloud providers for Llama AI models

- Oracle positioning itself as cheaper, faster alternative to Amazon and Google Cloud services

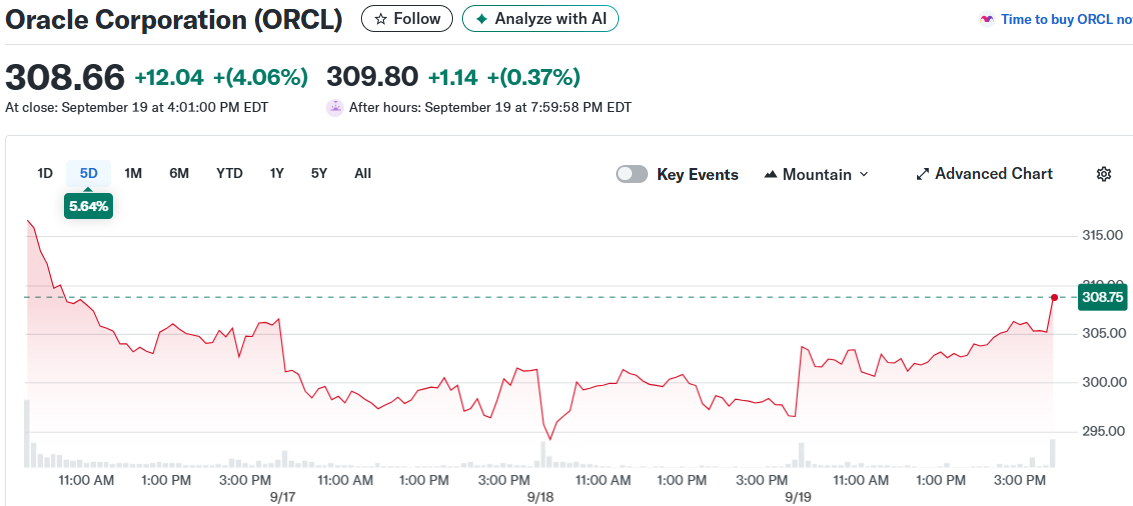

Oracle shares climbed 4% to $308.66 on Friday following reports of advanced negotiations with Meta for a massive cloud computing contract. The potential deal could be worth $20 billion over multiple years.

Oracle Corporation (ORCL)

Oracle Corporation (ORCL)

The agreement would provide Meta with the computing power needed to train and run its large AI models. Bloomberg and Reuters first reported the talks, though neither company has officially confirmed the discussions.

Oracle stock has gained 85% year-to-date as demand for cloud services continues to grow. The company has been landing major contracts with AI companies looking for computing infrastructure.

Meta is seeking additional cloud capacity to support its Llama AI models. The social media giant wants to expand AI features across Facebook, Instagram, and WhatsApp platforms.

By partnering with Oracle, Meta would diversify its cloud providers beyond Microsoft Azure. This strategy helps reduce dependence on any single supplier for critical infrastructure needs.

The deal terms are not finalized and could still change before completion. However, the reported $20 billion value shows the scale of Oracle’s cloud ambitions.

Oracle’s Growing AI Business

Oracle has been building momentum in the AI infrastructure space through several major partnerships. Earlier this year, the company signed a $300 billion cloud services agreement with OpenAI.

The OpenAI deal represents one of the largest contracts ever seen in the cloud computing sector. Oracle has also secured new business with xAI, Elon Musk’s AI venture.

These partnerships demonstrate Oracle’s ability to compete with established cloud leaders. The company has been positioning Oracle Cloud Infrastructure as a cost-effective alternative to Amazon Web Services and Google Cloud.

Oracle has made its systems more compatible with larger cloud platforms. This approach has helped boost adoption among companies already using multiple cloud providers.

The strategy appears to be working as Oracle reported record bookings in recent quarters. Investors have responded positively to the company’s cloud growth trajectory.

Market Competition Heats Up

Oracle faces intense competition from Amazon, Microsoft, and Google in the cloud market. These companies have dominated cloud computing for years with extensive infrastructure networks.

However, Oracle’s focus on AI workloads has created new opportunities for growth. The company offers specialized services designed for machine learning and AI model training.

Oracle’s cloud infrastructure can handle the massive computational requirements of modern AI systems. This capability has attracted attention from leading AI companies seeking reliable partners.

The potential Meta deal would further establish Oracle as a serious player in AI infrastructure. Success with high-profile clients often leads to additional contract opportunities.

Oracle’s stock price reflects investor confidence in the company’s cloud strategy. The shares have outperformed many technology stocks this year on strong fundamentals.

Meta’s decision to consider Oracle shows the growing demand for cloud computing power. AI companies need massive resources to train increasingly complex models.

Wall Street analysts maintain a Strong Buy rating on Oracle with an average price target of $340.75. This represents potential upside of 10.4% from current levels.

The talks with Meta are ongoing with no guaranteed outcome. However, Oracle’s track record of closing major deals suggests a positive resolution is possible.

Oracle reported increased bookings last week that drove the stock to all-time highs. The momentum continues with news of potential partnerships with major technology companies.

The post Oracle (ORCL) Stock: Jumps on Potential $20 Billion Meta AI Cloud Partnership appeared first on CoinCentral.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Marathon Digital BTC Transfers Highlight Miner Stress