Dogecoin Marketcap Explained: What It Means and How It Shapes DOGE's Value

Key Takeaways

- Market capitalization (market cap) measures the total dollar value of Dogecoin (DOGE), calculated as current price × circulating supply.

- As of December 2025, Dogecoin's market cap stands at approximately $20–$25 billion, placing it among the top 10 cryptocurrencies.

- Dogecoin's inflationary supply model (approximately 5 billion DOGE mined annually) impacts its market cap and influences its long-term price dynamics.

- While market cap provides a relative valuation for Dogecoin, it doesn't account for liquidity, actual capital investment, or real-world utility.

- The memecoin culture, combined with external social catalysts and celebrity endorsements, plays a critical role in shaping Dogecoin's price and market cap, making it more speculative than fundamentally driven.

Introduction

What Is Market Capitalization?

Definition of Market Cap

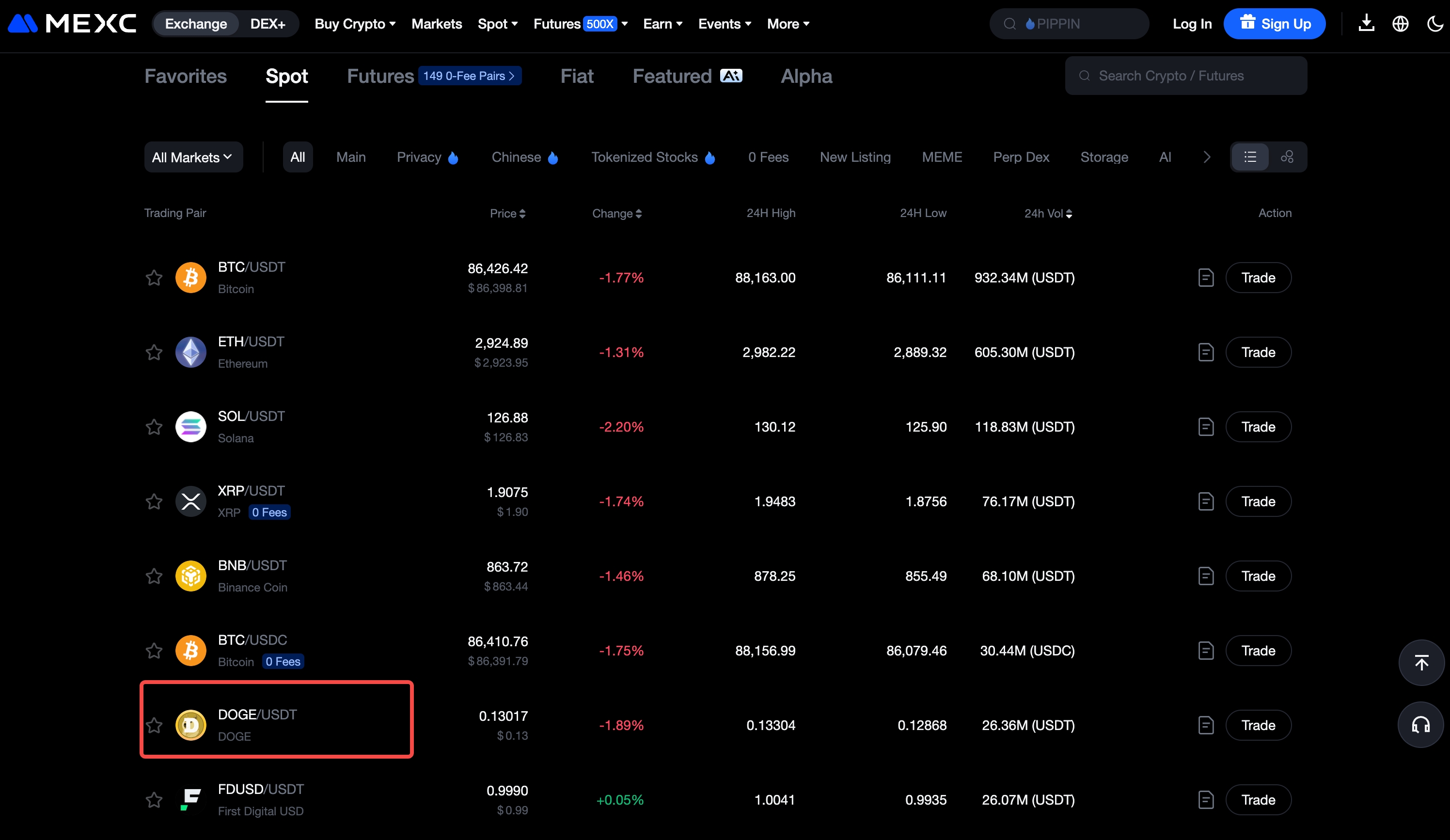

- Current Price (DOGE): $0.13–$0.14 (depending on the exchange)

- Circulating Supply: Approximately 167–168 billion DOGE

Why Market Cap Matters

- The overall value of an asset in circulation

- Market expectations for that asset

- The relative size of different cryptocurrencies in the market

How Dogecoin's Market Cap Affects Its Value

- Bitcoin remains the dominant store of value, with its market cap hovering near $900 billion as of late 2025.

- Ethereum has a market cap of around $300 billion.

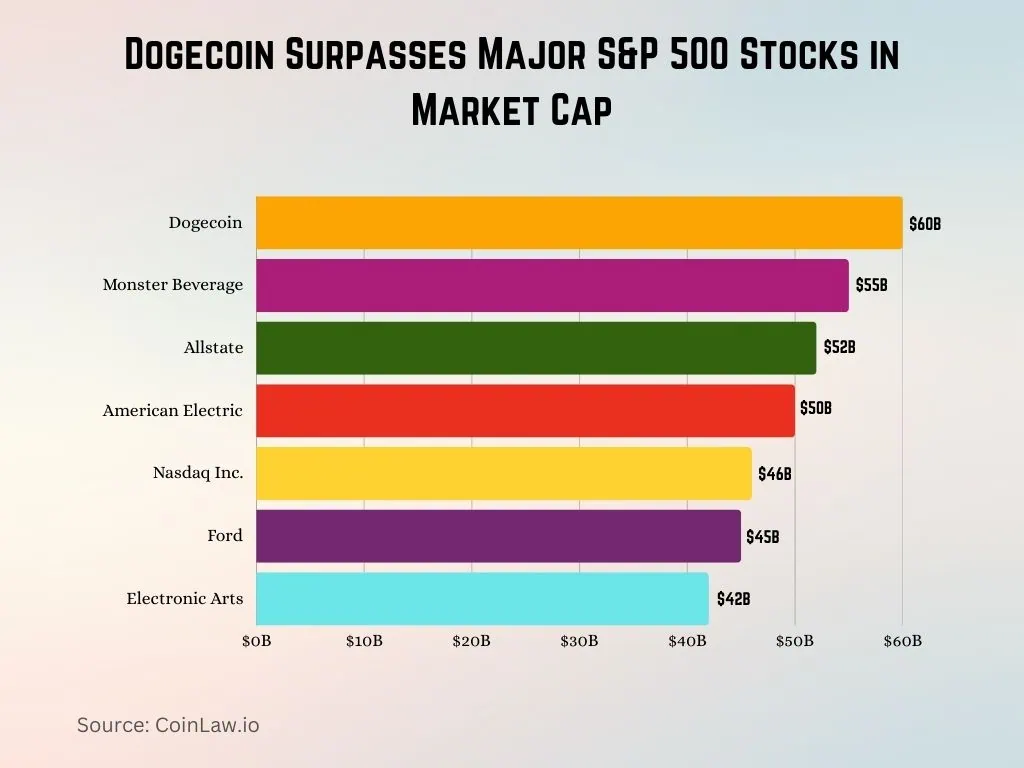

- Dogecoin, with its market cap around $20–$25 billion, is a significant player in the cryptocurrency space.

- Celebrity Endorsements: Prominent figures such as Elon Musk have significantly influenced Dogecoin's market cap. Musk's tweets have been shown to cause immediate surges in Dogecoin's price and, therefore, its market cap. For instance, during 2021, Musk's endorsement of Dogecoin as "the people’s cryptocurrency" led to an explosive rally, pushing its price from $0.01 to $0.74 and sending the market cap into the billions.

- Meme Culture: Dogecoin's association with the Doge meme made it particularly attractive to online communities, where it quickly became a symbol of internet culture. Its ability to thrive on social media platforms like Twitter and Reddit demonstrated the power of memetic influence in driving cryptocurrency markets.

- Grayscale's Dogecoin Trust and other investment products offer institutional investors exposure to Dogecoin without directly purchasing the token.

- The increasing institutional interest in cryptocurrencies has pushed larger-cap coins like Dogecoin to the forefront, creating new opportunities for adoption and price appreciation.

The Impact of Dogecoin's Inflationary Supply on Market Cap

- Yearly Minting: Each block on the Dogecoin network rewards miners with 10,000 DOGE. This annual increase in supply means that Dogecoin is not subject to the same scarcity-driven price appreciation seen in Bitcoin.

- Bitcoin's market cap can grow over time because the fixed supply creates scarcity, and demand drives price.

- Dogecoin's market cap is more volatile and more sensitive to demand fluctuations because of its inflationary model.

How Dogecoin's Market Cap Affects Speculative Cycles

- 2021 Surge: The Reddit r/WallStreetBets community and Elon Musk's tweets played a massive role in pushing Dogecoin's price and market cap to unprecedented heights.

- Meme-Driven Speculation: Dogecoin’s rise as a memecoin means that speculative buying can drive price increases, even if the asset lacks the fundamental value that typically supports long-term growth.

Conclusion: The Future of Dogecoin's Market Cap

Popular Articles

MEXC Restricted Countries: Complete List of Prohibited & Limited Regions

MEXC is dedicated to providing users with a convenient, efficient, and secure trading platform, empowering crypto enthusiasts worldwide to explore the digital asset ecosystem. We maintain the highest

Copy Trading Guide For Lead Traders

Copy Trading is an innovative cryptocurrency investment strategy that enables investors to automatically replicate the trades of experienced traders. For beginners lacking professional knowledge or tr

Why is Crypto Down? It’s Not "FUD"—It’s the Hard Asset Rotation & Pre-CNY Liquidity Void

If you are looking for a specific news headline to explain today's red candles, stop looking. There isn't one.Retail traders are currently scouring Twitter for "FUD" (Fear, Uncertainty, Doubt) to blam

Palladium (XPD) Live on MEXC: Institutional Guide to Trading the 100x Leverage "Super-Metal"

In the quiet corners of the commodities desk, traders have a nickname for Palladium: "The Widowmaker."It earned this moniker for a reason. Unlike Gold, which moves with the grace of a central banker,

Hot Crypto Updates

View More

Dogecoin (DOGE) Latest Price: Fresh Market Updates

The crypto market changes minute by minute, and the latest Dogecoin (DOGE) price offers the most up-to-date snapshot of its value. In this article, we highlight the newest movements, fresh data from

Dogecoin (DOGE) Bullish Price Prediction

Introduction to Bullish DOGE Outlook Optimistic investors often look to bullish price predictions for Dogecoin (DOGE) to identify the coin's growth potential during favorable market cycles. A bullish

Dogecoin (DOGE) 7-day Price Change

The Latest Dogecoin (DOGE) price has shown significant movement over the past week. In this article, we'll examine the current Dogecoin price, DOGE 7-day price performance, and the cryptocurrency

Dogecoin (DOGE) Price Prediction: Market Forecast and Analysis

Understanding the price prediction of Dogecoin (DOGE) gives traders and investors a forward-looking perspective on potential market trends. DOGE price predictions aren't guarantees, but they provide

Trending News

View More

ZKP’s $5M Presale Rewards & Lucrative Auctions Steal the Show as SOL & DOGE Flash Mixed Signals in 2026

Discover how Solana flashes whale-driven surges, Dogecoin grapples with fading momentum, and ZKP ignites buzz via its live presale auction and $5M rewards.

BlockDAG Presale Ends in 5 Days: Here’s Why the $0.001 Reset Crushes DOGE, ADA, & TRX in the Race for 50x Gains

Get ready for massive gains! Our list of top cryptos to watch for 2026 features a $0.001 entry aiming for $0.05. Grab this 50x potential before the Jan 26 cutoff

Dogecoin (DOGE) Daily Market Analysis

Here's the latest – cryptocurrency updates and Dogecoin developments: • DOGE price: $0.132 - $0.139 range • "Such" app launch announced (20 January 2026) • Japan

DOGE Technical Analysis Jan 22

The post DOGE Technical Analysis Jan 22 appeared on BitcoinEthereumNews.com. DOGE price is currently consolidating at the 0.13$ level; holding above the critical

Related Articles

What Is Ethereum’s Fusaka Upgrade? A Complete 2025 Guide to the Most Important Ethereum Network Upgrade

1. Background: Why Ethereum Needs the Fusaka Upgrade Ethereum has entered a clear “rollup-first” era. Instead of processing all user transactions directly on Layer 1, the network is evolving into a gl

What is Pieverse? The Timestamping and Compliance Infrastructure Built on x402

TL;DRPieverse is a Web3 payment and compliance infrastructure built on the x402 communication standard, designed to support agent-to-agent payments with built-in timestamping and regulatory verificati

What are Ethereum Spot ETFs?

On May 24, 2024, the SEC approved the first eight Ethereum spot ETFs to be listed in the United States, including those from BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark Invest, Invesco Galaxy

From ICO to Launchpad: Understanding the Asset Offering Cycle is Key to Catching the Next Bull Market

1. IntroductionAs a cornerstone of asset offering, user acquisition, and early-stage community building in the Web3 ecosystem, Launchpads have played a vital role in facilitating project fundraising a