Billionaire Michael Saylor’s Strategy Boosts USD Reserves by $748M to $2.19B

Billionaire Bitcoin advocate Michael Saylor’s company Strategy Inc. has increased its U.S. dollar reserves by $748 million, bringing total USD liquidity to $2.19 billion, according to a regulatory filing.

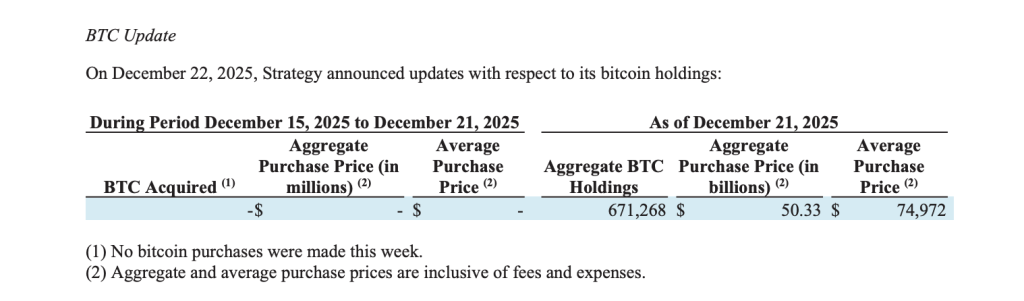

The update also confirmed that the firm continues to hold 671,268 bitcoin reinforcing its long-standing Bitcoin-centric treasury strategy.

ATM Program Raises $747.8M in Net Proceeds

The increase in cash reserves stems from sales conducted under Strategy’s at-the-market (ATM) offering program. During the period from December 15 to December 21, the company reports it sold approximately 4.54 million shares of its Class A common stock (MSTR), generating net proceeds of $747.8 million after sales commissions.

No preferred stock sales were recorded during the week, despite multiple preferred share classes remaining available for issuance.

As of December 21, Strategy reported over $41 billion in aggregate capacity remaining across its various common and preferred stock ATM programs highlighting substantial financial flexibility should the company choose to raise additional capital.

Bitcoin Holdings Remain Unchanged at 671,268 BTC

The filing shows that Strategy did not acquire any bitcoin during the reported period. Its aggregate bitcoin holdings remained steady at 671,268 BTC as of December 21, with an aggregate purchase price of approximately $50.33 billion.

The average purchase price across the company’s bitcoin holdings stood at $74,972 per bitcoin, inclusive of fees and expenses.

While the company has historically used equity and debt issuances to fund bitcoin acquisitions the absence of purchases this week suggests a pause in accumulation amid market conditions or a strategic decision to prioritize liquidity.

Liquidity Strengthens Balance Sheet Optionality

By lifting its USD reserves to $2.19 billion, Strategy strengthens its balance sheet and near-term optionality. The cash buffer provides flexibility to service obligations, manage volatility or fund future bitcoin purchases without immediate reliance on capital markets.

The filing does not specify how or when the cash will be deployed. Strategy has consistently framed capital raises as a means to support long-term bitcoin accumulation while maintaining sufficient liquidity to navigate market cycles.

Capital Markets Activity Shows Long-Term Strategy

The continued use of ATM programs shows Strategy’s willingness to actively tap equity markets to reinforce its capital structure. With no bitcoin purchases made during the week. This latest update suggests a tactical pause rather than a shift in long-term strategy.

Strategy’s expanding cash reserves alongside unchanged bitcoin holdings indicate a dual focus on balance-sheet resilience and readiness for future opportunities.

Bitcoin Slips Below $90K

Bitcoin has fallen below the $90,000 level, extending a pullback from its recent peak near $120,000 as investors grapple with uncertain macroeconomic signals and uneven liquidity conditions.

As interest rates stay elevated, the cost of capital continues to weigh on speculative assets. One analyst notes that Bitcoin tends to respond to forward-looking liquidity expectations, meaning that without clear conviction around a sustained easing cycle, institutional capital is likely to remain selective or sidelined.

You May Also Like

Quick Tips for Passing Your MyCPR NOW Final Exam

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!