Pi Network’s (PI) Price Dumps to Another All-Time Low Despite Frequent Network Updates

Although most of the cryptocurrency market is in the red today after the US Federal Reserve pivoted on its monetary strategy and refused to lower the interest rates yesterday, Pi Network’s native token has declined in a painful manner lately, charting consecutive all-time lows.

The asset has seen more than 94% of its value evaporate in less than a year after its launch last February.

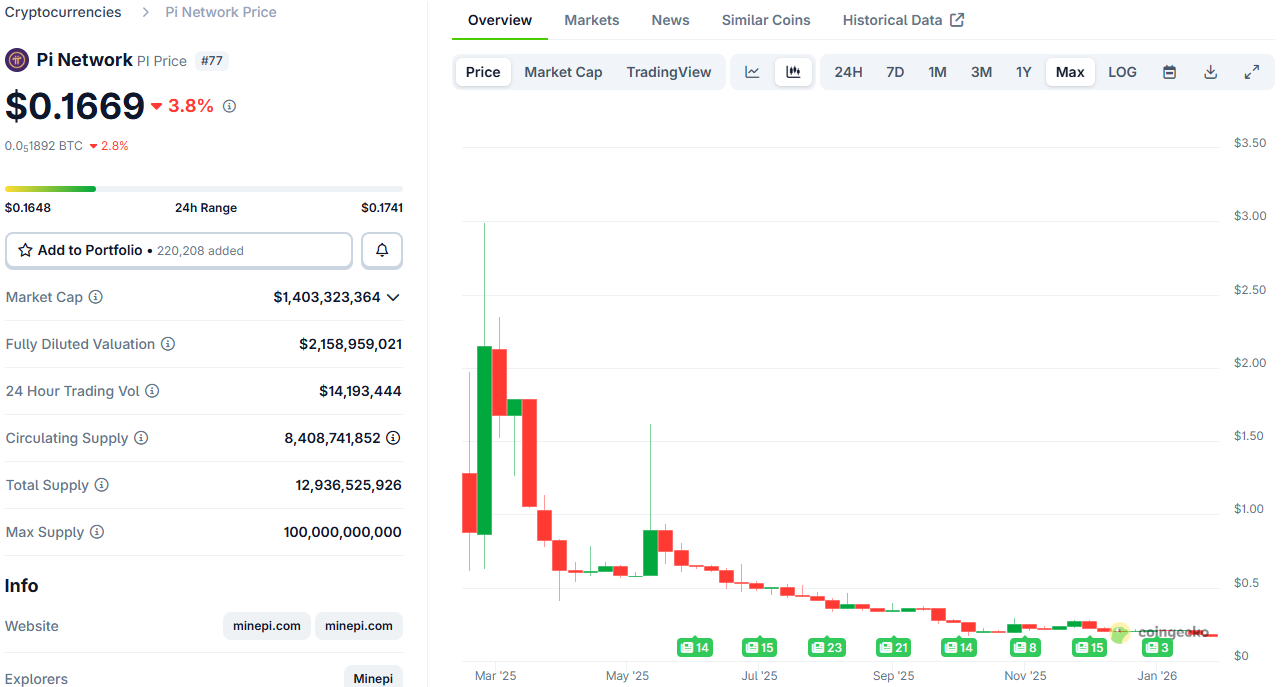

Pi Network (PI) Price on CoinGecko

Pi Network (PI) Price on CoinGecko

The chart above paints a clear picture. After years of delays and hype, PI was finally released for trading nearly a year ago and quickly skyrocketed to a new all-time high of $2.99 (CoinGecko data). Some smaller exchanges rushed to list the asset, but most of the bigger ones, such as Binance and Coinbase, stood away, despite some rumors.

PI’s meteoric but brief rise drove it close to the top 10 alts by market cap shortly after its debut. However, that was just a momentary phase, and the token plunged significantly in the following months.

It registered an all-time low after the early October crash at $0.172 before it bounced and remained within a confined range between $0.20 and $0.22 for months, with just a few brief deviations.

The mid-January market-wide correction, though, didn’t spare PI, and it dropped below $0.17 days ago to chart another ATL. The past 24 hours have been violent as well amid the growing geopolitical uncertainty and the Fed’s decision, and PI’s new low came at $0.1648. This means that the token has lost roughly 94.5% of its value in less than 12 months.

These consistent declines from the project’s native token are in contrast to the attempts by the team to improve the overall ecosystem. They have introduced two updates since the start of the year, but they seem insufficient to drive any actual traction for PI.

The post Pi Network’s (PI) Price Dumps to Another All-Time Low Despite Frequent Network Updates appeared first on CryptoPotato.

You May Also Like

Silver Golub & Teitell Launches Free App for Tracking Connecticut Court Cases

Crypto Executives Advocate for U.S. Strategic Bitcoin Reserve Legislation